- China

- /

- Commercial Services

- /

- SZSE:000826

Why Investors Shouldn't Be Surprised By TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT Co., LTD.'s (SZSE:000826) 29% Share Price Plunge

TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT Co., LTD. (SZSE:000826) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 47% share price drop.

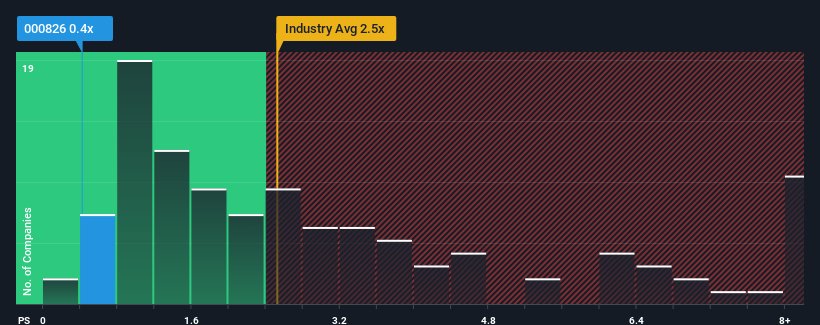

Following the heavy fall in price, TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Commercial Services industry in China have P/S ratios greater than 2.5x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT

How TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT Has Been Performing

For example, consider that TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT?

TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 19%. The last three years don't look nice either as the company has shrunk revenue by 36% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 30% shows it's an unpleasant look.

With this in mind, we understand why TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT's P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Having almost fallen off a cliff, TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT's share price has pulled its P/S way down as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT (1 is significant) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if TUS Environmental Science and Technology Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000826

TUS Environmental Science and Technology Development

Provides environment improvement solutions in China.

Good value with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026