- China

- /

- Commercial Services

- /

- SHSE:688701

Zhejiang Zone-King Environmental Sci&Tech Co., Ltd.'s (SHSE:688701) Popularity With Investors Under Threat As Stock Sinks 27%

Unfortunately for some shareholders, the Zhejiang Zone-King Environmental Sci&Tech Co., Ltd. (SHSE:688701) share price has dived 27% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 28% in that time.

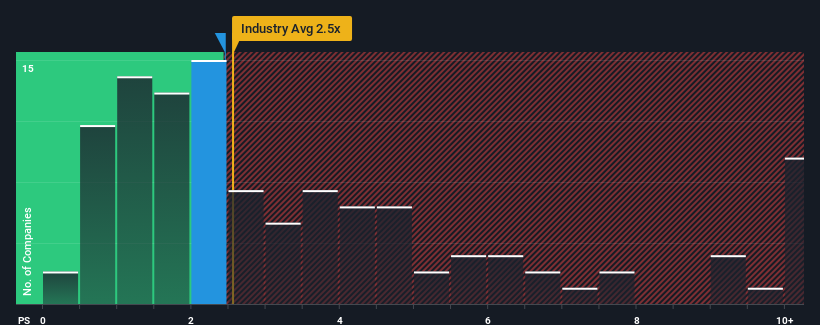

Even after such a large drop in price, it's still not a stretch to say that Zhejiang Zone-King Environmental Sci&Tech's price-to-sales (or "P/S") ratio of 2.5x right now seems quite "middle-of-the-road" compared to the Commercial Services industry in China, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Zhejiang Zone-King Environmental Sci&Tech

How Zhejiang Zone-King Environmental Sci&Tech Has Been Performing

For example, consider that Zhejiang Zone-King Environmental Sci&Tech's financial performance has been pretty ordinary lately as revenue growth is non-existent. It might be that many expect the uninspiring revenue performance to only match most other companies at best over the coming period, which has kept the P/S from rising. Those who are bullish on Zhejiang Zone-King Environmental Sci&Tech will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Zhejiang Zone-King Environmental Sci&Tech will help you shine a light on its historical performance.How Is Zhejiang Zone-King Environmental Sci&Tech's Revenue Growth Trending?

Zhejiang Zone-King Environmental Sci&Tech's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The longer-term trend has been no better as the company has no revenue growth to show for over the last three years either. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

In contrast to the company, the rest of the industry is expected to grow by 29% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's somewhat alarming that Zhejiang Zone-King Environmental Sci&Tech's P/S sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Bottom Line On Zhejiang Zone-King Environmental Sci&Tech's P/S

With its share price dropping off a cliff, the P/S for Zhejiang Zone-King Environmental Sci&Tech looks to be in line with the rest of the Commercial Services industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We find it unexpected that Zhejiang Zone-King Environmental Sci&Tech trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

You always need to take note of risks, for example - Zhejiang Zone-King Environmental Sci&Tech has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Zone-King Environmental Sci&Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688701

Zhejiang Zone-King Environmental Sci&Tech

Zhejiang Zone-King Environmental Sci&Tech Co., Ltd.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives