- China

- /

- Professional Services

- /

- SHSE:603909

C&D Holsin Engineering Consulting Co., Ltd (SHSE:603909) Stocks Shoot Up 42% But Its P/E Still Looks Reasonable

C&D Holsin Engineering Consulting Co., Ltd (SHSE:603909) shares have had a really impressive month, gaining 42% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 11% in the last twelve months.

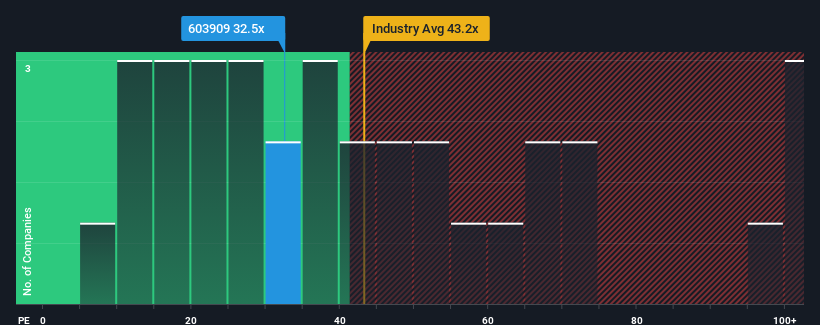

Even after such a large jump in price, you could still be forgiven for feeling indifferent about C&D Holsin Engineering Consulting's P/E ratio of 32.5x, since the median price-to-earnings (or "P/E") ratio in China is also close to 33x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been pleasing for C&D Holsin Engineering Consulting as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for C&D Holsin Engineering Consulting

Does Growth Match The P/E?

C&D Holsin Engineering Consulting's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 19% last year. The latest three year period has also seen an excellent 55% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 17% each year as estimated by the one analyst watching the company. That's shaping up to be similar to the 18% per annum growth forecast for the broader market.

In light of this, it's understandable that C&D Holsin Engineering Consulting's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

C&D Holsin Engineering Consulting appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of C&D Holsin Engineering Consulting's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Having said that, be aware C&D Holsin Engineering Consulting is showing 2 warning signs in our investment analysis, you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603909

C&D Holsin Engineering Consulting

Offers engineering and technical services in China.

Flawless balance sheet and good value.

Market Insights

Community Narratives