Exploring 3 Undiscovered Gems in Asia with Promising Potential

Reviewed by Simply Wall St

As global markets navigate a complex economic landscape marked by cautious Federal Reserve commentary and persistent inflation concerns, investors are increasingly looking towards Asia for opportunities. In this environment, identifying stocks with robust fundamentals and growth potential becomes crucial, especially as the region's dynamic economies continue to evolve.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 5.00% | 14.21% | 13.26% | ★★★★★★ |

| Soft-World International | NA | -1.48% | 5.58% | ★★★★★★ |

| TCM Biotech International | 2.84% | 2.11% | 5.25% | ★★★★★★ |

| BIO-FD&CLtd | 0.15% | 2.82% | 18.20% | ★★★★★★ |

| Changchai Company | NA | 0.32% | -6.09% | ★★★★★★ |

| Chin Hsin Environ Engineering | 6.12% | 40.89% | 41.55% | ★★★★★☆ |

| Jinsanjiang (Zhaoqing) Silicon Material | 3.24% | 18.00% | -5.63% | ★★★★★☆ |

| New Asia Construction & Development | 44.83% | 8.29% | 44.77% | ★★★★★☆ |

| AblePrint Technology | 7.90% | 35.99% | 14.47% | ★★★★★☆ |

| Guangdong Brandmax MarketingLtd | 18.55% | -10.19% | -37.23% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Vobile Group (SEHK:3738)

Simply Wall St Value Rating: ★★★★★☆

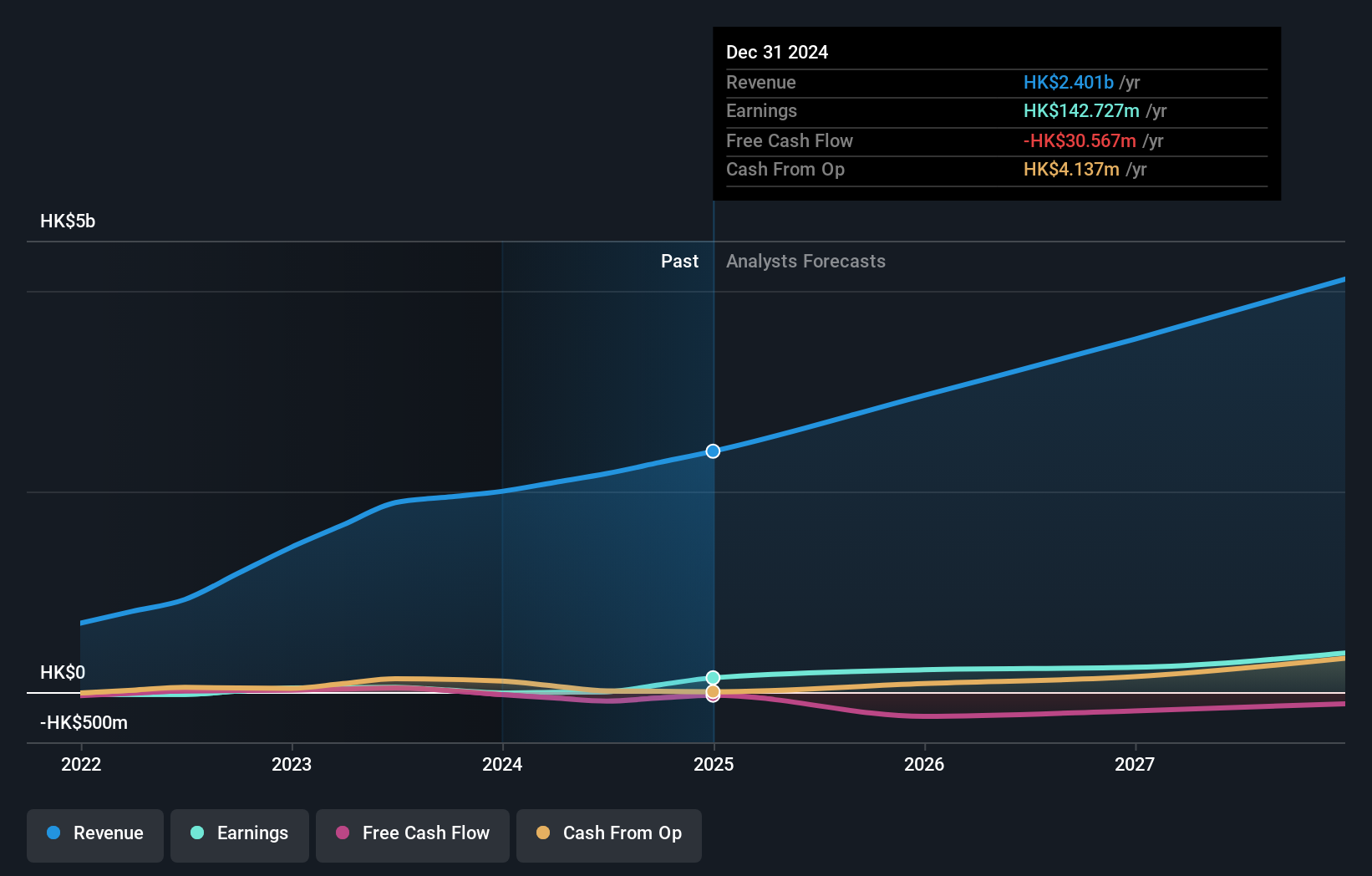

Overview: Vobile Group Limited is an investment holding company that offers software as a service for digital content asset protection and transactions across the United States, Mainland China, and internationally, with a market cap of approximately HK$13.83 billion.

Operations: Vobile Group generates revenue primarily through its SaaS offerings, amounting to approximately HK$2.68 billion.

Vobile Group, a dynamic player in the digital content industry, has seen its earnings skyrocket by 4431% over the past year, far outpacing the software sector's 57.5% growth. With sales hitting HKD 1.46 billion for H1 2025 and net income rising to HKD 102 million from HKD 41 million a year ago, this company is on an impressive trajectory. The strategic alliance with Shanghai Film Group enhances its position in content asset operations and global video centers. Its debt management is sound with a net debt to equity ratio of just 16%, indicating financial stability amidst rapid expansion.

Beijing GeoEnviron Engineering & Technology (SHSE:603588)

Simply Wall St Value Rating: ★★★★☆☆

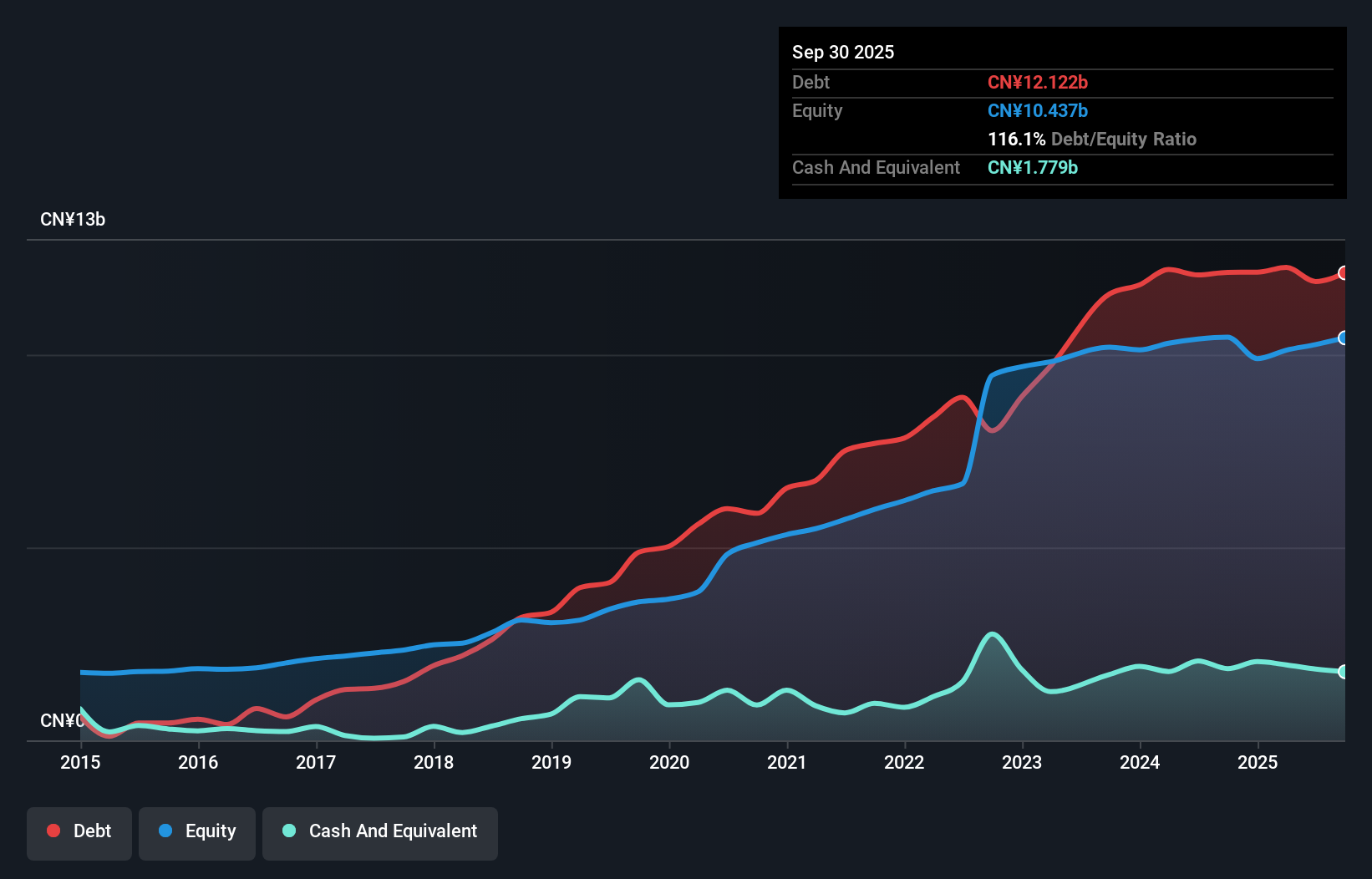

Overview: Beijing GeoEnviron Engineering & Technology, Inc. operates in the environmental engineering sector and has a market capitalization of CN¥10.85 billion.

Operations: The company generates revenue primarily from its environmental engineering services. It has shown a net profit margin trend that highlights the financial efficiency of its operations.

Beijing GeoEnviron Engineering & Technology, a smaller player in the commercial services industry, is showing promising signs with earnings growth of 33.3% last year, outpacing the industry's 5.1%. Despite a high net debt to equity ratio at 97.9%, the company has reduced this from 124.5% over five years and covers interest payments well with EBIT at 4.4x coverage. Trading at a price-to-earnings ratio of 19.1x against the market's 44.9x suggests good value for investors seeking opportunities in Asia's dynamic markets, while its recent share repurchase plan indicates confidence in its future prospects.

Shenzhen Jufei Optoelectronics (SZSE:300303)

Simply Wall St Value Rating: ★★★★★★

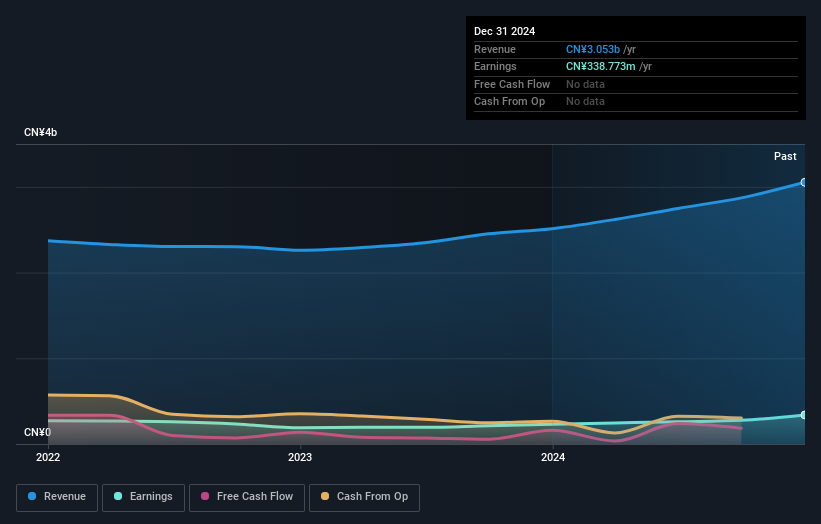

Overview: Shenzhen Jufei Optoelectronics Co., Ltd. specializes in the research, development, manufacture, marketing, and sale of SMD LED devices across various international markets with a market capitalization of CN¥10.37 billion.

Operations: Jufei Optoelectronics generates revenue through the sale of SMD LED devices across multiple international markets. The company's net profit margin has shown significant fluctuations, reflecting changes in operational efficiency and market conditions.

Shenzhen Jufei Optoelectronics, a notable player in the semiconductor sector, has seen its debt to equity ratio plummet from 29.4% to 2.7% over five years, indicating strong financial management. The firm boasts high-quality earnings and a price-to-earnings ratio of 32.8x, which is attractive compared to the broader Chinese market's 44.9x. Despite a slight dip in net income recently (CNY 124 million vs CNY 148 million last year), earnings grew by an impressive 21.7% over the past year, outpacing industry growth of 10.4%. Recent share repurchases further reflect confidence in its prospects.

- Delve into the full analysis health report here for a deeper understanding of Shenzhen Jufei Optoelectronics.

Gain insights into Shenzhen Jufei Optoelectronics' past trends and performance with our Past report.

Turning Ideas Into Actions

- Dive into all 2381 of the Asian Undiscovered Gems With Strong Fundamentals we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3738

Vobile Group

An investment holding company, provides software as a service for digital content asset protection and transaction in the United States, Mainland China, and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives