- China

- /

- Commercial Services

- /

- SHSE:603177

Zhejiang Tuna Environmental Science & TechnologyCo.,Ltd. (SHSE:603177) Stock Rockets 28% As Investors Are Less Pessimistic Than Expected

Those holding Zhejiang Tuna Environmental Science & TechnologyCo.,Ltd. (SHSE:603177) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 47% over that time.

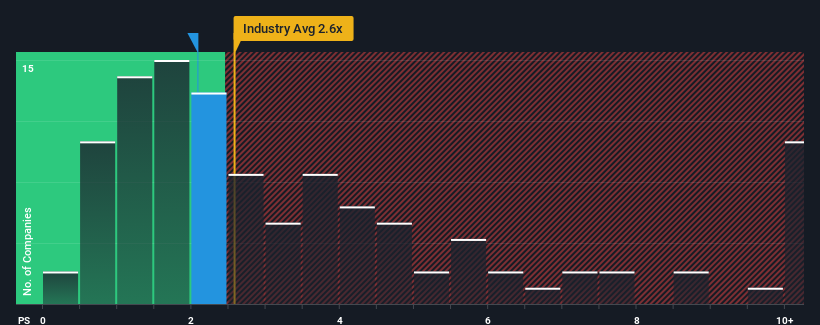

Although its price has surged higher, there still wouldn't be many who think Zhejiang Tuna Environmental Science & TechnologyCo.Ltd's price-to-sales (or "P/S") ratio of 2.1x is worth a mention when the median P/S in China's Commercial Services industry is similar at about 2.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Zhejiang Tuna Environmental Science & TechnologyCo.Ltd

What Does Zhejiang Tuna Environmental Science & TechnologyCo.Ltd's P/S Mean For Shareholders?

The revenue growth achieved at Zhejiang Tuna Environmental Science & TechnologyCo.Ltd over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for Zhejiang Tuna Environmental Science & TechnologyCo.Ltd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Zhejiang Tuna Environmental Science & TechnologyCo.Ltd would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 26% gain to the company's top line. Pleasingly, revenue has also lifted 47% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 30% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Zhejiang Tuna Environmental Science & TechnologyCo.Ltd's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Zhejiang Tuna Environmental Science & TechnologyCo.Ltd's P/S

Zhejiang Tuna Environmental Science & TechnologyCo.Ltd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Zhejiang Tuna Environmental Science & TechnologyCo.Ltd revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Having said that, be aware Zhejiang Tuna Environmental Science & TechnologyCo.Ltd is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Zhejiang Tuna Environmental Science & TechnologyCo.Ltd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang Tuna Environmental Science & TechnologyCo.Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603177

Zhejiang Tuna Environmental Science & TechnologyCo.Ltd

Zhejiang Tuna Environmental Science & TechnologyCo.,Ltd.

Good value with mediocre balance sheet.

Market Insights

Community Narratives