- China

- /

- Professional Services

- /

- SZSE:301289

Undiscovered Gems These 3 Global Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

In the midst of a volatile global market, U.S. stocks have recently shown resilience, buoyed by easing trade tensions and supportive monetary policy signals from the Federal Reserve. As investors navigate these uncertain waters, identifying undiscovered gems in the stock market can be an effective way to enhance portfolio diversity and capitalize on unique growth opportunities that may arise from current economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Saha-Union | 0.74% | 0.97% | 18.05% | ★★★★★★ |

| TI Cloud | NA | 12.55% | 6.36% | ★★★★★★ |

| Daphne International Holdings | NA | -5.92% | 82.03% | ★★★★★★ |

| Wison Engineering Services | 28.12% | -0.65% | 12.25% | ★★★★★★ |

| HG Metal Manufacturing | 3.75% | 8.47% | 6.94% | ★★★★★★ |

| YH Entertainment Group | 4.44% | -11.47% | -43.36% | ★★★★★★ |

| JiaXing Gas Group | 49.18% | 19.35% | 19.32% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Banyan Tree Holdings | 42.74% | 15.33% | 72.59% | ★★★★☆☆ |

| TSTE | 38.15% | 4.63% | -6.91% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Shenzhen Leaguer (SZSE:002243)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenzhen Leaguer Co., Ltd. specializes in the design, manufacturing, and service provision of plastic packaging solutions for cosmetics, daily necessities, health products, and food both in China and internationally, with a market cap of CN¥10.93 billion.

Operations: Shenzhen Leaguer generates revenue primarily from its plastic packaging solutions for various consumer goods sectors. The company's financial performance is highlighted by a net profit margin of 8.5%, reflecting its ability to convert sales into profit efficiently.

Shenzhen Leaguer has shown promising signs despite its challenges. Over the past year, earnings surged by 51.2%, outpacing the packaging industry's decline of 3.1%. However, over five years, earnings have decreased annually by 18.8%, reflecting some volatility. The company's net debt to equity ratio stands at a satisfactory 38%, although the overall debt to equity ratio rose from 26.4% to 62.4% in five years, suggesting increased leverage but manageable interest coverage due to high-quality earnings. Recent results show net income rising from CNY 81 million to CNY 118 million year-over-year, indicating potential for future growth amidst industry headwinds.

- Take a closer look at Shenzhen Leaguer's potential here in our health report.

Gain insights into Shenzhen Leaguer's past trends and performance with our Past report.

Shanghai National Center of Testing and Inspection for Electric Cable and Wire (SZSE:301289)

Simply Wall St Value Rating: ★★★★★★

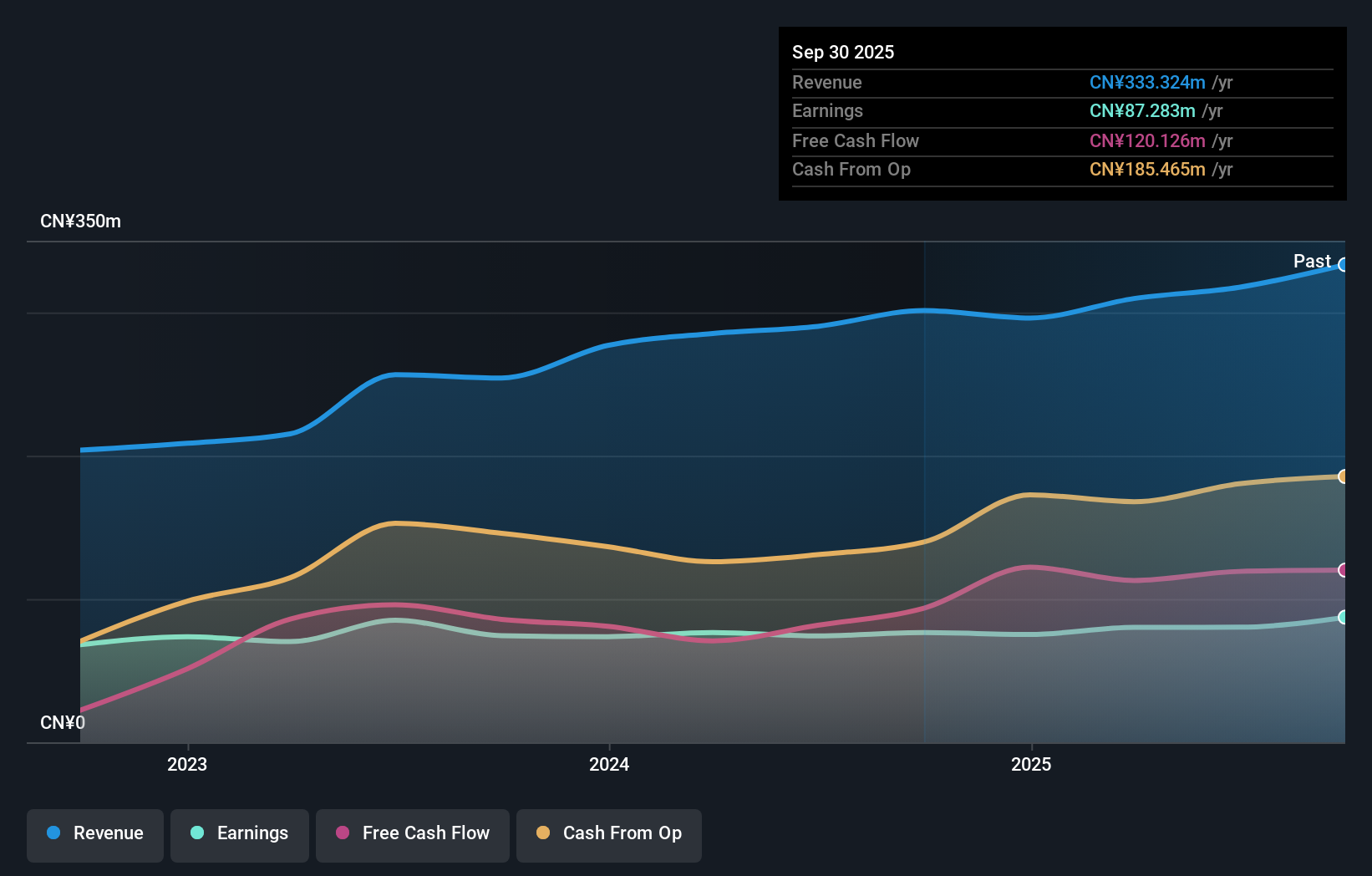

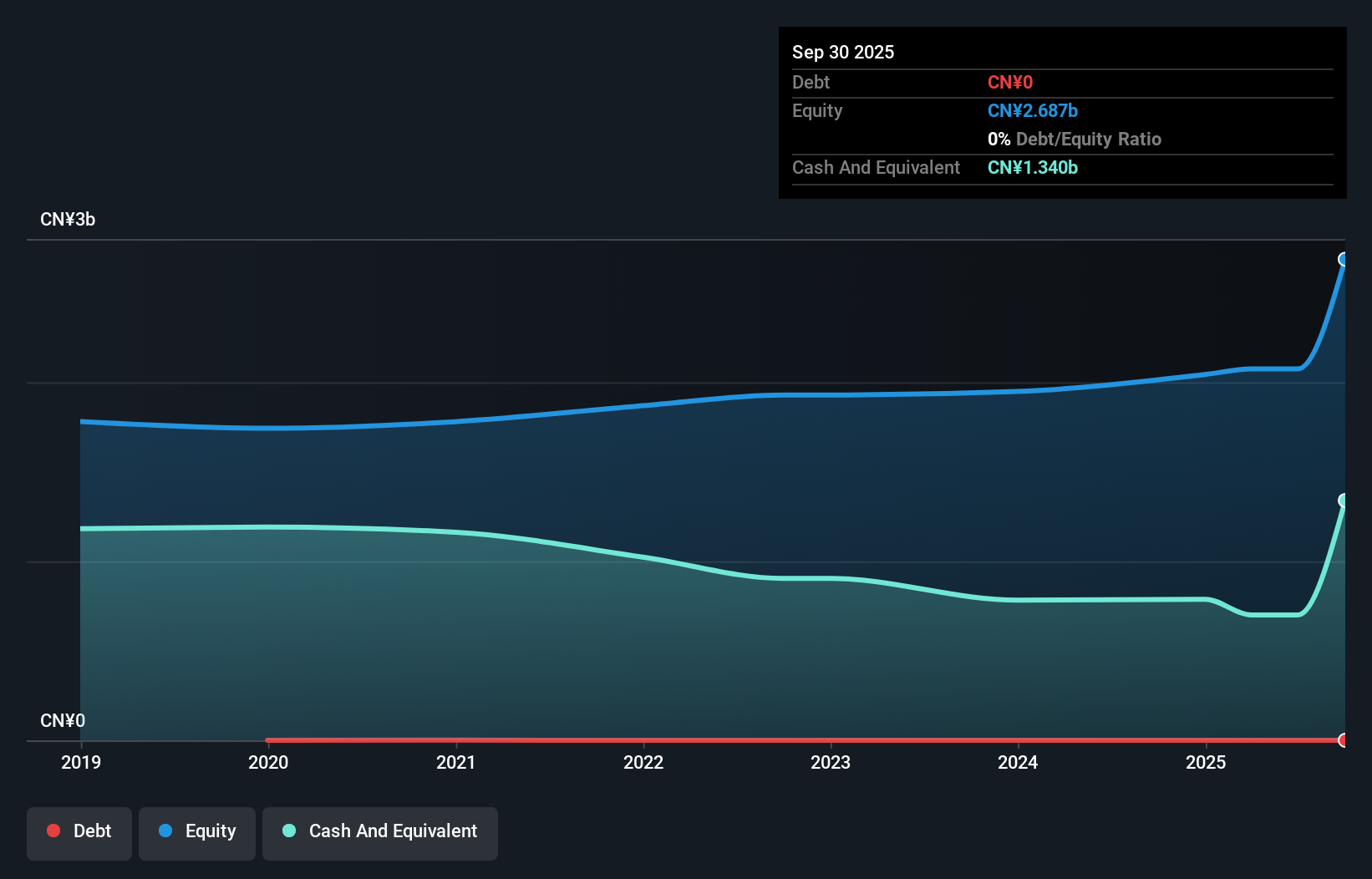

Overview: Shanghai National Center of Testing and Inspection for Electric Cable and Wire Co., Ltd offers quality supervision and inspection services for wires and cables in China, with a market capitalization of CN¥4.29 billion.

Operations: The company generates revenue primarily through quality supervision and inspection services for wires and cables. It has a market capitalization of CN¥4.29 billion.

Shanghai National Center of Testing and Inspection for Electric Cable and Wire has shown promising financial growth, with earnings rising 8.2% over the past year, outpacing the industry average of 3.6%. The company reported sales of CNY 255.52 million for the nine months ending September 2025, up from CNY 218.31 million a year ago, while net income increased to CNY 66.02 million from CNY 54.02 million in the same period last year. Its debt-to-equity ratio improved significantly over five years from 0.8 to a mere 0.1, indicating robust financial health and potential for continued performance enhancement in its niche market segment.

Guangdong Provincial Academy of Building Research Group (SZSE:301632)

Simply Wall St Value Rating: ★★★★★★

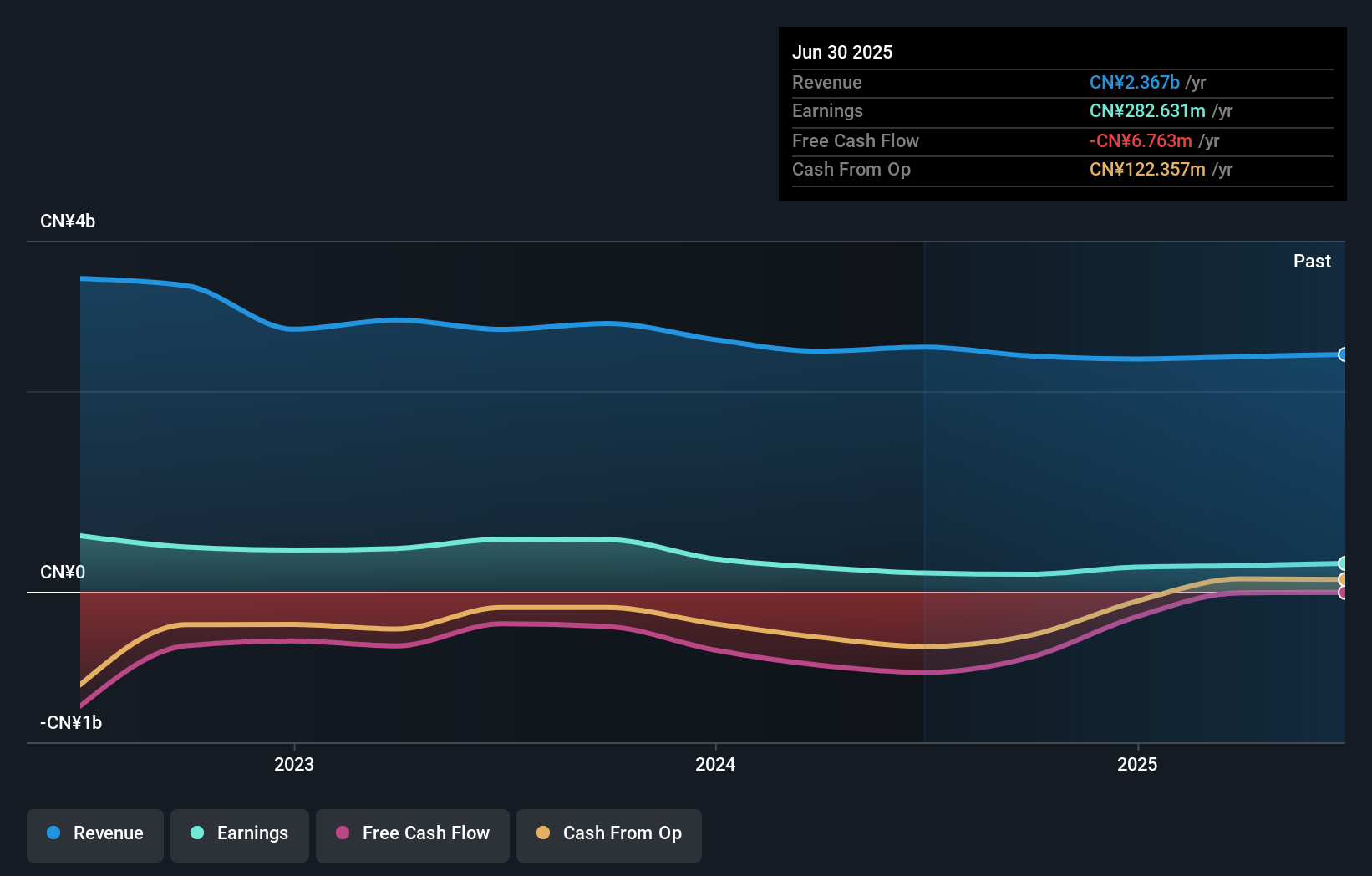

Overview: Guangdong Provincial Academy of Building Research Group Co., Ltd. operates in the construction and building research industry with a market capitalization of CN¥12.43 billion.

Operations: The company generates revenue primarily through its construction and building research activities. The net profit margin has shown notable fluctuations, reflecting changes in operational efficiency and cost management.

Guangdong Provincial Academy of Building Research Group, a smaller player in the construction sector, has shown resilience with earnings growing 4.7% over the past year, outpacing the industry's -8.2%. The company is debt-free now compared to a 0.03 debt-to-equity ratio five years ago, indicating solid financial health. Recent earnings results for nine months ending September 2025 reported sales of CNY 723.85 million and net income of CNY 15.3 million, reversing from a loss last year. Additionally, its inclusion in key indices like the Shenzhen Stock Exchange Composite Index highlights its growing market presence post-IPO completion raising CNY 686 million this August.

- Navigate through the intricacies of Guangdong Provincial Academy of Building Research Group with our comprehensive health report here.

Learn about Guangdong Provincial Academy of Building Research Group's historical performance.

Taking Advantage

- Navigate through the entire inventory of 2928 Global Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301289

Shanghai National Center of Testing and Inspection for Electric Cable and Wire

Provides wire and cable quality supervision and inspection services in China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives