As global markets navigate a period of volatility, small-cap stocks have particularly felt the pressure, with indices like the Russell 2000 dipping into correction territory amidst inflation concerns and political uncertainties. Despite these challenges, opportunities remain for investors seeking stocks with robust fundamentals that can weather such turbulent times. In this environment, identifying companies with strong balance sheets, consistent earnings growth, and a clear competitive advantage becomes crucial.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Transnational Corporation of Nigeria | 45.51% | 31.42% | 58.48% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Hayleys | 140.54% | 19.07% | 20.35% | ★★★★☆☆ |

| Standard Chartered Bank Kenya | 9.32% | 12.22% | 22.08% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Liuzhou Chemical Industry (SHSE:600423)

Simply Wall St Value Rating: ★★★★★★

Overview: Liuzhou Chemical Industry Co., Ltd. focuses on the production and sale of hydrogen peroxide in China, with a market capitalization of approximately CN¥2.24 billion.

Operations: Liuzhou Chemical Industry generates revenue primarily from its chemical industry segment, with reported earnings of CN¥178.44 million. The company's financial performance can be assessed through its market capitalization, which stands at approximately CN¥2.24 billion.

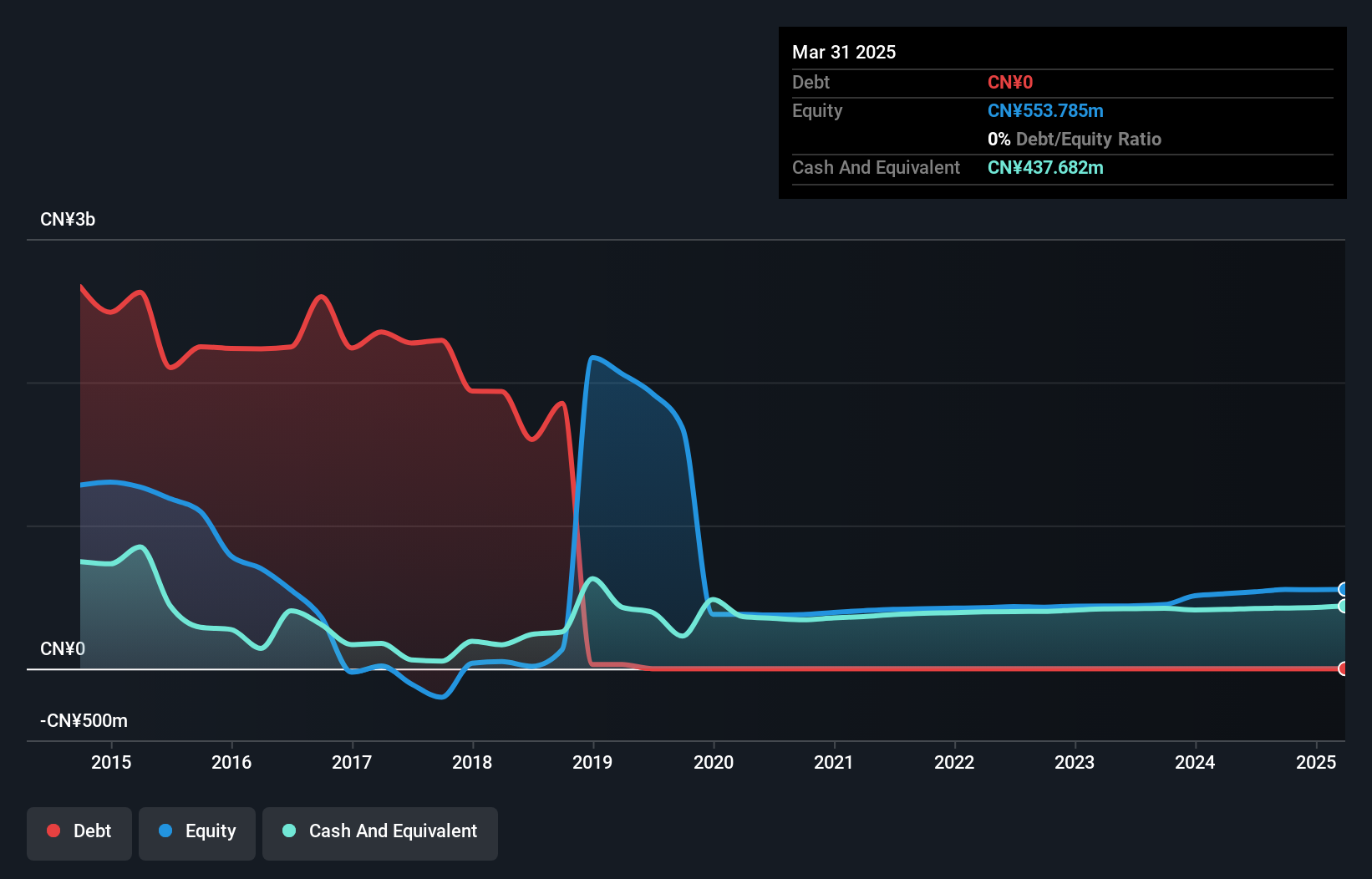

Liuzhou Chemical, a nimble player in the industry, has shown impressive growth with earnings soaring by 381% over the past year, outpacing its sector's -3.4%. The company is debt-free and boasts a price-to-earnings ratio of 26.4x, which is favorable compared to the CN market average of 31.8x. Recent reports highlight sales climbing to CNY 129 million from CNY 93 million year-on-year, while net income jumped to CNY 31 million from CNY 11 million. This performance suggests robust operational efficiency and potential for continued momentum within its niche market space.

- Unlock comprehensive insights into our analysis of Liuzhou Chemical Industry stock in this health report.

Gain insights into Liuzhou Chemical Industry's past trends and performance with our Past report.

GrandiT (SHSE:688549)

Simply Wall St Value Rating: ★★★★☆☆

Overview: GrandiT Co., Ltd. researches, develops, produces, and markets electronic chemical materials for the semiconductor industry in China, with a market cap of CN¥11.80 billion.

Operations: GrandiT generates revenue primarily from its specialty chemicals segment, which contributed CN¥994.34 million.

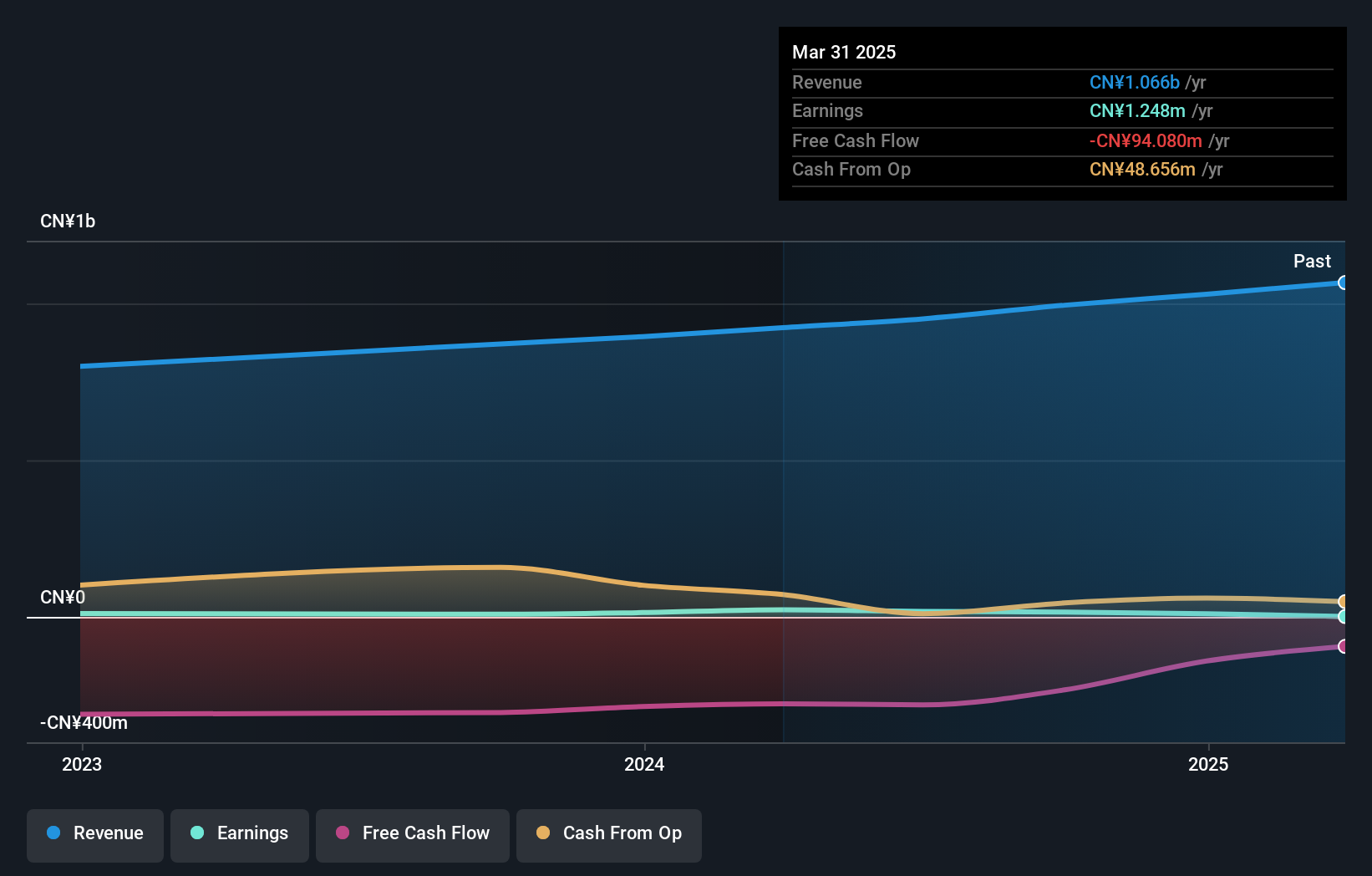

GrandiT, a notable player in its industry, has experienced significant earnings growth of 77.8% over the past year, outpacing the broader Chemicals sector's -3.4%. Despite this impressive performance, the company's debt-to-equity ratio has risen from 0% to 5.5% over five years, although it holds more cash than total debt, indicating solid financial footing. Recent results for nine months ending September 2024 showed revenue climbing to CN¥749 million from CN¥648 million year-over-year and net income reaching CN¥29.73 million compared to last year's CN¥28.23 million. However, diluted EPS dropped slightly to CNY0.0201 from CNY0.03 previously due to large one-off gains impacting quality earnings earlier in the period.

- Click here and access our complete health analysis report to understand the dynamics of GrandiT.

Understand GrandiT's track record by examining our Past report.

JirFine Intelligent Equipment (SZSE:301603)

Simply Wall St Value Rating: ★★★★☆☆

Overview: JirFine Intelligent Equipment Co., Ltd. is involved in the research, development, production, and sale of CNC machine tools with a market cap of CN¥4.82 billion.

Operations: JirFine Intelligent Equipment generates revenue primarily through the sale of CNC machine tools. The company's net profit margin is 15.6%, indicating its profitability after accounting for all expenses.

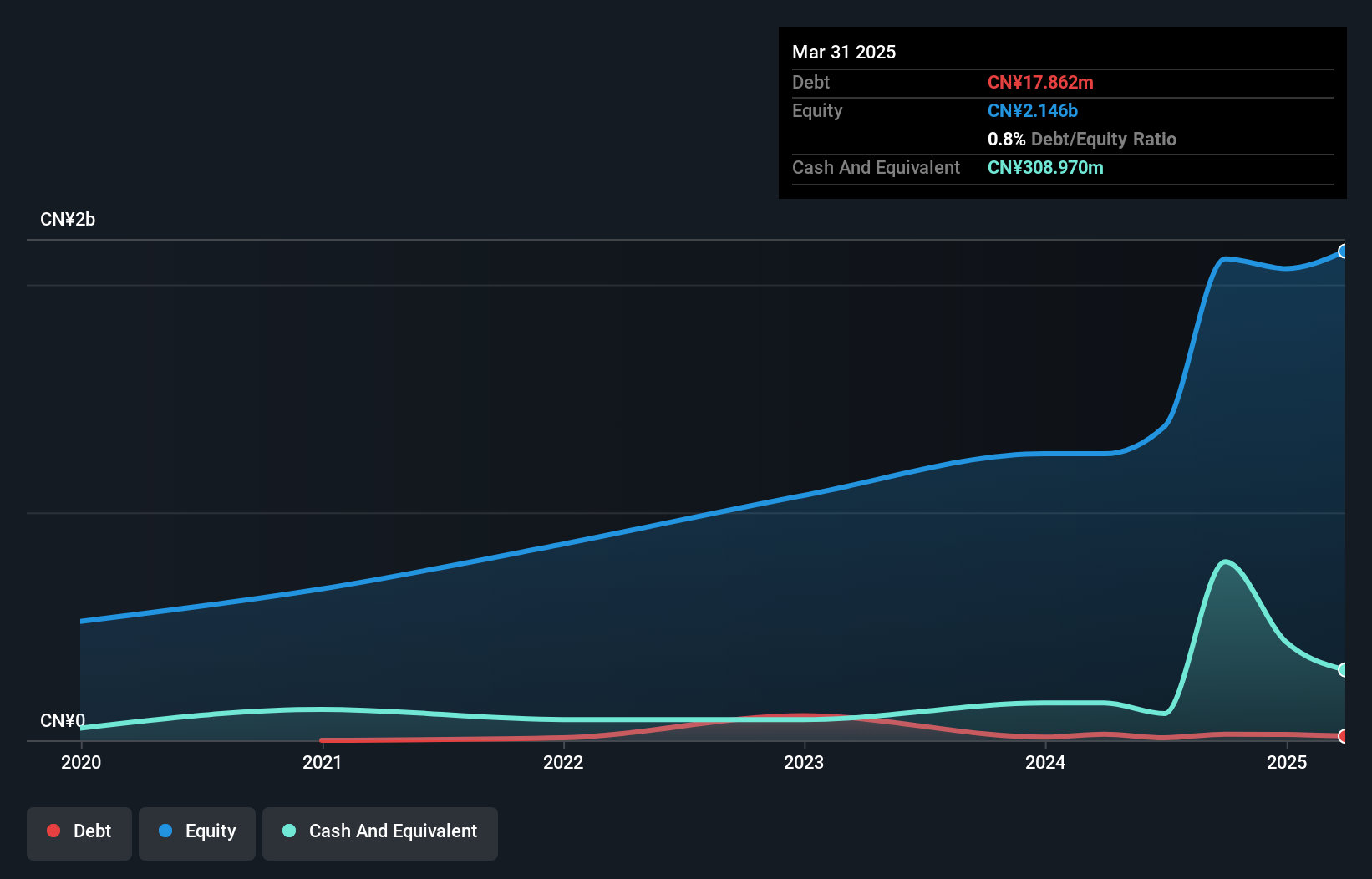

JirFine Intelligent Equipment, a relatively small player in the machinery sector, has shown promising growth with earnings increasing by 14% over the past year, outpacing the industry's modest rise of 0.2%. The company boasts a Price-to-Earnings ratio of 24.8x, which is attractive compared to the broader CN market's 31.8x. Despite not being free cash flow positive recently, JirFine maintains more cash than total debt and effectively covers its interest obligations. Recently added to the S&P Global BMI Index, this inclusion could enhance visibility and support future growth prospects for JirFine in its competitive landscape.

- Navigate through the intricacies of JirFine Intelligent Equipment with our comprehensive health report here.

Learn about JirFine Intelligent Equipment's historical performance.

Seize The Opportunity

- Delve into our full catalog of 4551 Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688549

GrandiT

Researches and develops, produces, and markets electronic chemical materials for the semiconductor industry in China.

Adequate balance sheet low.

Market Insights

Community Narratives