- China

- /

- Aerospace & Defense

- /

- SHSE:688543

Undiscovered Gems To Explore In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by tariff uncertainties and mixed economic indicators, investors are finding opportunities in the small-cap sector, with indices like the S&P 600 reflecting nuanced shifts amid broader market sentiment. While U.S. job growth has shown signs of cooling and manufacturing activity begins to expand again, discerning investors are on the lookout for potential undiscovered gems that may thrive in these dynamic conditions. Identifying promising stocks often involves looking for companies with strong fundamentals, innovative growth strategies, and resilience to macroeconomic challenges—qualities that can position them well even amidst fluctuating market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Spic Yuanda Environmental-ProtectionLtd (SHSE:600292)

Simply Wall St Value Rating: ★★★★★☆

Overview: Spic Yuanda Environmental-Protection Co., Ltd. is a company focused on environmental protection solutions, with a market capitalization of CN¥9.99 billion.

Operations: Spic Yuanda derives its revenue primarily from environmental protection solutions. The company's financial data lacks specific figures on revenue segments, making it challenging to provide a detailed breakdown of cost structures or profit margins.

Spic Yuanda, a smaller player in the environmental protection sector, has shown robust earnings growth of 176% over the past year, outpacing its industry. Despite this impressive performance, its earnings have decreased by 26.7% annually over the last five years. The net debt to equity ratio sits comfortably at 14%, indicating a satisfactory debt level. Trading at 65% below estimated fair value suggests potential undervaluation in the market. Recent volatility in share price may concern some investors; however, interest payments are well covered by EBIT at nearly 30 times coverage, highlighting financial resilience amidst market fluctuations.

Jiangxi Guoke Defence GroupLtd (SHSE:688543)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangxi Guoke Defence Group Co., Ltd. engages in the research, development, production, and sale of military products both domestically and internationally, with a market cap of CN¥8.89 billion.

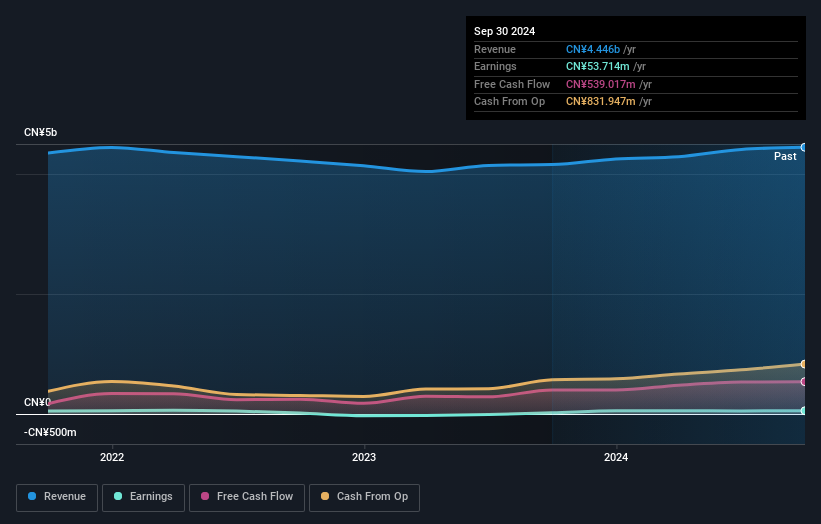

Operations: Jiangxi Guoke Defence Group generates revenue primarily from its Aerospace & Defense segment, amounting to CN¥1.13 billion.

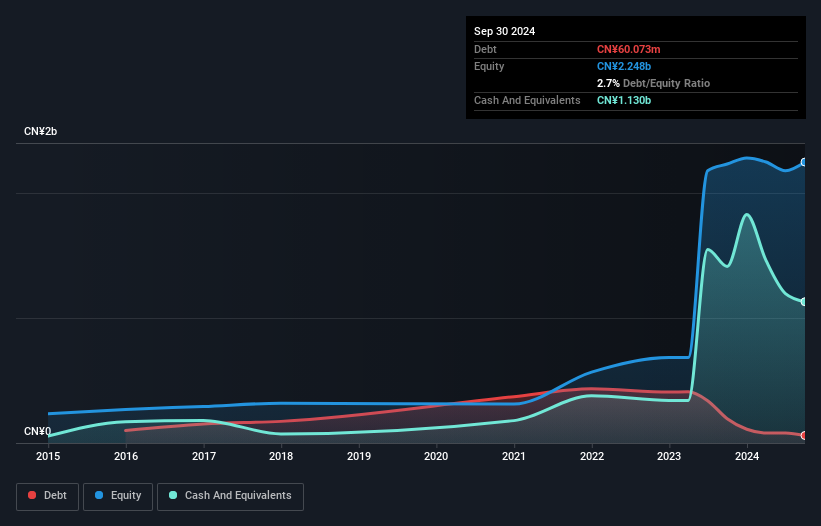

Jiangxi Guoke Defence Group, a notable player in the Aerospace & Defense sector, showcases impressive financial health with cash exceeding total debt and a reduced debt-to-equity ratio from 91.7% to 2.7% over five years. Their earnings growth of 56.1% last year outpaced the industry's -13.4%, reflecting robust performance and high-quality earnings. The company also offers value with a price-to-earnings ratio of 45.1x, below the industry average of 59.8x, suggesting potential for investors seeking opportunities in this space despite no recent share repurchases under their buyback program announced earlier in February 2024 for CNY76 million.

Teemsun TechnologyLtd (SZSE:301571)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Teemsun Technology Co., Ltd is a company specializing in the research, development, production, sale, and service of infrared thermal imaging and other optoelectronics equipment with a market cap of CN¥7.78 billion.

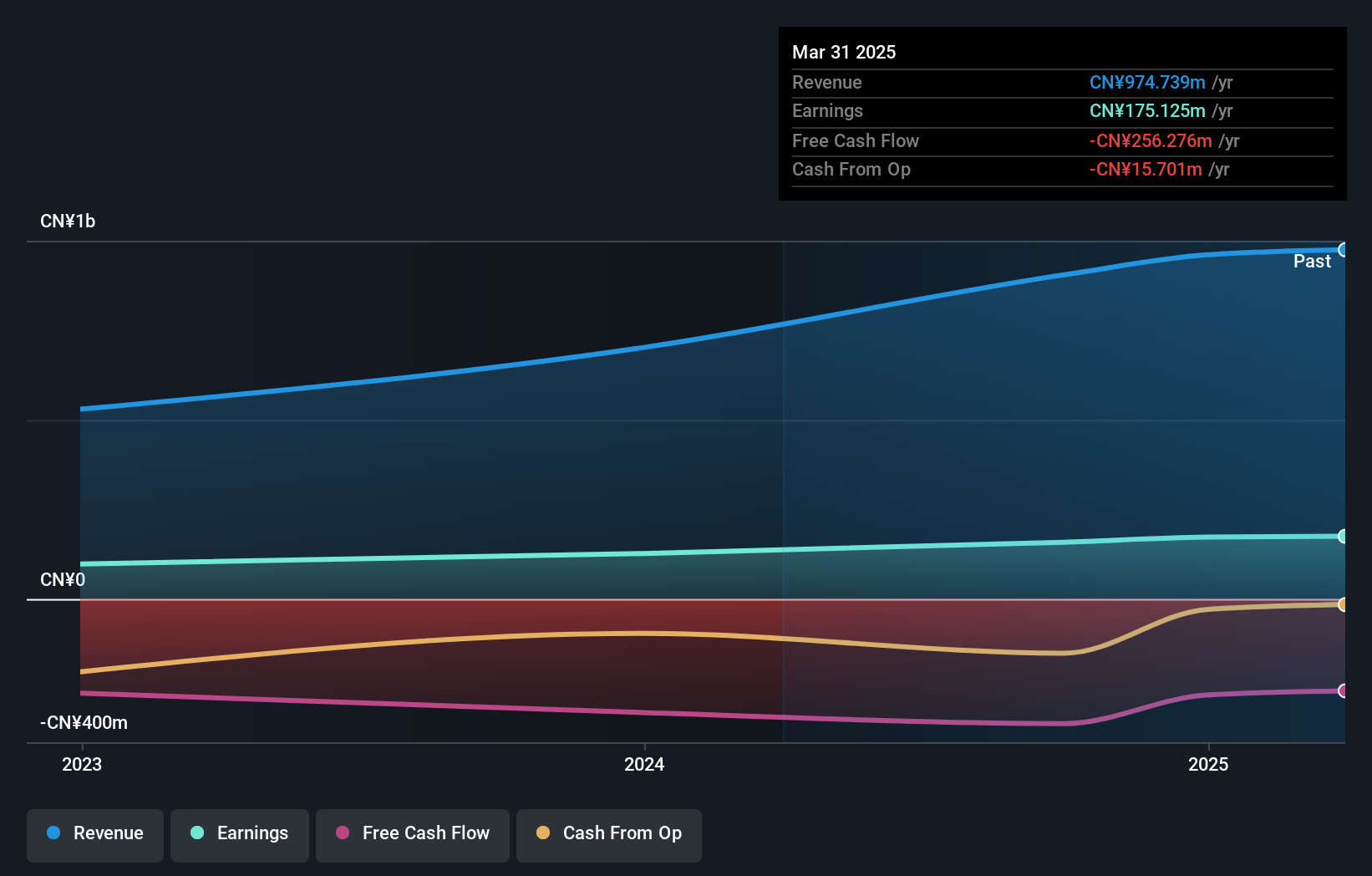

Operations: Teemsun Technology Co., Ltd generates revenue primarily from its aerospace and defense segment, amounting to CN¥905.08 million. The company's financial performance is significantly influenced by this sector, which plays a crucial role in its overall revenue model.

Teemsun Technology Ltd., a smaller player in the Aerospace & Defense sector, has shown impressive earnings growth of 32.6% over the past year, outpacing the industry's -13.4%. The company boasts a solid financial position with its interest payments well covered by EBIT at 14.9 times, indicating robust operational efficiency. Despite not being free cash flow positive, Teemsun's price-to-earnings ratio stands at 49.1x, which is more attractive compared to the industry average of 59.8x. A recent shareholders meeting suggests active engagement with stakeholders and potential strategic developments on the horizon for this promising enterprise in Beijing.

Key Takeaways

- Delve into our full catalog of 4706 Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688543

Jiangxi Guoke Defence GroupLtd

Through its subsidiaries, researches and develops, produces, and sells military products in China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives