Hunan SUND Technological Corporation's (SZSE:301548) Shares Climb 31% But Its Business Is Yet to Catch Up

Hunan SUND Technological Corporation (SZSE:301548) shareholders have had their patience rewarded with a 31% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 47% in the last year.

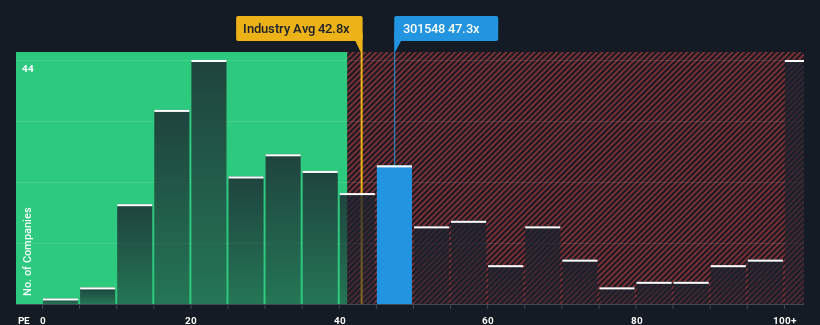

Following the firm bounce in price, Hunan SUND Technological's price-to-earnings (or "P/E") ratio of 47.3x might make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 39x and even P/E's below 22x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With earnings that are retreating more than the market's of late, Hunan SUND Technological has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for Hunan SUND Technological

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Hunan SUND Technological's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 29%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 25% overall rise in EPS. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Looking ahead now, EPS is anticipated to climb by 35% during the coming year according to the only analyst following the company. With the market predicted to deliver 37% growth , the company is positioned for a comparable earnings result.

With this information, we find it interesting that Hunan SUND Technological is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Hunan SUND Technological shares have received a push in the right direction, but its P/E is elevated too. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Hunan SUND Technological currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Hunan SUND Technological that you should be aware of.

If you're unsure about the strength of Hunan SUND Technological's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Hunan SUND Technological, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hunan SUND Technological might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301548

Hunan SUND Technological

Researches, develops, produces, and sells bearing products and transmission systems in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives