Shenzhen Han's CNC Technology Co., Ltd.'s (SZSE:301200) 38% Price Boost Is Out Of Tune With Revenues

Shenzhen Han's CNC Technology Co., Ltd. (SZSE:301200) shareholders would be excited to see that the share price has had a great month, posting a 38% gain and recovering from prior weakness. Unfortunately, despite the strong performance over the last month, the full year gain of 4.7% isn't as attractive.

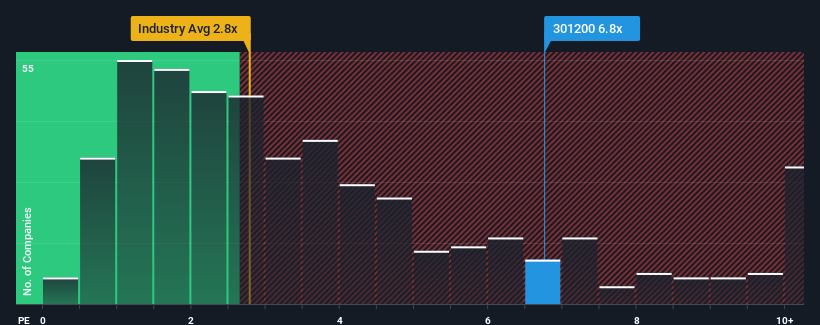

After such a large jump in price, when almost half of the companies in China's Machinery industry have price-to-sales ratios (or "P/S") below 2.8x, you may consider Shenzhen Han's CNC Technology as a stock not worth researching with its 6.8x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Shenzhen Han's CNC Technology

How Shenzhen Han's CNC Technology Has Been Performing

With revenue growth that's superior to most other companies of late, Shenzhen Han's CNC Technology has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Shenzhen Han's CNC Technology's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Shenzhen Han's CNC Technology's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 32% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 29% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 20% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 23%, which is noticeably more attractive.

In light of this, it's alarming that Shenzhen Han's CNC Technology's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Shenzhen Han's CNC Technology's P/S?

Shenzhen Han's CNC Technology's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Shenzhen Han's CNC Technology, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Shenzhen Han's CNC Technology you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301200

Shenzhen Han's CNC Technology

Engages in the research, development, and manufacturing of printed circuit board (PCB) products.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives