ShaoYang Victor Hydraulics Co.,Ltd (SZSE:301079) Investors Are Less Pessimistic Than Expected

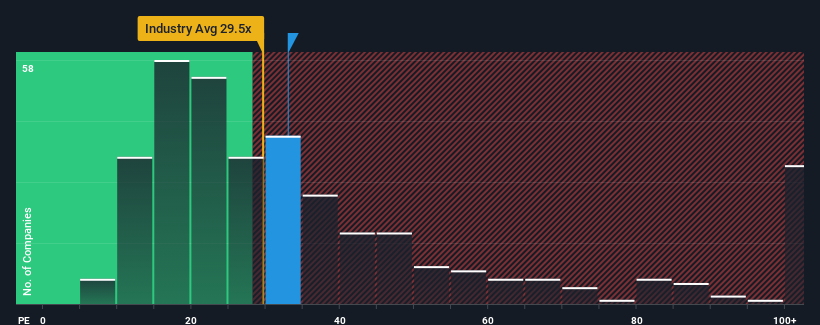

With a median price-to-earnings (or "P/E") ratio of close to 30x in China, you could be forgiven for feeling indifferent about ShaoYang Victor Hydraulics Co.,Ltd's (SZSE:301079) P/E ratio of 33x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For example, consider that ShaoYang Victor HydraulicsLtd's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for ShaoYang Victor HydraulicsLtd

Is There Some Growth For ShaoYang Victor HydraulicsLtd?

In order to justify its P/E ratio, ShaoYang Victor HydraulicsLtd would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 41% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 41% shows it's an unpleasant look.

In light of this, it's somewhat alarming that ShaoYang Victor HydraulicsLtd's P/E sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that ShaoYang Victor HydraulicsLtd currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 3 warning signs for ShaoYang Victor HydraulicsLtd you should be aware of, and 1 of them shouldn't be ignored.

Of course, you might also be able to find a better stock than ShaoYang Victor HydraulicsLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade ShaoYang Victor HydraulicsLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301079

ShaoYang Victor HydraulicsLtd

Engages in the designing, research and development, manufacturing, and sales of hydraulic piston pumps, cylinders, and systems in China.

Adequate balance sheet low.

Market Insights

Community Narratives