- China

- /

- Consumer Durables

- /

- SZSE:000521

Exploring Three Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

In the current global market landscape, uncertainty surrounding trade policies and mixed economic signals have led to fluctuations in major indices, with small-cap stocks experiencing particular volatility. Amidst this backdrop, investors are increasingly on the lookout for undiscovered gems that demonstrate resilience and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Quemchi | 0.66% | 82.67% | 21.69% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Hollyland (China) Electronics Technology | 3.46% | 13.95% | 11.27% | ★★★★★☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Changhong Meiling (SZSE:000521)

Simply Wall St Value Rating: ★★★★★★

Overview: Changhong Meiling Co., Ltd. is engaged in the electrical machinery and equipment manufacturing industry both in China and internationally, with a market cap of CN¥7.73 billion.

Operations: Changhong Meiling generates revenue primarily from its operations in the electrical machinery and equipment manufacturing sector. The company's financial performance is influenced by its cost structure, which impacts its net profit margin.

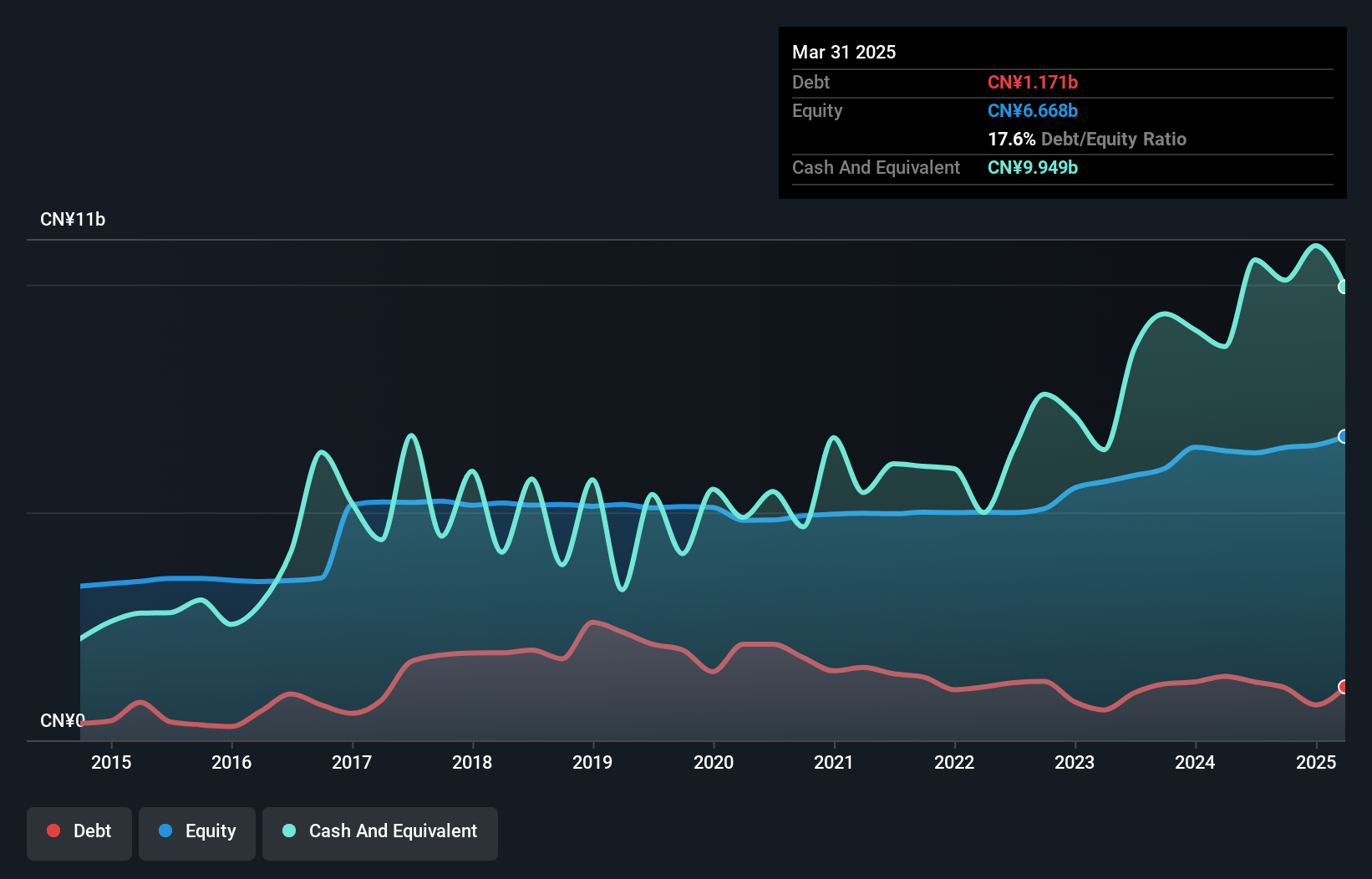

Earnings for Changhong Meiling have outpaced the Consumer Durables industry with a 33% growth, contrasting sharply against the industry's -1.9%. The company is trading at a compelling 72.2% below its estimated fair value, suggesting potential undervaluation. Over the past five years, its debt-to-equity ratio has improved significantly from 38.7% to 17.9%, indicating better financial health and reduced leverage risk. With high-quality earnings and positive free cash flow, this small entity appears well-positioned within its sector despite challenges in maintaining consistent capital expenditure levels around US$275 million annually over recent years.

COFCO Technology & Industry (SZSE:301058)

Simply Wall St Value Rating: ★★★★★☆

Overview: COFCO Technology & Industry Co., Ltd. is a scientific and technological company that serves as an agricultural food engineering technology service provider and grain machine products supplier, with a market cap of CN¥5.35 billion.

Operations: COFCO Technology & Industry's revenue primarily stems from its role as an agricultural food engineering technology service provider and grain machine products supplier. The company has a market cap of CN¥5.35 billion. It focuses on delivering specialized solutions in these sectors, contributing to its financial performance.

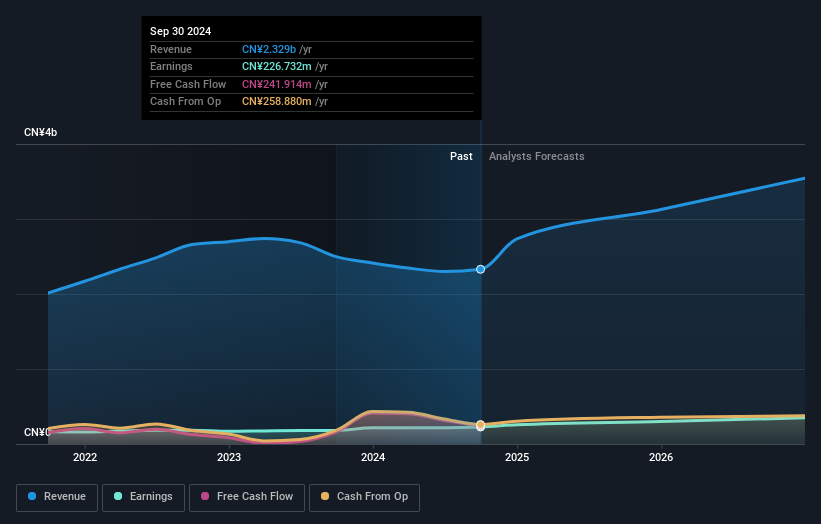

COFCO Technology & Industry stands out with its impressive earnings growth of 26.5% over the past year, outpacing the Construction industry's -3.9%. The company is trading at a discount, 14.9% below its estimated fair value, which might catch the eye of those seeking undervalued opportunities. Despite an increase in debt to equity ratio from 0% to 2.2%, COFCO's debt isn't alarming due to more cash than total debt and sufficient interest coverage by profits. With high-quality past earnings and a forecasted annual growth rate of 18.1%, future prospects seem promising for this dynamic player in its sector.

Central Automotive Products (TSE:8117)

Simply Wall St Value Rating: ★★★★★★

Overview: Central Automotive Products Ltd. is involved in the import, export, and wholesale of automotive parts and accessories, with a market cap of ¥83.58 billion.

Operations: Central Automotive Products generates revenue primarily through the import, export, and wholesale of automotive parts and accessories. The company has a market cap of ¥83.58 billion.

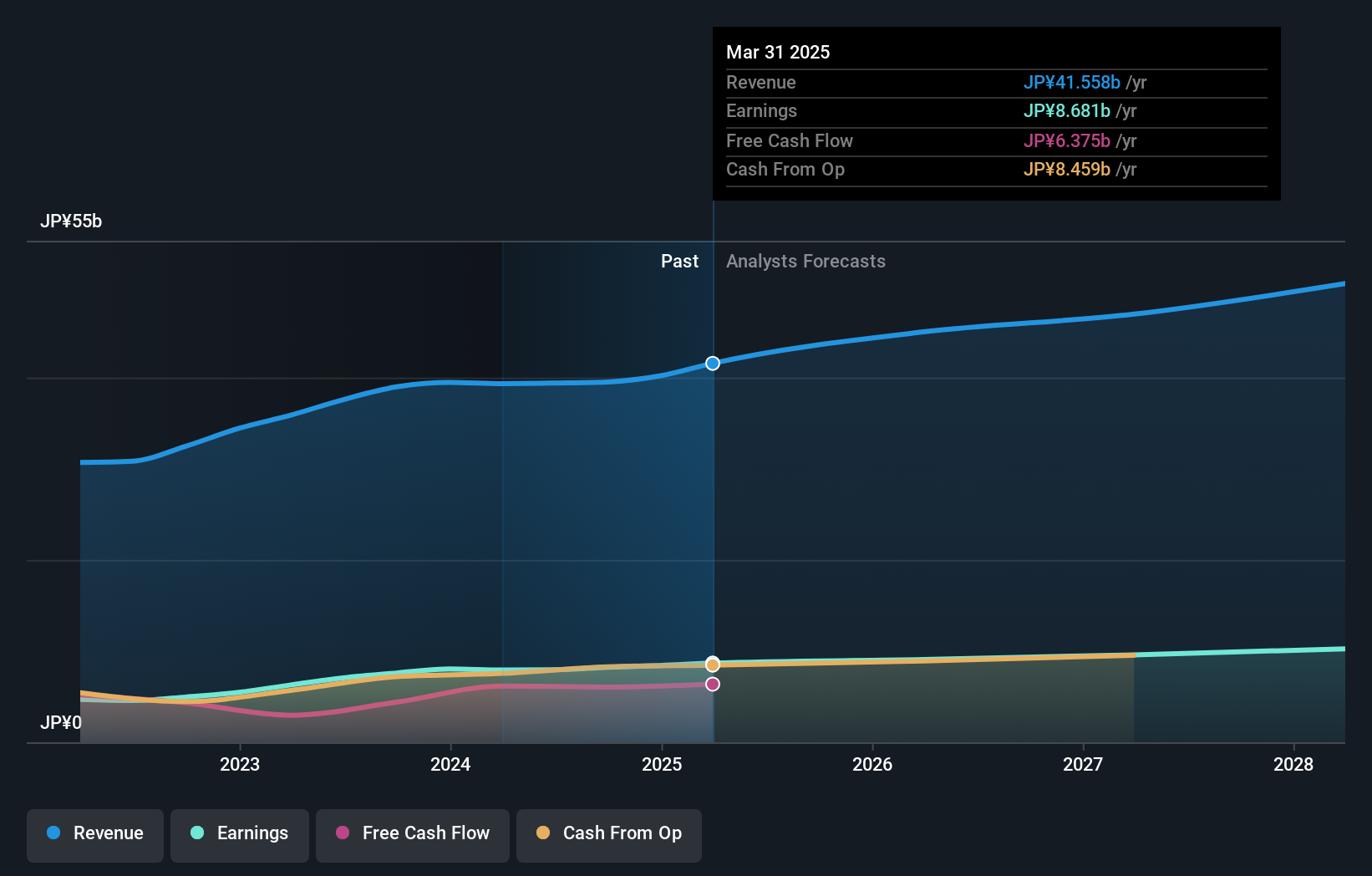

Central Automotive Products, a dynamic player in the automotive sector, has demonstrated robust financial health with a 20% annual earnings growth over the past five years. Despite not outpacing the industry last year, its debt-free status and high-quality earnings stand out. The company seems to be trading at an attractive 43% below its estimated fair value, offering potential upside for investors. With free cash flow remaining positive and forecasted earnings growth of 6% annually, Central Automotive appears well-positioned for future opportunities in its competitive landscape.

- Navigate through the intricacies of Central Automotive Products with our comprehensive health report here.

Learn about Central Automotive Products' historical performance.

Make It Happen

- Navigate through the entire inventory of 4699 Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000521

Changhong Meiling

Engages in the research, development, and manufacturing of refrigeration appliances and washing machines in China and internationally.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives