- China

- /

- Aerospace & Defense

- /

- SZSE:301050

Chengdu RML Technology Co., Ltd.'s (SZSE:301050) Price Is Right But Growth Is Lacking

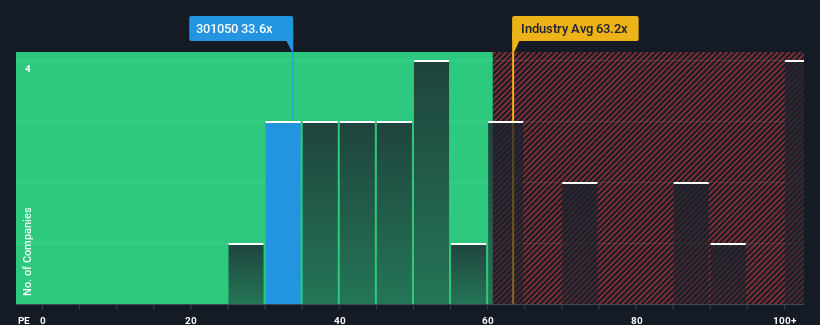

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 39x, you may consider Chengdu RML Technology Co., Ltd. (SZSE:301050) as an attractive investment with its 33.6x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Chengdu RML Technology has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Chengdu RML Technology

Is There Any Growth For Chengdu RML Technology?

Chengdu RML Technology's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered an exceptional 41% gain to the company's bottom line. The latest three year period has also seen an excellent 46% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 0.8% during the coming year according to the dual analysts following the company. With the market predicted to deliver 37% growth , that's a disappointing outcome.

With this information, we are not surprised that Chengdu RML Technology is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Chengdu RML Technology's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Chengdu RML Technology maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Chengdu RML Technology with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Chengdu RML Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301050

Chengdu RML Technology

Engages in the research, development, manufacturing, testing, and sale of millimeter-wave microsystems.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives