- China

- /

- Construction

- /

- SZSE:301027

Undiscovered Gems on None for December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by central banks adjusting interest rates and mixed performances across major indices, small-cap stocks have faced notable challenges, with the Russell 2000 Index underperforming against its larger-cap counterparts. Despite these headwinds, opportunities may exist in overlooked sectors where companies demonstrate resilience through solid fundamentals and adaptability to shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Thai Energy Storage Technology | 9.49% | -1.42% | 1.73% | ★★★★★☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

GuiZhouYongJi PrintingLtd (SHSE:603058)

Simply Wall St Value Rating: ★★★★★☆

Overview: GuiZhouYongJi Printing Co., Ltd operates in the packaging and printing industry across China and Australia, with a market capitalization of CN¥4.97 billion.

Operations: GuiZhouYongJi Printing Co., Ltd generates revenue primarily from its packaging and printing operations in China and Australia. The company's net profit margin is 12%, reflecting its ability to manage costs effectively relative to its revenue streams.

GuiZhouYongJi Printing has shown impressive earnings growth of 50.2% over the past year, outpacing the Packaging industry's 18.4%. Despite a debt to equity ratio rising to 29.3% over five years, its net debt to equity ratio remains satisfactory at 9.1%, indicating prudent financial management. The company reported sales of ¥610 million for the first nine months of 2024, up from ¥519 million last year, with net income more than doubling to ¥128 million from ¥61 million. Its price-to-earnings ratio at 29.6x is attractive compared to the broader Chinese market's average of 38x, suggesting potential value for investors seeking growth opportunities in this sector.

Hualan Group (SZSE:301027)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hualan Group Co., Ltd. offers integrated services for urban and rural construction in China, with a market cap of CN¥2.24 billion.

Operations: Hualan Group generates revenue primarily from its integrated services in urban and rural construction across China. The company's financial performance is characterized by a focus on managing costs effectively, impacting its net profit margin.

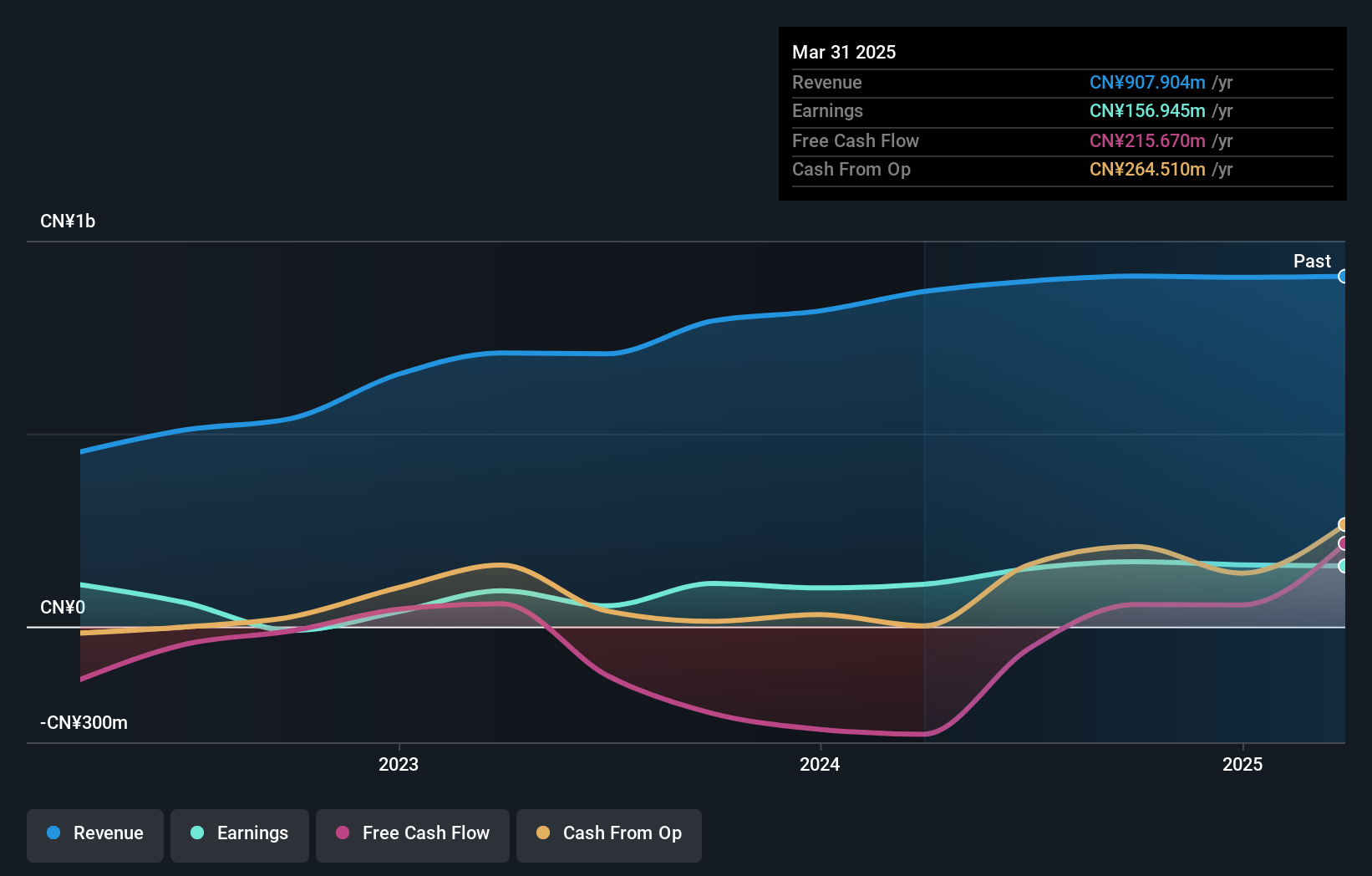

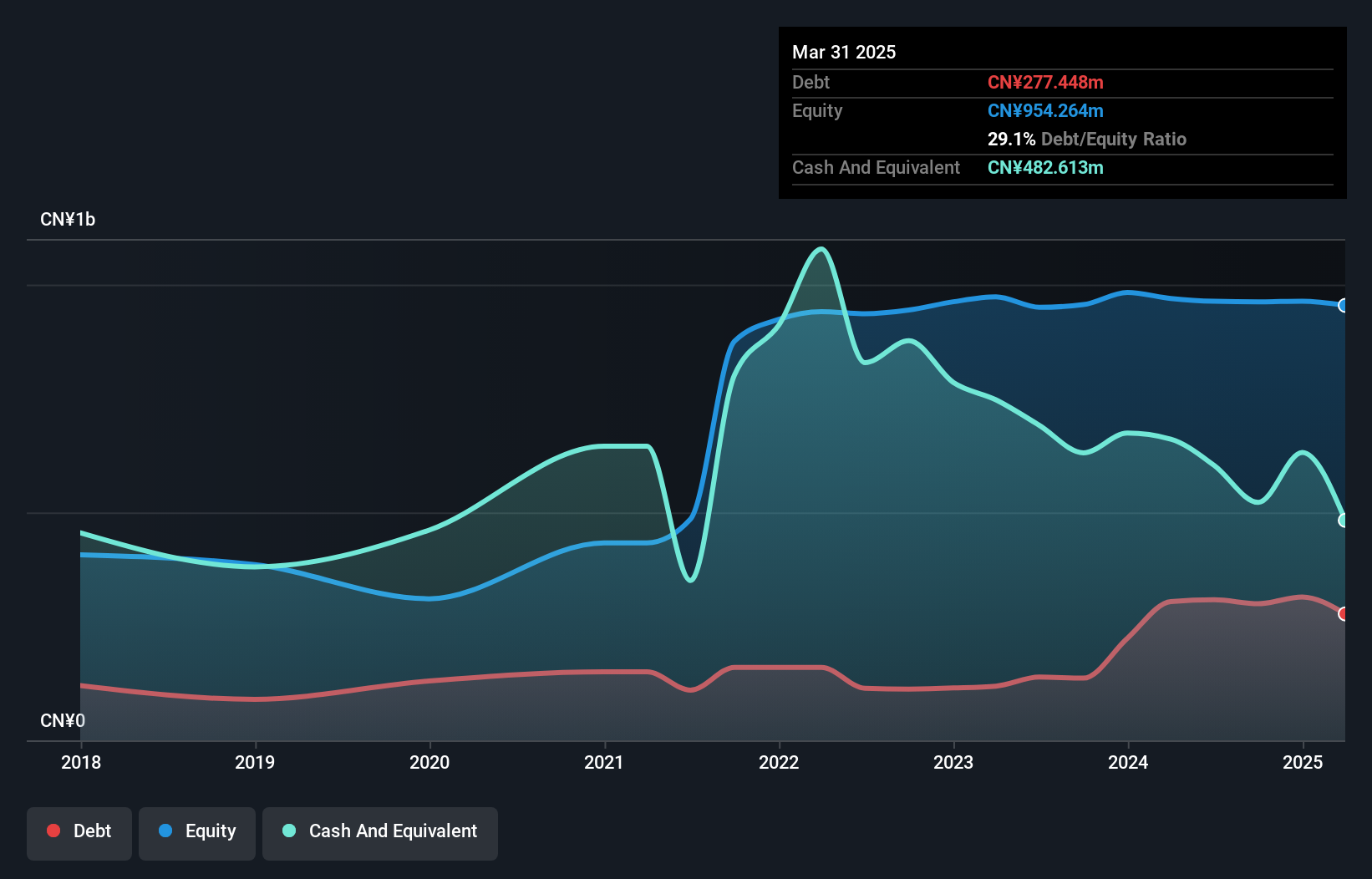

Hualan Group's financial landscape paints a complex picture. Over the past year, earnings surged by 26.6%, outpacing the construction industry's -3.9% trend, yet revenue for nine months ending September 2024 fell to CNY 307.57 million from CNY 402.84 million previously, with a net loss of CNY 23.47 million compared to CNY 9.55 million last year. The debt-to-equity ratio improved from 36.5% to 31.1% over five years, indicating better financial management despite volatile share prices recently and non-cash earnings contributing significantly to its high-quality earnings profile amidst declining free cash flow scenarios.

- Take a closer look at Hualan Group's potential here in our health report.

Gain insights into Hualan Group's historical performance by reviewing our past performance report.

create restaurants holdings (TSE:3387)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Create Restaurants Holdings Inc. is a company that plans, develops, and manages food courts, izakaya bars, dinner-time restaurants, and bakeries in Japan with a market capitalization of approximately ¥252.24 billion.

Operations: The company generates revenue primarily through its diverse portfolio of food courts, izakaya bars, dinner-time restaurants, and bakeries. It has a market capitalization of approximately ¥252.24 billion.

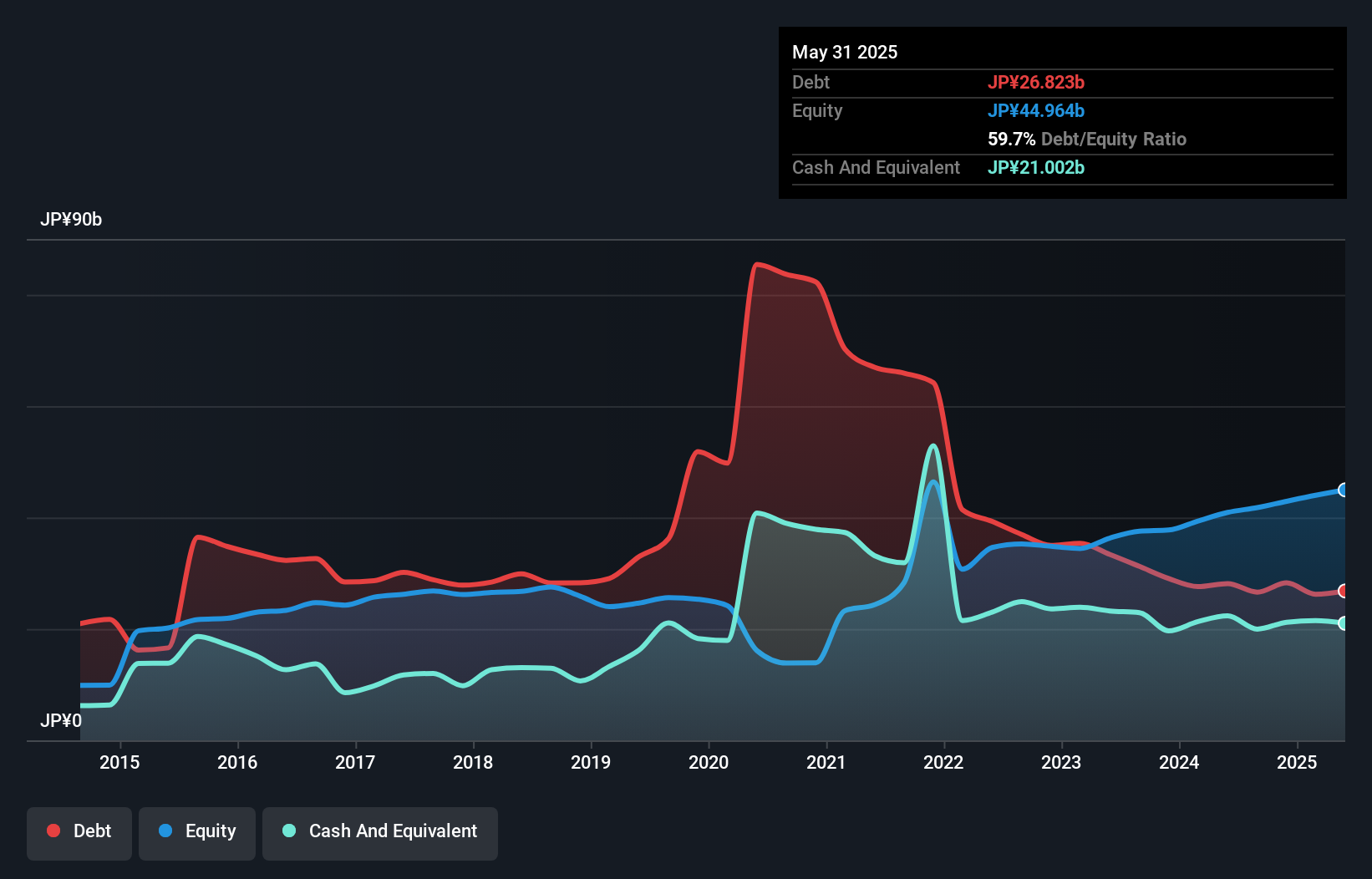

Create Restaurants Holdings, a dynamic player in the hospitality sector, has caught attention with its robust earnings growth of 78.5% over the past year, outpacing the industry average of 24.5%. This impressive performance is backed by a reduction in its debt to equity ratio from 141.3% to 63.7% over five years, indicating improved financial health. Despite a large one-off loss of ¥3.2 billion impacting recent results, the company appears undervalued at 51.3% below estimated fair value and maintains satisfactory net debt levels at 15.9%, suggesting potential for future growth as it integrates new acquisitions into operations.

- Click to explore a detailed breakdown of our findings in create restaurants holdings' health report.

Gain insights into create restaurants holdings' past trends and performance with our Past report.

Next Steps

- Dive into all 4621 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hualan Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301027

Hualan Group

Provides integrated services in the field of urban and rural construction in China.

Adequate balance sheet very low.

Market Insights

Community Narratives