Revenues Tell The Story For Guangdong Shenling Environmental Systems Co., Ltd. (SZSE:301018) As Its Stock Soars 28%

Despite an already strong run, Guangdong Shenling Environmental Systems Co., Ltd. (SZSE:301018) shares have been powering on, with a gain of 28% in the last thirty days. Looking further back, the 23% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

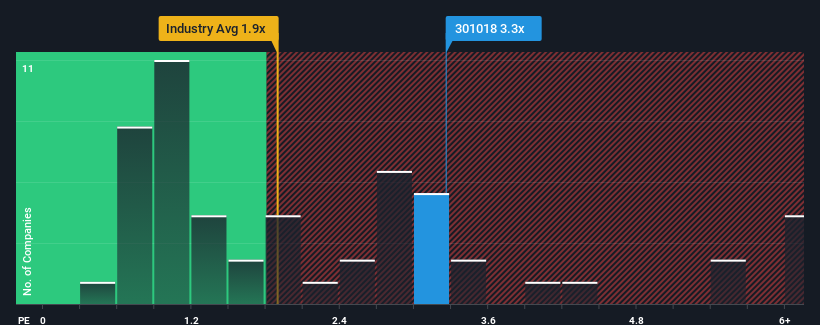

Following the firm bounce in price, you could be forgiven for thinking Guangdong Shenling Environmental Systems is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.3x, considering almost half the companies in China's Building industry have P/S ratios below 1.9x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Guangdong Shenling Environmental Systems

How Guangdong Shenling Environmental Systems Has Been Performing

Recent times haven't been great for Guangdong Shenling Environmental Systems as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guangdong Shenling Environmental Systems.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Guangdong Shenling Environmental Systems would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.0%. Pleasingly, revenue has also lifted 57% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 40% during the coming year according to the three analysts following the company. With the industry only predicted to deliver 21%, the company is positioned for a stronger revenue result.

With this information, we can see why Guangdong Shenling Environmental Systems is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Guangdong Shenling Environmental Systems shares have taken a big step in a northerly direction, but its P/S is elevated as a result. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Guangdong Shenling Environmental Systems shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Guangdong Shenling Environmental Systems, and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301018

Guangdong Shenling Environmental Systems

Guangdong Shenling Environmental Systems Co., Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives