Nanjing Railway New Technology Co.,Ltd.'s (SZSE:301016) Shares Climb 25% But Its Business Is Yet to Catch Up

Nanjing Railway New Technology Co.,Ltd. (SZSE:301016) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 48% in the last year.

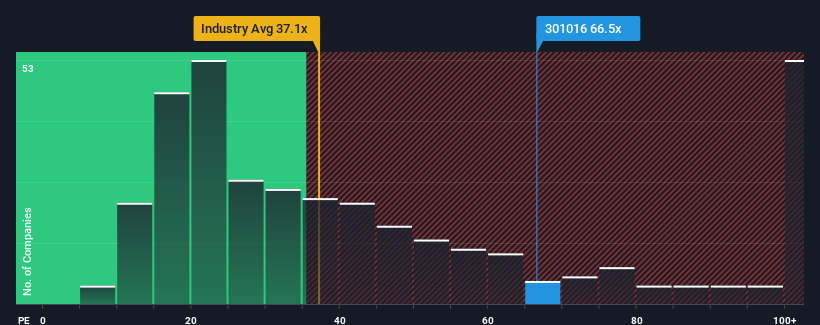

After such a large jump in price, Nanjing Railway New TechnologyLtd may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 66.5x, since almost half of all companies in China have P/E ratios under 37x and even P/E's lower than 21x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

The earnings growth achieved at Nanjing Railway New TechnologyLtd over the last year would be more than acceptable for most companies. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Nanjing Railway New TechnologyLtd

Is There Enough Growth For Nanjing Railway New TechnologyLtd?

Nanjing Railway New TechnologyLtd's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings growth, the company posted a worthy increase of 9.7%. However, this wasn't enough as the latest three year period has seen an unpleasant 63% overall drop in EPS. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 40% shows it's an unpleasant look.

With this information, we find it concerning that Nanjing Railway New TechnologyLtd is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Nanjing Railway New TechnologyLtd's P/E

Shares in Nanjing Railway New TechnologyLtd have built up some good momentum lately, which has really inflated its P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Nanjing Railway New TechnologyLtd revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 3 warning signs for Nanjing Railway New TechnologyLtd (2 make us uncomfortable!) that you need to take into consideration.

Of course, you might also be able to find a better stock than Nanjing Railway New TechnologyLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Nanjing Railway New TechnologyLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nanjing Railway New TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301016

Nanjing Railway New TechnologyLtd

Engages in the research, development, and manufacturing of rail vehicle body parts and bogie parts in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives