Zhejiang JW Precision Machinery Co.,Ltd's (SZSE:300984) 28% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, Zhejiang JW Precision Machinery Co.,Ltd (SZSE:300984) shares have been powering on, with a gain of 28% in the last thirty days. The last 30 days bring the annual gain to a very sharp 100%.

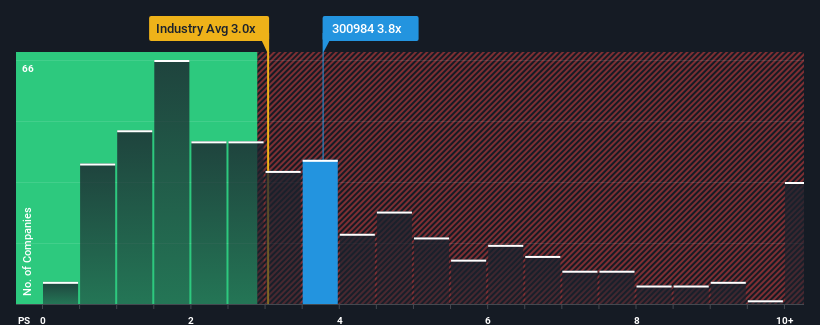

Since its price has surged higher, you could be forgiven for thinking Zhejiang JW Precision MachineryLtd is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.8x, considering almost half the companies in China's Machinery industry have P/S ratios below 3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Zhejiang JW Precision MachineryLtd

What Does Zhejiang JW Precision MachineryLtd's Recent Performance Look Like?

Zhejiang JW Precision MachineryLtd has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Zhejiang JW Precision MachineryLtd's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Zhejiang JW Precision MachineryLtd?

The only time you'd be truly comfortable seeing a P/S as high as Zhejiang JW Precision MachineryLtd's is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. This was backed up an excellent period prior to see revenue up by 34% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 22% shows it's noticeably less attractive.

In light of this, it's alarming that Zhejiang JW Precision MachineryLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Zhejiang JW Precision MachineryLtd's P/S?

Zhejiang JW Precision MachineryLtd shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Zhejiang JW Precision MachineryLtd revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Zhejiang JW Precision MachineryLtd (at least 3 which don't sit too well with us), and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang JW Precision MachineryLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300984

Zhejiang JW Precision MachineryLtd

Engages in the research and development, production, and sale of bearing rings in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026