- China

- /

- Construction

- /

- SZSE:300982

Revenues Tell The Story For Suwen Electric Energy Technology Co.,Ltd. (SZSE:300982) As Its Stock Soars 26%

Suwen Electric Energy Technology Co.,Ltd. (SZSE:300982) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 60% share price drop in the last twelve months.

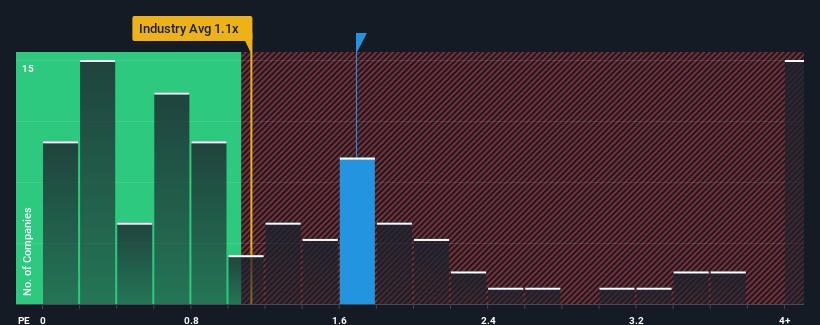

Following the firm bounce in price, when almost half of the companies in China's Construction industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Suwen Electric Energy TechnologyLtd as a stock probably not worth researching with its 1.7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Suwen Electric Energy TechnologyLtd

What Does Suwen Electric Energy TechnologyLtd's Recent Performance Look Like?

Suwen Electric Energy TechnologyLtd's revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Suwen Electric Energy TechnologyLtd's future stacks up against the industry? In that case, our free report is a great place to start.How Is Suwen Electric Energy TechnologyLtd's Revenue Growth Trending?

Suwen Electric Energy TechnologyLtd's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.1% last year. This was backed up an excellent period prior to see revenue up by 71% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 38% during the coming year according to the seven analysts following the company. That's shaping up to be materially higher than the 15% growth forecast for the broader industry.

In light of this, it's understandable that Suwen Electric Energy TechnologyLtd's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Suwen Electric Energy TechnologyLtd's P/S?

The large bounce in Suwen Electric Energy TechnologyLtd's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Suwen Electric Energy TechnologyLtd's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 3 warning signs we've spotted with Suwen Electric Energy TechnologyLtd (including 1 which is a bit concerning).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300982

Suwen Electric Energy TechnologyLtd

Suwen Electric Energy Technology Co.,Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives