- China

- /

- Electrical

- /

- SZSE:300913

Risks Still Elevated At These Prices As Zhejiang Zhaolong Interconnect Technology Co.,Ltd. (SZSE:300913) Shares Dive 28%

The Zhejiang Zhaolong Interconnect Technology Co.,Ltd. (SZSE:300913) share price has softened a substantial 28% over the previous 30 days, handing back much of the gains the stock has made lately. Still, a bad month hasn't completely ruined the past year with the stock gaining 32%, which is great even in a bull market.

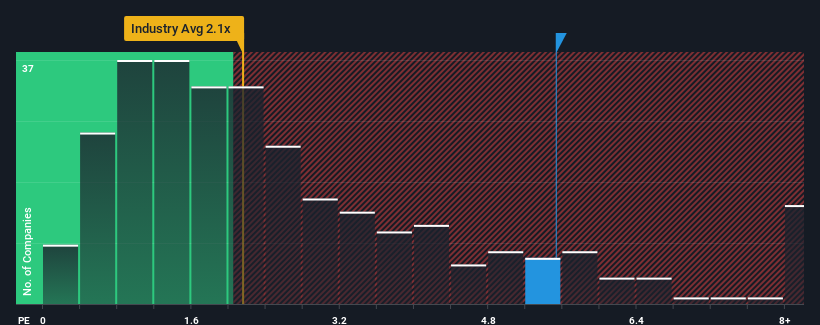

Although its price has dipped substantially, you could still be forgiven for thinking Zhejiang Zhaolong Interconnect TechnologyLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.5x, considering almost half the companies in China's Electrical industry have P/S ratios below 2.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Zhejiang Zhaolong Interconnect TechnologyLtd

How Zhejiang Zhaolong Interconnect TechnologyLtd Has Been Performing

Zhejiang Zhaolong Interconnect TechnologyLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Zhejiang Zhaolong Interconnect TechnologyLtd will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Zhejiang Zhaolong Interconnect TechnologyLtd's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 11%. Even so, admirably revenue has lifted 31% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 23% during the coming year according to the only analyst following the company. That's shaping up to be similar to the 23% growth forecast for the broader industry.

With this information, we find it interesting that Zhejiang Zhaolong Interconnect TechnologyLtd is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Zhejiang Zhaolong Interconnect TechnologyLtd's P/S

A significant share price dive has done very little to deflate Zhejiang Zhaolong Interconnect TechnologyLtd's very lofty P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given Zhejiang Zhaolong Interconnect TechnologyLtd's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 1 warning sign for Zhejiang Zhaolong Interconnect TechnologyLtd that you need to take into consideration.

If you're unsure about the strength of Zhejiang Zhaolong Interconnect TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Zhaolong Interconnect TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300913

Zhejiang Zhaolong Interconnect TechnologyLtd

Zhejiang Zhaolong Interconnect Technology Co.,Ltd.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives