- China

- /

- Electrical

- /

- SZSE:300907

Kangping Technology (Suzhou) Co., Ltd.'s (SZSE:300907) Shares Climb 29% But Its Business Is Yet to Catch Up

Those holding Kangping Technology (Suzhou) Co., Ltd. (SZSE:300907) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 13% in the last twelve months.

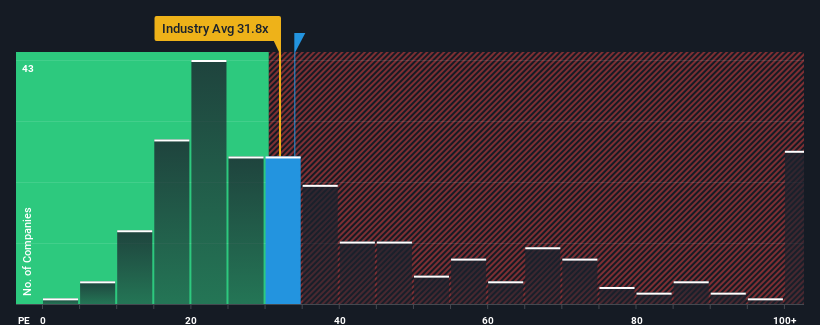

In spite of the firm bounce in price, it's still not a stretch to say that Kangping Technology (Suzhou)'s price-to-earnings (or "P/E") ratio of 33.9x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 31x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Kangping Technology (Suzhou) certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Kangping Technology (Suzhou)

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Kangping Technology (Suzhou)'s is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 65% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 38% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 40% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Kangping Technology (Suzhou)'s P/E sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Bottom Line On Kangping Technology (Suzhou)'s P/E

Kangping Technology (Suzhou) appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Kangping Technology (Suzhou) revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Kangping Technology (Suzhou) (of which 1 makes us a bit uncomfortable!) you should know about.

If you're unsure about the strength of Kangping Technology (Suzhou)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kangping Technology (Suzhou) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300907

Kangping Technology (Suzhou)

Engages in the research and development, design, production, and sale of motors and related products.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives