- China

- /

- Electronic Equipment and Components

- /

- SHSE:603773

Top Growth Companies With Strong Insider Ownership October 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by interest rate adjustments and shifts in consumer spending, the U.S. indices have shown resilience with notable performances from small- and mid-cap stocks. In this environment, identifying growth companies with strong insider ownership can be particularly appealing, as such ownership often signals confidence in the company's future prospects and aligns management's interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We're going to check out a few of the best picks from our screener tool.

WG TECH (Jiang Xi) (SHSE:603773)

Simply Wall St Growth Rating: ★★★★★☆

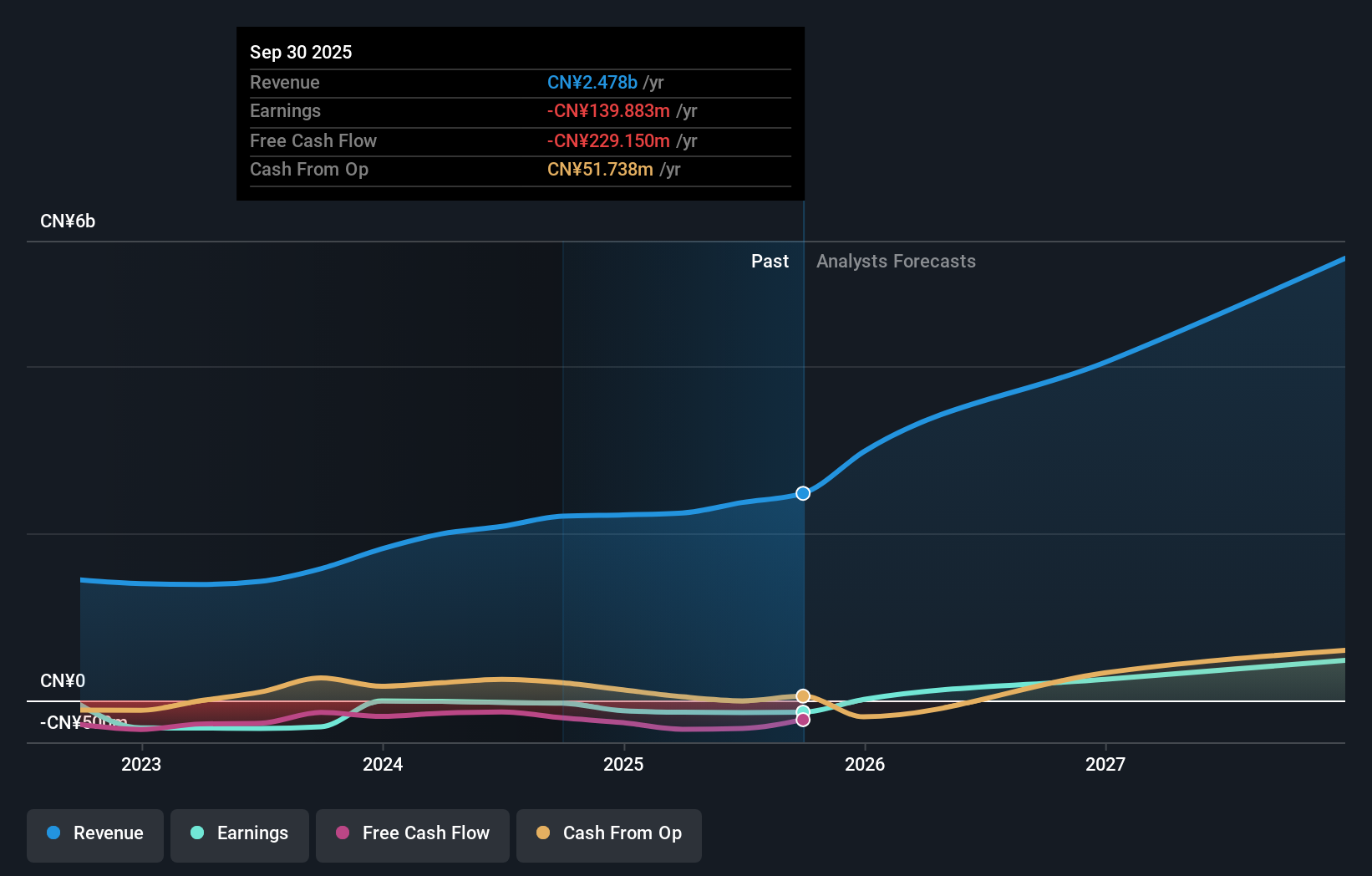

Overview: WG TECH (Jiang Xi) Co., Ltd. operates in the photoelectric glass finishing industry in China with a market capitalization of CN¥4.77 billion.

Operations: The company's revenue is primarily derived from its optoelectronics segment, totaling CN¥2.08 billion.

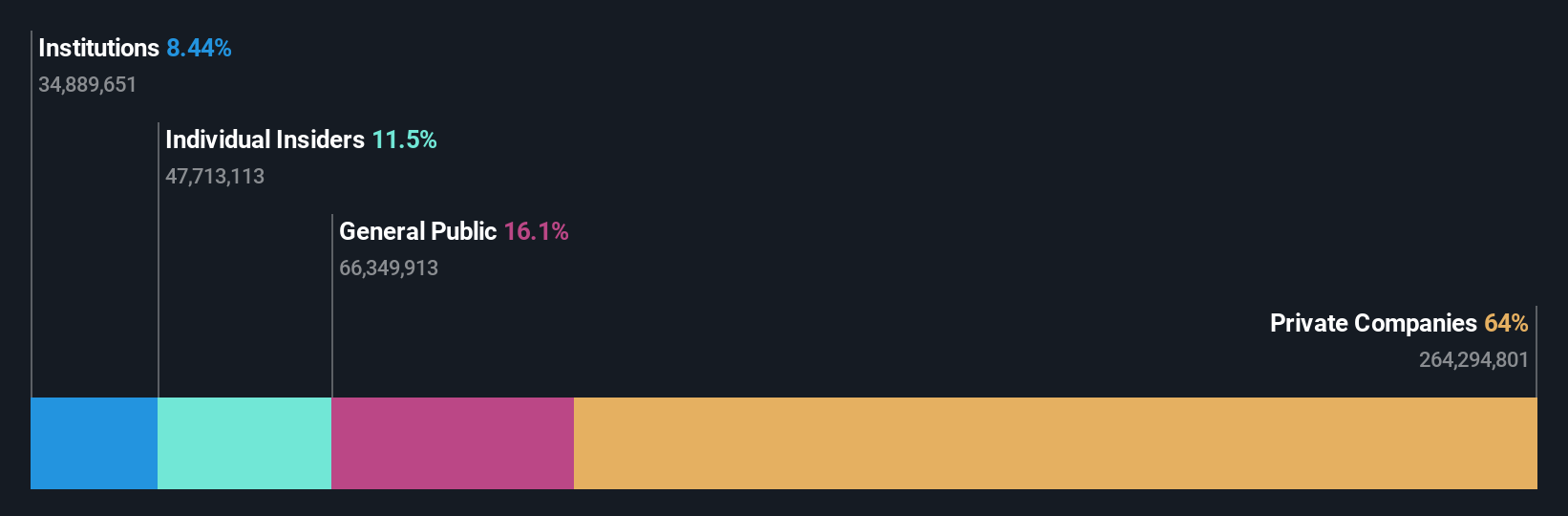

Insider Ownership: 34.3%

WG TECH (Jiang Xi) shows potential as a growth company with high insider ownership, highlighted by its recent inclusion in the S&P Global BMI Index. Despite reporting a net loss of CNY 30.42 million for the first half of 2024, revenue grew significantly to CNY 1.04 billion from the previous year. The company's revenue is forecast to grow at an impressive rate of nearly 40% annually, surpassing market averages, though profitability remains a few years away.

- Unlock comprehensive insights into our analysis of WG TECH (Jiang Xi) stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of WG TECH (Jiang Xi) shares in the market.

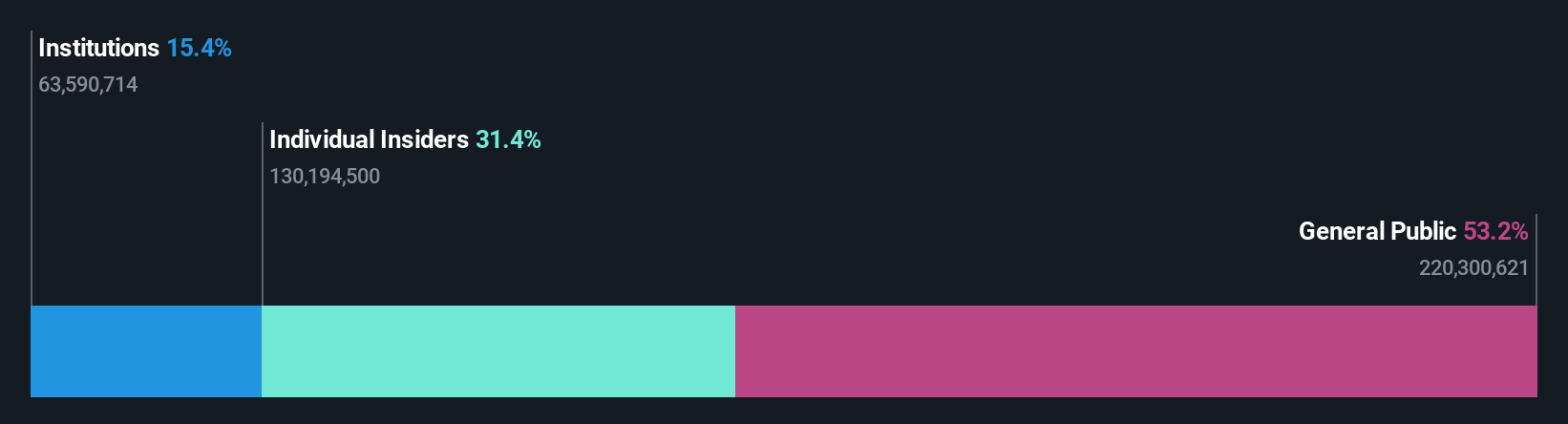

Farsoon Technologies (SHSE:688433)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Farsoon Technologies specializes in supplying industrial plastic laser sintering and metal laser melting systems across China, North America, and Europe, with a market cap of CN¥8.33 billion.

Operations: The company's revenue is primarily derived from its Machinery & Industrial Equipment segment, amounting to CN¥592.19 million.

Insider Ownership: 11.1%

Farsoon Technologies demonstrates potential for growth, with earnings projected to rise 54.5% annually, outpacing the CN market average. The company was recently added to the S&P Global BMI Index, signaling increased recognition. However, recent financials show a decline in sales and net income for H1 2024 compared to last year, with sales at CNY 226.33 million and net income at CNY 32.9 million. Despite this volatility, revenue growth forecasts remain strong at over 45% annually.

- Get an in-depth perspective on Farsoon Technologies' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Farsoon Technologies is priced higher than what may be justified by its financials.

Luoyang Xinqianglian Slewing Bearing (SZSE:300850)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Luoyang Xinqianglian Slewing Bearing Co., Ltd. operates in the manufacturing of slewing bearings and has a market cap of CN¥7.15 billion.

Operations: Luoyang Xinqianglian Slewing Bearing Co., Ltd. generates its revenue primarily from the production and sale of slewing bearings.

Insider Ownership: 36.3%

Luoyang Xinqianglian Slewing Bearing is positioned for significant growth, with earnings expected to rise 66.8% annually and revenue projected to grow 31.5% per year, both surpassing the CN market averages. Despite this potential, recent financials show a net loss of CNY 100.76 million for H1 2024 compared to a net income of CNY 100.71 million last year, highlighting challenges such as high volatility and past shareholder dilution impacting its financial stability.

- Take a closer look at Luoyang Xinqianglian Slewing Bearing's potential here in our earnings growth report.

- Our valuation report here indicates Luoyang Xinqianglian Slewing Bearing may be overvalued.

Summing It All Up

- Discover the full array of 1483 Fast Growing Companies With High Insider Ownership right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if WG TECH (Jiang Xi) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603773

WG TECH (Jiang Xi)

Engages in photoelectric glass finishing business in China.

High growth potential and slightly overvalued.