- China

- /

- Water Utilities

- /

- SHSE:688466

3 Growth Companies With High Insider Ownership And Up To 36% Revenue Growth

Reviewed by Simply Wall St

As global markets navigate a landscape marked by accelerating U.S. inflation and rising stock indexes nearing record highs, investors are increasingly focused on growth opportunities that can withstand economic fluctuations. In this context, companies with high insider ownership often attract attention due to the potential alignment of interests between management and shareholders, making them compelling candidates for those seeking robust revenue growth amidst current market dynamics.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 111.4% |

Let's dive into some prime choices out of the screener.

Vobile Group (SEHK:3738)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vobile Group Limited is an investment holding company offering software as a service for digital content asset protection and transactions across the United States, Japan, Mainland China, and internationally, with a market cap of HK$7.47 billion.

Operations: The company's revenue segment primarily consists of HK$2.18 billion from its software as a service offerings for digital content asset protection and transactions across various international markets.

Insider Ownership: 23%

Revenue Growth Forecast: 18.1% p.a.

Vobile Group's earnings are forecast to grow significantly at 74.1% annually, outpacing the Hong Kong market average of 11.7%, though its return on equity is expected to remain low at 6.9%. Despite recent volatility in share price and declining profit margins, Vobile's new copyright management services for generative AI could position it well within the growing $3 trillion media industry. Recent leadership changes include appointing Ms. Laverna Jun Lin Chan as a non-executive director.

- Navigate through the intricacies of Vobile Group with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Vobile Group is priced higher than what may be justified by its financials.

GreenTech Environmental (SHSE:688466)

Simply Wall St Growth Rating: ★★★★★☆

Overview: GreenTech Environmental Co., Ltd. operates in water treatment and waste-to-resources projects in China, with a market capitalization of approximately CN¥1.89 billion.

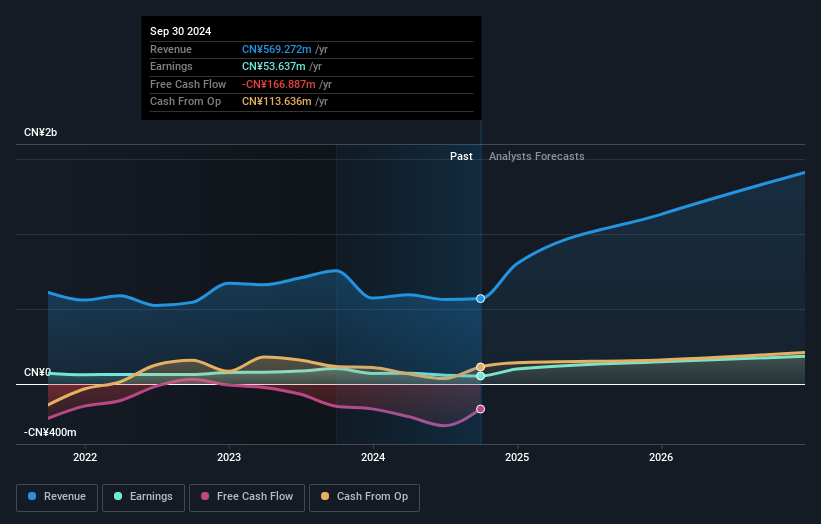

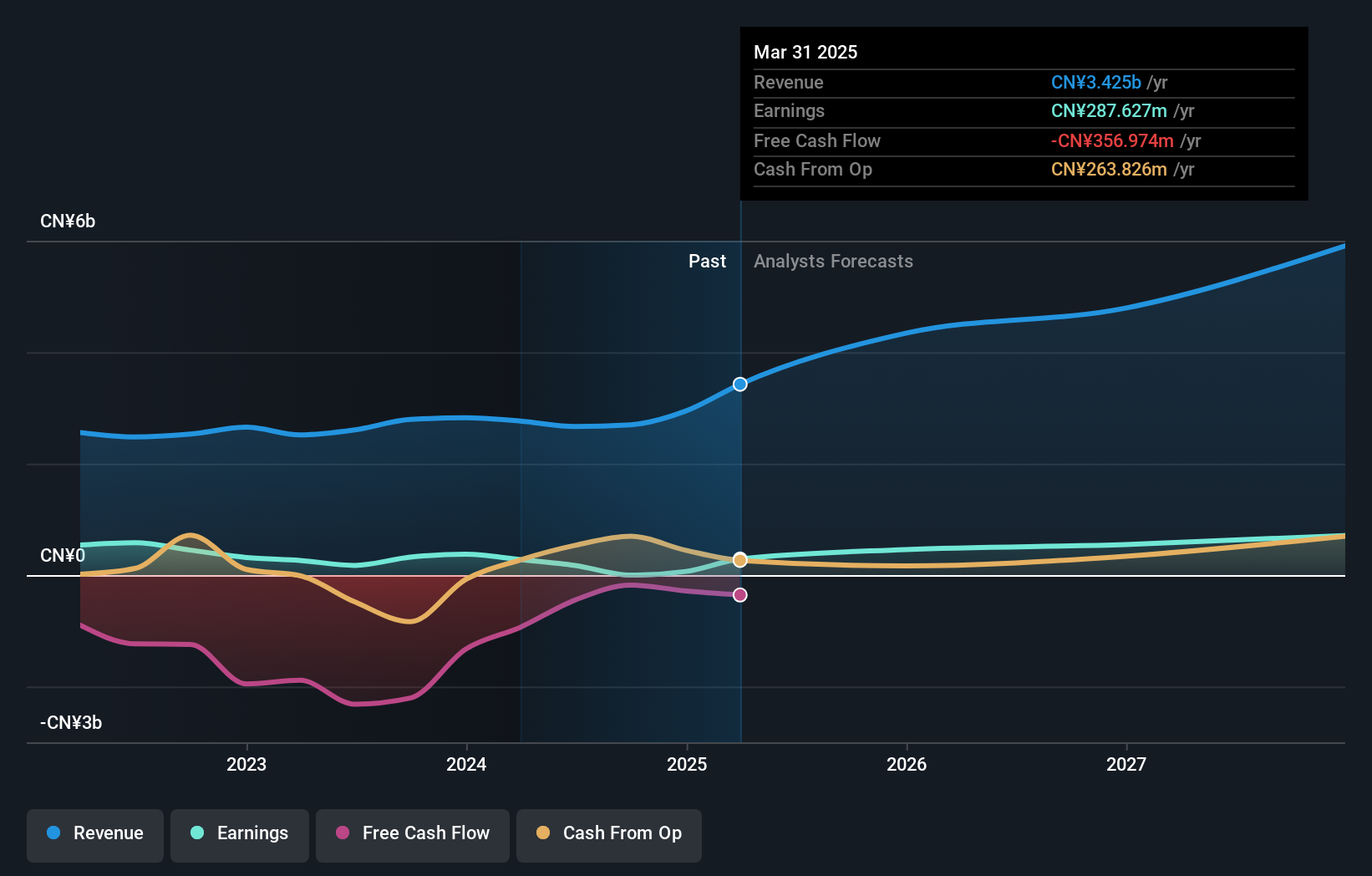

Operations: GreenTech Environmental Co., Ltd. generates revenue through its operations in water treatment and waste-to-resources projects within China.

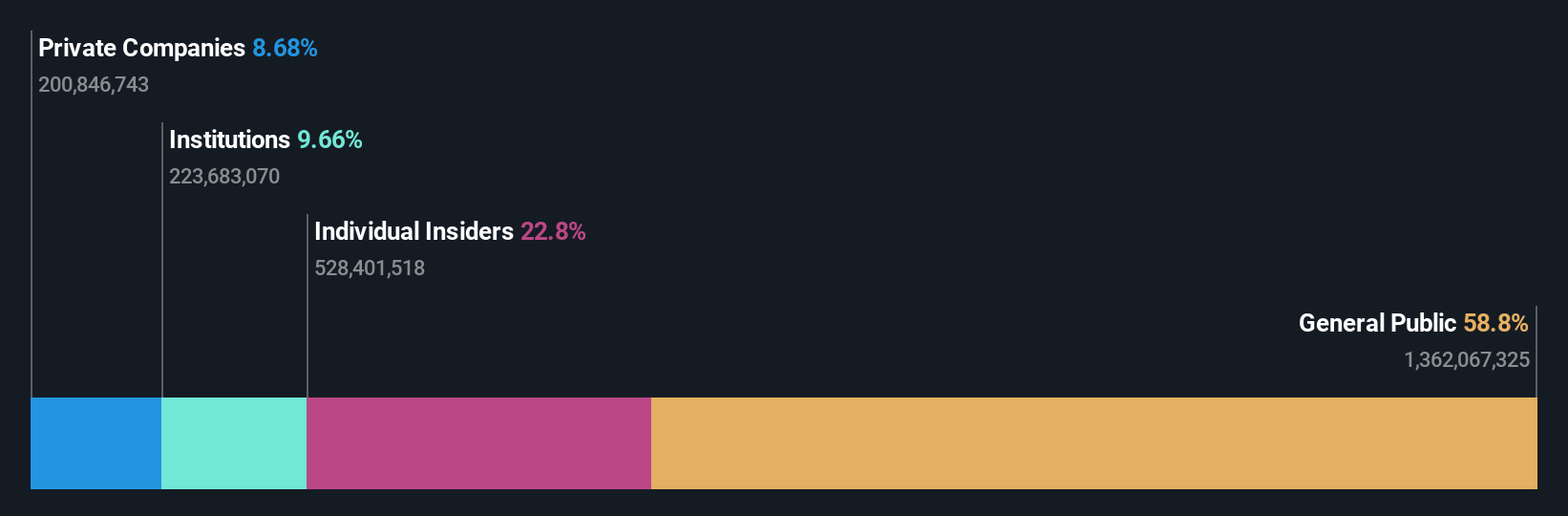

Insider Ownership: 28.8%

Revenue Growth Forecast: 36.1% p.a.

GreenTech Environmental is poised for substantial growth, with revenue expected to increase by 36.1% annually and earnings projected to grow at 44.1%, surpassing the Chinese market average. Despite lower profit margins of 9.4% compared to last year's 13.6%, insider ownership remains stable without significant recent trading activity. However, the dividend yield of 2.34% is not well-covered by earnings or free cash flows, and return on equity is forecasted to remain modest at 13.2%.

- Click here and access our complete growth analysis report to understand the dynamics of GreenTech Environmental.

- The analysis detailed in our GreenTech Environmental valuation report hints at an inflated share price compared to its estimated value.

Luoyang Xinqianglian Slewing Bearing (SZSE:300850)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Luoyang Xinqianglian Slewing Bearing Co., Ltd. (SZSE:300850) specializes in the manufacturing of slewing bearings and has a market cap of CN¥7.33 billion.

Operations: Luoyang Xinqianglian Slewing Bearing Co., Ltd. generates its revenue primarily through the production and sale of slewing bearings.

Insider Ownership: 36.3%

Revenue Growth Forecast: 22.4% p.a.

Luoyang Xinqianglian Slewing Bearing is set for significant growth, with revenue projected to rise by 22.4% annually, outpacing the Chinese market average. Despite being removed from key indices, the company aims for profitability within three years and anticipates an earnings increase of 108.2% per year. While insider trading activity has been minimal recently, a Special Shareholders Meeting will address strategic adjustments and capital management initiatives. Return on equity is expected to remain low at 8.2%.

- Click to explore a detailed breakdown of our findings in Luoyang Xinqianglian Slewing Bearing's earnings growth report.

- According our valuation report, there's an indication that Luoyang Xinqianglian Slewing Bearing's share price might be on the expensive side.

Seize The Opportunity

- Discover the full array of 1462 Fast Growing Companies With High Insider Ownership right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688466

GreenTech Environmental

Engages in the water treatment and waste-to-resources projects in the People’s Republic of China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives