- China

- /

- Construction

- /

- SZSE:300732

Some Henan ZhongGong Design & Research Group Co., Ltd. (SZSE:300732) Shareholders Look For Exit As Shares Take 27% Pounding

Henan ZhongGong Design & Research Group Co., Ltd. (SZSE:300732) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 29% share price drop.

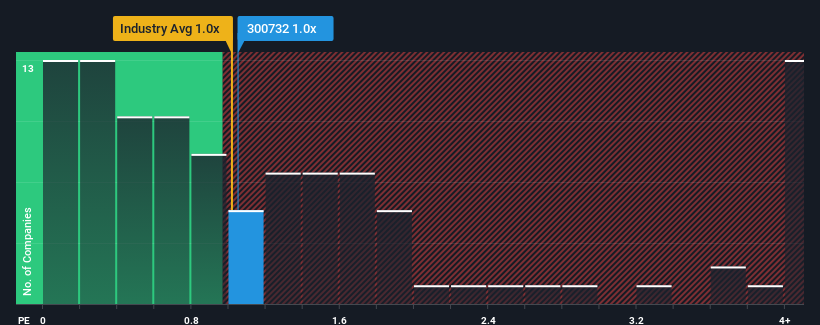

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Henan ZhongGong Design & Research Group's P/S ratio of 1x, since the median price-to-sales (or "P/S") ratio for the Construction industry in China is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Henan ZhongGong Design & Research Group

What Does Henan ZhongGong Design & Research Group's P/S Mean For Shareholders?

For instance, Henan ZhongGong Design & Research Group's receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Henan ZhongGong Design & Research Group's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

Henan ZhongGong Design & Research Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 15%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 13% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 14% shows it's noticeably less attractive.

With this in mind, we find it intriguing that Henan ZhongGong Design & Research Group's P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Key Takeaway

Following Henan ZhongGong Design & Research Group's share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Henan ZhongGong Design & Research Group's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

And what about other risks? Every company has them, and we've spotted 5 warning signs for Henan ZhongGong Design & Research Group (of which 3 are potentially serious!) you should know about.

If these risks are making you reconsider your opinion on Henan ZhongGong Design & Research Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Henan ZhongGong Design & Research Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300732

Henan ZhongGong Design & Research Group

Engages in engineering consulting, investigation, mapping, design, supervision, and construction management services in China and internationally.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives