Saimo Technology Co.,Ltd.'s (SZSE:300466) 27% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Saimo Technology Co.,Ltd. (SZSE:300466) shares have retraced a considerable 27% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 30%, which is great even in a bull market.

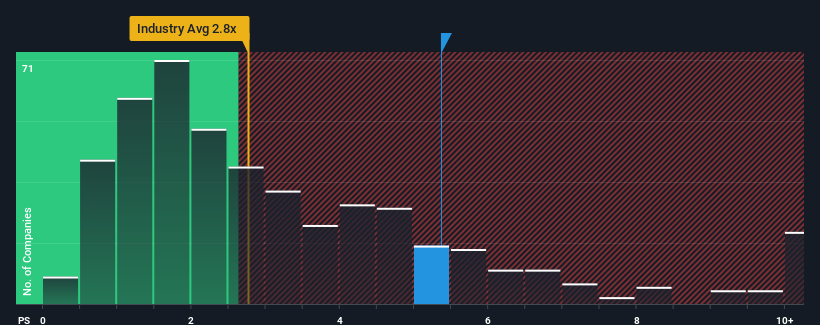

Although its price has dipped substantially, when almost half of the companies in China's Machinery industry have price-to-sales ratios (or "P/S") below 2.8x, you may still consider Saimo TechnologyLtd as a stock not worth researching with its 5.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Saimo TechnologyLtd

What Does Saimo TechnologyLtd's Recent Performance Look Like?

Saimo TechnologyLtd has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Saimo TechnologyLtd's earnings, revenue and cash flow.How Is Saimo TechnologyLtd's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Saimo TechnologyLtd's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 12% last year. This was backed up an excellent period prior to see revenue up by 33% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

This is in contrast to the rest of the industry, which is expected to grow by 25% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that Saimo TechnologyLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Saimo TechnologyLtd's P/S?

Even after such a strong price drop, Saimo TechnologyLtd's P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Saimo TechnologyLtd revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It is also worth noting that we have found 2 warning signs for Saimo TechnologyLtd (1 is a bit unpleasant!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Saimo TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300466

Saimo TechnologyLtd

Provides intelligent detection products and control systems in China.

Mediocre balance sheet with weak fundamentals.

Market Insights

Community Narratives