- China

- /

- Electrical

- /

- SZSE:300341

Discovering February 2025's Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and mixed economic signals, small-cap stocks have shown resilience despite broader market fluctuations. With U.S. job growth cooling and manufacturing activity seeing a tentative recovery, investors are increasingly on the lookout for under-the-radar opportunities that can thrive in such dynamic environments. Identifying these "undiscovered gems" involves seeking companies with strong fundamentals and unique growth potential that align well with current market conditions, offering a promising avenue for diversification within an investor's portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Akmerkez Gayrimenkul Yatirim Ortakligi | NA | 43.32% | 27.57% | ★★★★★★ |

| African Rainbow Capital Investments | NA | 37.52% | 38.29% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| OHB | 57.88% | 1.74% | 24.66% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Shanghai Jin Jiang Online Network Service (SHSE:600650)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Jin Jiang Online Network Service Co., Ltd. operates in the online network services sector and has a market capitalization of CN¥6.59 billion.

Operations: Shanghai Jin Jiang Online Network Service generates revenue primarily from its online network services. The company's financial performance is highlighted by a net profit margin trend that has shown notable variation over recent periods.

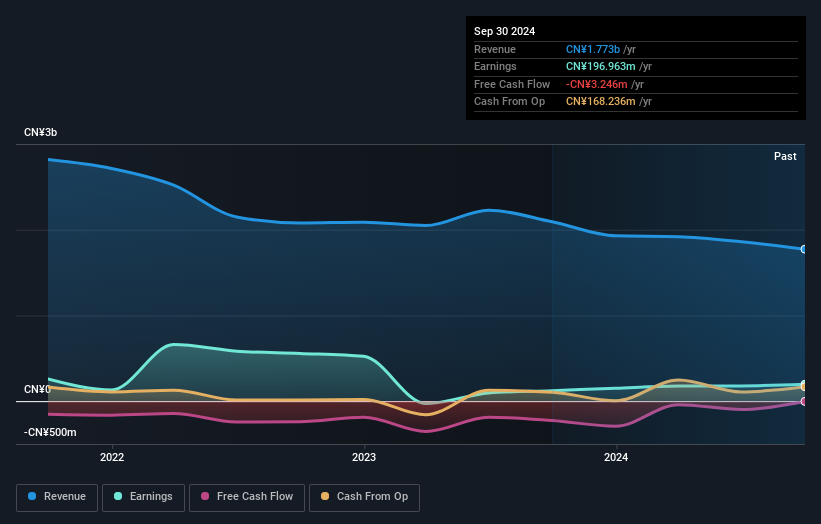

Shanghai Jin Jiang Online Network Service has shown impressive earnings growth of 60.6% over the past year, outpacing the Specialty Retail industry's -10%. However, a significant one-off gain of CN¥53.5M influenced these results, suggesting caution in interpreting this growth as sustainable. The company is profitable with more cash than total debt, indicating solid financial health despite its volatile share price in recent months. Over five years, earnings have decreased by 3.2% annually while the debt-to-equity ratio improved from 1.2 to 1%, reflecting better financial management and positioning for potential future stability amidst industry challenges.

Jilin Joinature PolymerLtd (SHSE:688716)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jilin Joinature Polymer Co., Ltd. focuses on the research, development, production, and sale of polyetheretherketone raw materials in China with a market capitalization of CN¥5.40 billion.

Operations: Jilin Joinature Polymer generates revenue primarily from the sale of polyetheretherketone raw materials. The company's financial performance includes a market capitalization of CN¥5.40 billion.

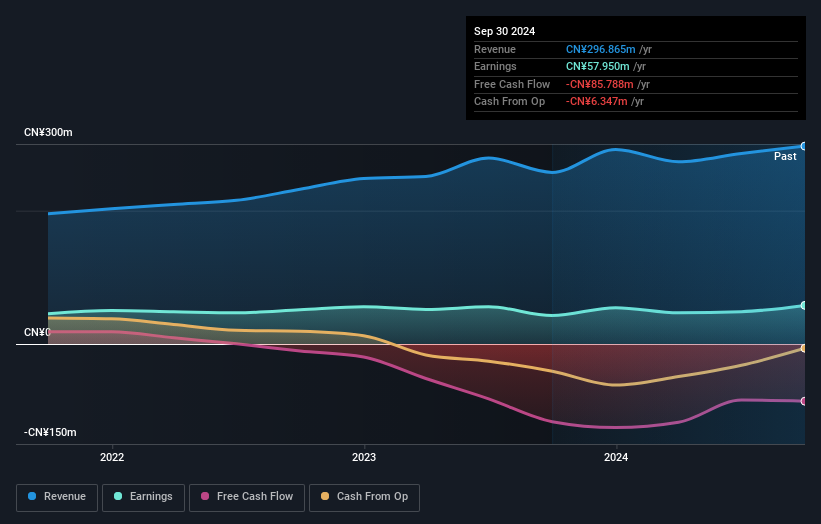

Jilin Joinature Polymer has showcased impressive earnings growth of 36% over the past year, outpacing its industry peers by a significant margin. The company boasts high-quality non-cash earnings, which indicates robust financial health. Additionally, it has successfully reduced its debt-to-equity ratio from 4.4 to 0.9 over five years, highlighting effective debt management strategies. Despite these strengths, the free cash flow remains negative at -US$85 million as of September 2024, suggesting room for improvement in cash generation. Recent shareholder activities include a special meeting scheduled for December 25th in Changchun, reflecting ongoing corporate governance engagement.

- Take a closer look at Jilin Joinature PolymerLtd's potential here in our health report.

Understand Jilin Joinature PolymerLtd's track record by examining our Past report.

Motic (Xiamen) Electric GroupLtd (SZSE:300341)

Simply Wall St Value Rating: ★★★★★★

Overview: Motic (Xiamen) Electric Group Co., Ltd engages in the research, development, production, and sale of insulation products and related components for electrical transmission and distribution networks within China's electrical power industry, with a market cap of CN¥9.28 billion.

Operations: The company generates revenue primarily through the sale of insulation products and components for electrical transmission and distribution networks in China. The financial data does not provide explicit details on cost breakdowns or specific revenue figures, but the market cap stands at CN¥9.28 billion.

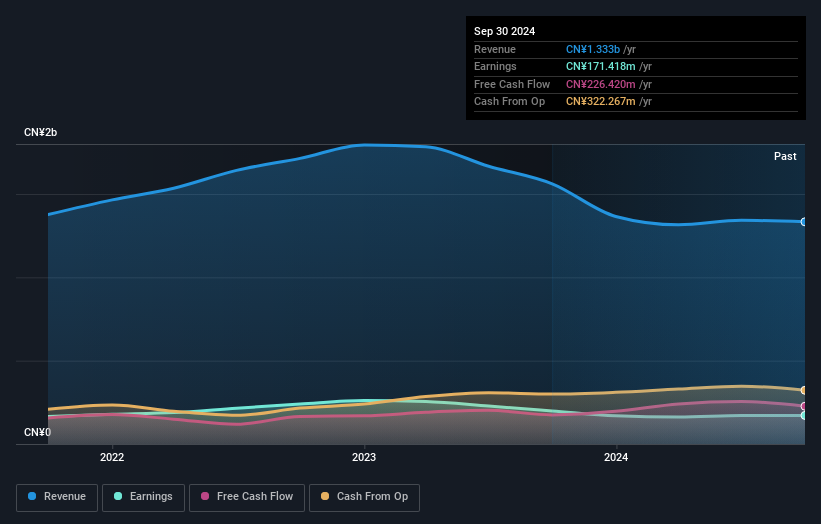

With a notable reduction in its debt to equity ratio from 16.3% to 0.3% over the past five years, Motic (Xiamen) Electric Group showcases financial discipline, further bolstered by having more cash than total debt. Despite experiencing negative earnings growth of -13.7% last year, contrasting with the electrical industry average of 1.1%, the company remains profitable and free cash flow positive, suggesting resilience in its operations. The recent announcement of a special shareholders meeting hints at potential strategic shifts that could redefine its business structure and governance, possibly impacting future performance positively or negatively depending on execution.

Where To Now?

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4718 more companies for you to explore.Click here to unveil our expertly curated list of 4721 Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300341

Motic (Xiamen) Electric GroupLtd

Researches, develops, produces, and sells insulation products and other related components for the power transmission and transformation industry in China.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives