Revenues Not Telling The Story For Guangdong Jinming Machinery Co., Ltd. (SZSE:300281) After Shares Rise 47%

Guangdong Jinming Machinery Co., Ltd. (SZSE:300281) shareholders are no doubt pleased to see that the share price has bounced 47% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 10% over that time.

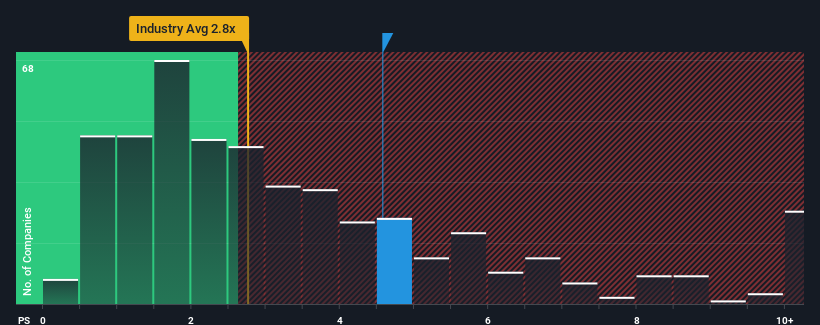

Since its price has surged higher, given close to half the companies operating in China's Machinery industry have price-to-sales ratios (or "P/S") below 2.8x, you may consider Guangdong Jinming Machinery as a stock to potentially avoid with its 4.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Guangdong Jinming Machinery

What Does Guangdong Jinming Machinery's P/S Mean For Shareholders?

For instance, Guangdong Jinming Machinery's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Guangdong Jinming Machinery, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Guangdong Jinming Machinery's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Guangdong Jinming Machinery's is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.8%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 12% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 27% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Guangdong Jinming Machinery is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Guangdong Jinming Machinery's P/S?

The large bounce in Guangdong Jinming Machinery's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Guangdong Jinming Machinery currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Guangdong Jinming Machinery, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Guangdong Jinming Machinery, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300281

Guangdong Jinming Machinery

Manufactures and sells a range of plastic film extrusion machineries in China.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives