Stock Analysis

MilDef Group And Two Other Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

Amid a backdrop of mixed global market performances, with some indices showing resilience and others under pressure from various economic factors, investors continue to navigate through complex landscapes. In such environments, growth companies with high insider ownership can be particularly intriguing as these insiders may have a vested interest in the company’s long-term success, aligning their goals closely with that of shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Yggdrazil Group (SET:YGG) | 12% | 33.5% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 30.1% |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 28.4% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.8% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| Vow (OB:VOW) | 31.7% | 97.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

We're going to check out a few of the best picks from our screener tool.

MilDef Group (OM:MILDEF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MilDef Group AB specializes in developing, manufacturing, and selling rugged IT solutions and special electronics mainly for the security and defense sectors, with a market capitalization of approximately SEK 2.79 billion.

Operations: The company primarily generates revenue by developing, manufacturing, and marketing rugged IT solutions and specialized electronics for the security and defense sectors.

Insider Ownership: 23%

Revenue Growth Forecast: 16.7% p.a.

MilDef Group, a growth company with high insider ownership, shows mixed financial performance but promising growth prospects. Recent earnings indicate modest year-over-year gains with SEK 301.5 million in sales for Q2 2024, up from SEK 288.8 million the previous year. Despite this, first-half profits declined to SEK 11.9 million from SEK 37.6 million year-over-year due to a challenging first quarter. Analysts forecast MilDef's earnings to grow significantly at 70.79% annually and revenue at 16.7% annually, outpacing the broader Swedish market expectations of 15.4% and 1%, respectively, although profit margins have decreased compared to last year.

- Click to explore a detailed breakdown of our findings in MilDef Group's earnings growth report.

- Our expertly prepared valuation report MilDef Group implies its share price may be lower than expected.

Perfect Presentation for Commercial Services (SASE:7204)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Perfect Presentation for Commercial Services Company, based in the Kingdom of Saudi Arabia, provides ICT services and technology solutions with a market capitalization of SAR 4.73 billion.

Operations: The company generates revenue primarily through Call Centre Services (SAR 312.83 million), Operation and Maintenance Services (SAR 369.64 million), and Software Licenses and Development Services (SAR 397.48 million).

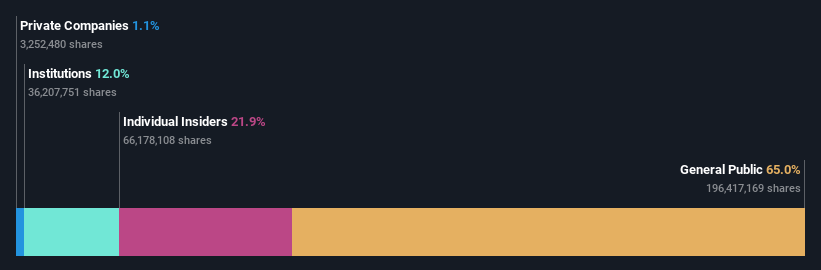

Insider Ownership: 18.2%

Revenue Growth Forecast: 17.5% p.a.

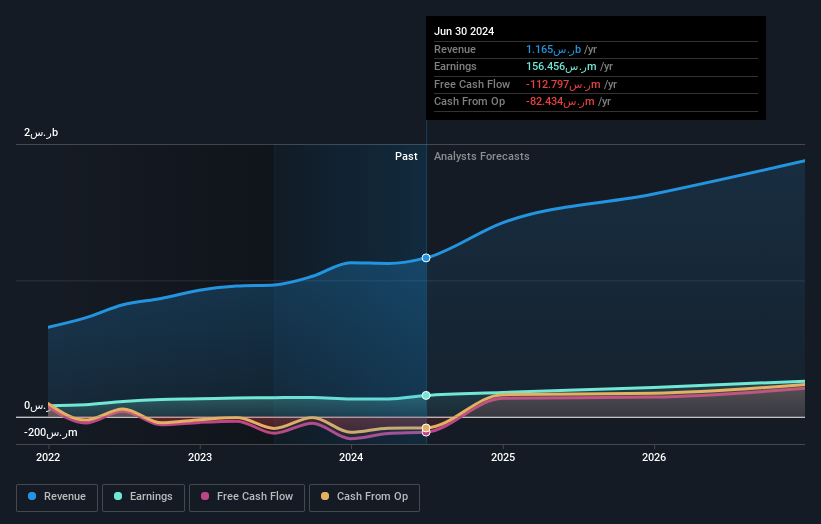

Perfect Presentation for Commercial Services, a company with high insider ownership, recently secured significant contracts, including a SAR 51.74 million deal with Prince Muhammad bin Abdulaziz Hospital and a SAR 63.34 million project for Hafar Al-Batin Health Cluster hospitals. These deals are expected to positively impact financial results through 2027. Despite slower revenue growth forecasts at 17.5% annually compared to the market average, earnings are projected to outpace the Saudi market significantly, growing at an estimated 23.47% per year. However, the company's debt is not well covered by operating cash flow, indicating potential financial leverage issues.

- Dive into the specifics of Perfect Presentation for Commercial Services here with our thorough growth forecast report.

- According our valuation report, there's an indication that Perfect Presentation for Commercial Services' share price might be on the expensive side.

Chongqing Mas Sci.&Tech.Co.Ltd (SZSE:300275)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chongqing Mas Sci.&Tech.Co.,Ltd. specializes in providing safety technology equipment and safety information services across China, with a market capitalization of approximately CN¥3.03 billion.

Operations: The company generates its revenue primarily from the sale of safety technology equipment and the provision of safety information services.

Insider Ownership: 21.9%

Revenue Growth Forecast: 22.9% p.a.

Chongqing Mas Sci.&Tech.Co.Ltd. is poised for robust growth with earnings expected to increase by 28.72% annually over the next three years, outpacing the Chinese market's 22.1% forecast. Revenue growth also looks promising at 22.9% per year, exceeding both the 20% general high-growth benchmark and China's market average of 13.6%. However, return on equity is projected to be modest at 9.6%, which could raise concerns about capital efficiency amidst no significant insider trading activity reported in recent months.

- Click here and access our complete growth analysis report to understand the dynamics of Chongqing Mas Sci.&Tech.Co.Ltd.

- Our valuation report unveils the possibility Chongqing Mas Sci.&Tech.Co.Ltd's shares may be trading at a premium.

Key Takeaways

- Explore the 1453 names from our Fast Growing Companies With High Insider Ownership screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300275

Chongqing Mas Sci.&Tech.Co.Ltd

Provides safety technology equipment and safety information services in China.

High growth potential with proven track record.