- China

- /

- Electrical

- /

- SZSE:001301

Global Growth Companies With High Insider Ownership February 2025

Reviewed by Simply Wall St

As global markets navigate geopolitical tensions and economic uncertainties, with U.S. services PMI entering contraction territory and major indices facing volatility, investors are increasingly looking for stability in growth companies with strong insider ownership. In such a climate, high insider ownership can be an attractive attribute as it often signals confidence in the company's potential and aligns the interests of management with those of shareholders.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Laopu Gold (SEHK:6181) | 36.4% | 43.2% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| Gudeng Precision Industrial (TPEX:3680) | 30.8% | 33% |

| WinWay Technology (TWSE:6515) | 22.6% | 32.8% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| M31 Technology (TPEX:6643) | 27.2% | 47.7% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 121.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

Here's a peek at a few of the choices from the screener.

Shijiazhuang Shangtai Technology (SZSE:001301)

Simply Wall St Growth Rating: ★★★★☆☆

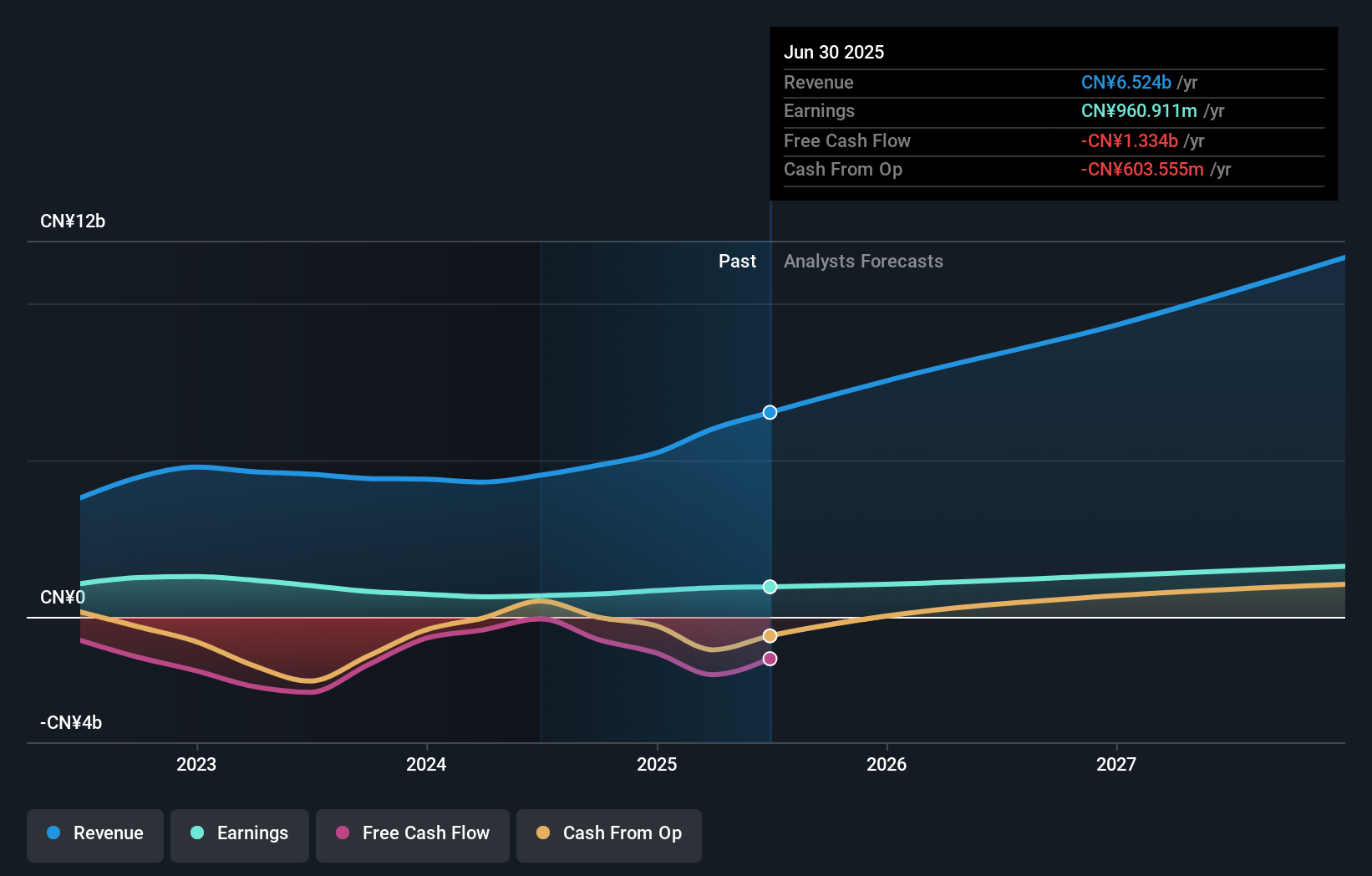

Overview: Shijiazhuang Shangtai Technology Co., Ltd. (SZSE:001301) operates in the technology sector and has a market capitalization of approximately CN¥14.11 billion.

Operations: Shijiazhuang Shangtai Technology Co., Ltd. (SZSE:001301) operates in the technology sector and has a market capitalization of approximately CN¥14.11 billion. Revenue Segments (in millions of CN¥): null

Insider Ownership: 39.7%

Shijiazhuang Shangtai Technology is trading at a favorable price-to-earnings ratio of 19.7x compared to the CN market's 38.6x, indicating good value relative to peers and industry standards. The company's revenue is projected to grow significantly at 23% annually, outpacing the CN market average of 13.4%. Recent developments include a convertible bond issuance approved in February 2025 and a share repurchase program worth CNY 100 million for employee incentives, reflecting strategic financial maneuvers.

- Get an in-depth perspective on Shijiazhuang Shangtai Technology's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Shijiazhuang Shangtai Technology implies its share price may be lower than expected.

Pamica Technology (SZSE:001359)

Simply Wall St Growth Rating: ★★★★☆☆

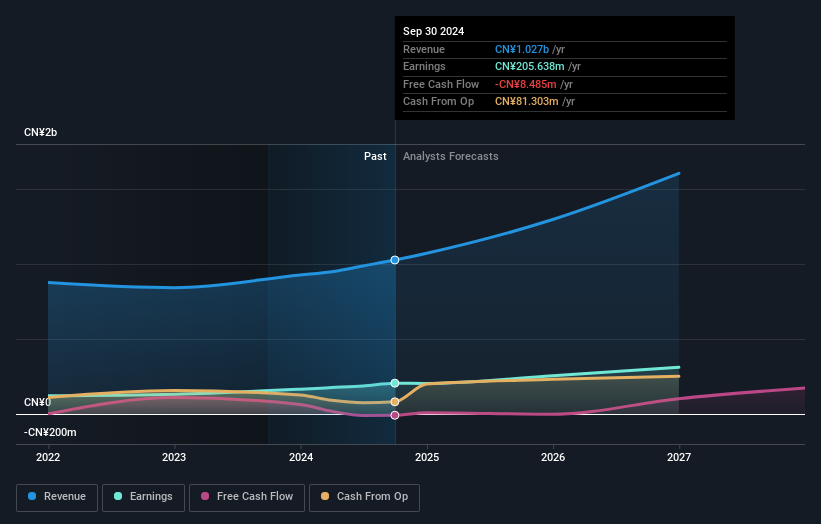

Overview: Pamica Technology Corporation focuses on the R&D, production, and sale of mica insulation materials, glass fiber cloth, and new energy insulation materials with a market cap of CN¥5.03 billion.

Operations: Pamica Technology's revenue is derived from its activities in mica insulation materials, glass fiber cloth, and new energy insulation materials.

Insider Ownership: 30.1%

Pamica Technology's revenue is forecast to grow at 20.5% annually, surpassing the CN market's 13.4%. Its price-to-earnings ratio of 26.9x suggests it offers good value compared to the CN market average of 38.6x. While earnings are expected to grow significantly at over 20% annually, they lag behind the broader market's projected growth of 25.4%. A Special Shareholders Meeting is scheduled for January 2025 in Hubei, China.

- Dive into the specifics of Pamica Technology here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Pamica Technology shares in the market.

Chongqing Mas Sci.&Tech.Co.Ltd (SZSE:300275)

Simply Wall St Growth Rating: ★★★★★☆

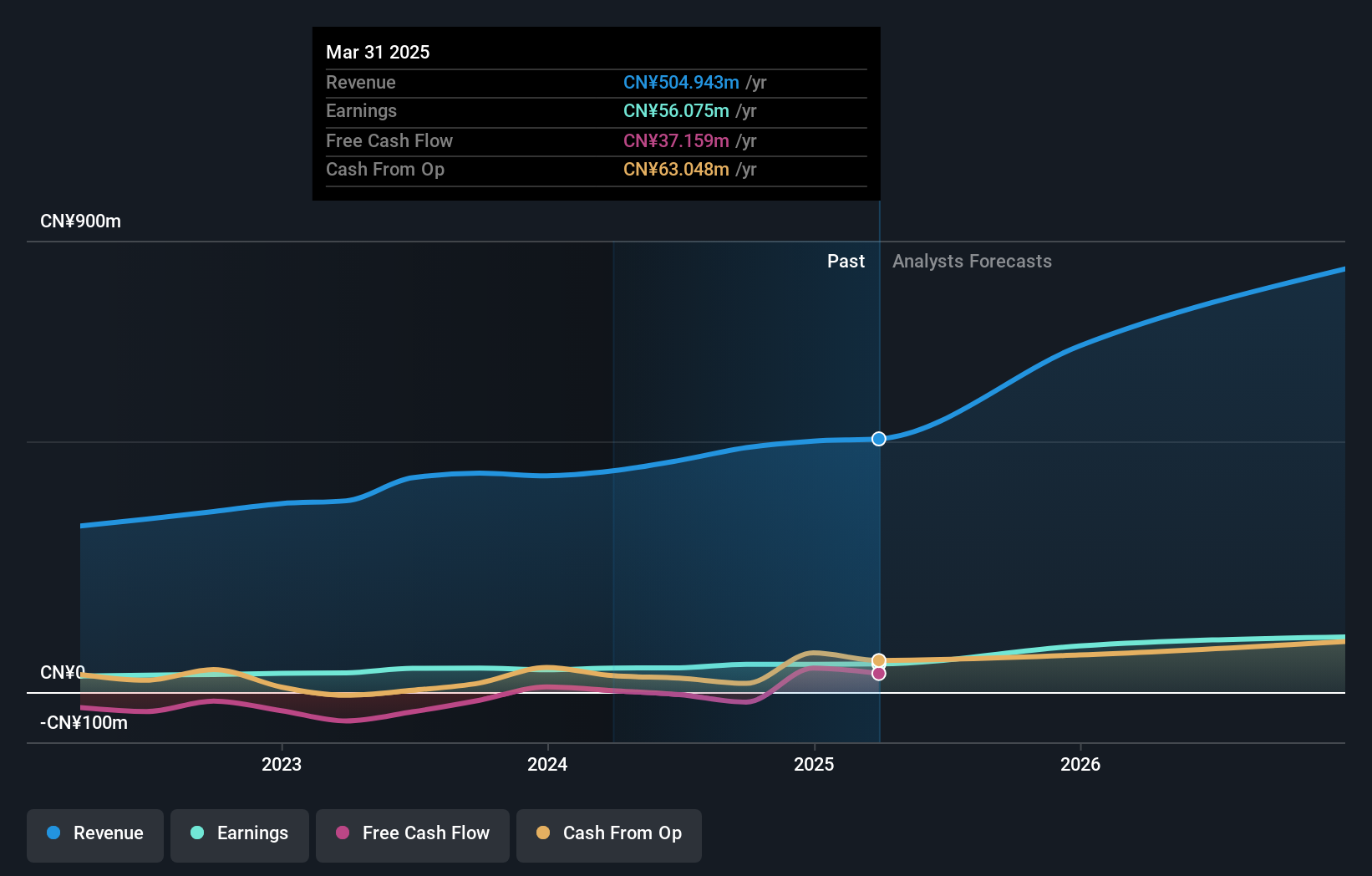

Overview: Chongqing Mas Sci.&Tech.Co., Ltd. operates in China, offering safety technology equipment and safety information services, with a market cap of CN¥4.71 billion.

Operations: The company's revenue segments include safety technology equipment and safety information services in China.

Insider Ownership: 21.8%

Chongqing Mas Sci.&Tech.Co.Ltd. is poised for substantial growth, with earnings projected to increase by 29.1% annually, outpacing the CN market's 25.4%. Revenue is also expected to grow robustly at 23.7% per year, exceeding both the market and significant growth benchmarks. Despite no recent insider trading activity, the company has completed a share buyback of nearly CNY 25.5 million worth of shares under its repurchase plan announced in February 2024.

- Click here to discover the nuances of Chongqing Mas Sci.&Tech.Co.Ltd with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Chongqing Mas Sci.&Tech.Co.Ltd is priced higher than what may be justified by its financials.

Key Takeaways

- Navigate through the entire inventory of 871 Fast Growing Global Companies With High Insider Ownership here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001301

Shijiazhuang Shangtai Technology

Shijiazhuang Shangtai Technology Co., Ltd.

Very undervalued with reasonable growth potential.

Market Insights

Community Narratives