Revenues Not Telling The Story For Anshan Senyuan Road and Bridge Co., Ltd (SZSE:300210) After Shares Rise 32%

The Anshan Senyuan Road and Bridge Co., Ltd (SZSE:300210) share price has done very well over the last month, posting an excellent gain of 32%. This latest share price bounce rounds out a remarkable 303% gain over the last twelve months.

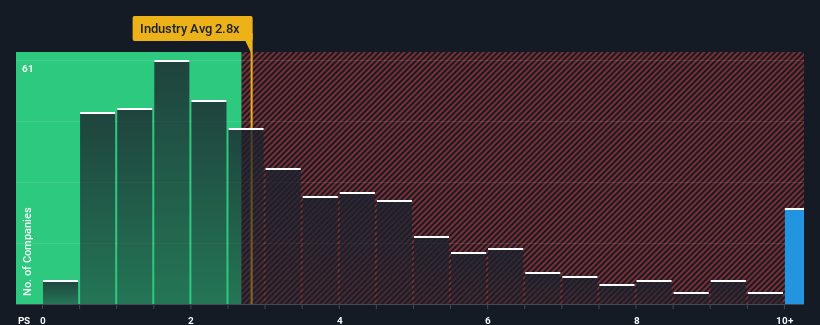

Since its price has surged higher, you could be forgiven for thinking Anshan Senyuan Road and Bridge is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 35.8x, considering almost half the companies in China's Machinery industry have P/S ratios below 2.8x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Anshan Senyuan Road and Bridge

How Anshan Senyuan Road and Bridge Has Been Performing

As an illustration, revenue has deteriorated at Anshan Senyuan Road and Bridge over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Anshan Senyuan Road and Bridge, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Anshan Senyuan Road and Bridge?

In order to justify its P/S ratio, Anshan Senyuan Road and Bridge would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 18%. As a result, revenue from three years ago have also fallen 53% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 28% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that Anshan Senyuan Road and Bridge is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Anshan Senyuan Road and Bridge's P/S

Shares in Anshan Senyuan Road and Bridge have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Anshan Senyuan Road and Bridge currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about these 3 warning signs we've spotted with Anshan Senyuan Road and Bridge.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300210

Anshan Senyuan Road and Bridge

Engages in the research, development, production, and sale of road maintenance equipment China.

Imperfect balance sheet with very low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026