- China

- /

- Electrical

- /

- SZSE:300105

Uncovering December 2024's Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate cuts from the ECB and SNB, coupled with anticipation of a Federal Reserve rate cut, small-cap stocks have faced challenges, notably underperforming their large-cap counterparts as evidenced by the Russell 2000 Index's recent declines. In this environment of fluctuating economic indicators and shifting market sentiment, identifying potential "undiscovered gems" requires a keen eye for companies that demonstrate resilience and growth potential despite broader market headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Elite Color Environmental Resources Science & Technology | 30.80% | 12.99% | 1.83% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

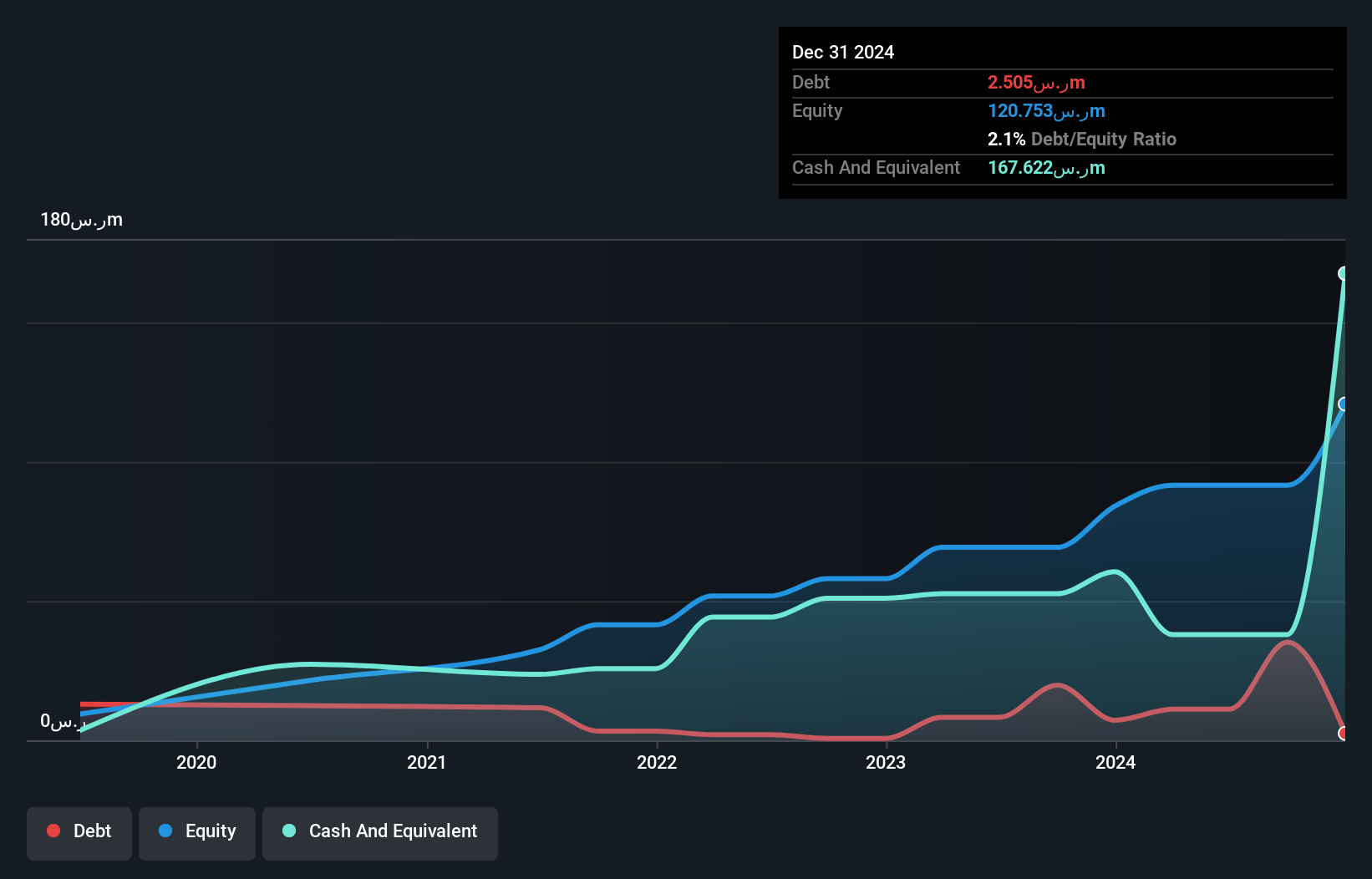

Saudi Azm for Communication and Information Technology (SASE:9534)

Simply Wall St Value Rating: ★★★★★☆

Overview: Saudi Azm for Communication and Information Technology Company, with a market cap of SAR1.85 billion, offers business and digital technology solutions in the Kingdom of Saudi Arabia through its subsidiaries.

Operations: The company generates revenue primarily from Enterprise Services (SAR116.12 million) and Proprietary Technologies (SAR58.94 million), with additional income from Advisory and Platforms for Third Parties segments.

Saudi Azm for Communication and Information Technology has shown notable financial resilience, with earnings growth of 21% over the past year, outpacing the IT industry's 18.9%. The company’s debt to equity ratio improved significantly from 138% to just 12% in five years, indicating a robust balance sheet. Despite this progress, its share price has been highly volatile recently. Non-cash earnings remain high, suggesting quality in reported profits. Although free cash flow is negative at -A$1.14M as of June 2024, sufficient cash covers total debt obligations comfortably, hinting at a potential for future stability amidst current fluctuations.

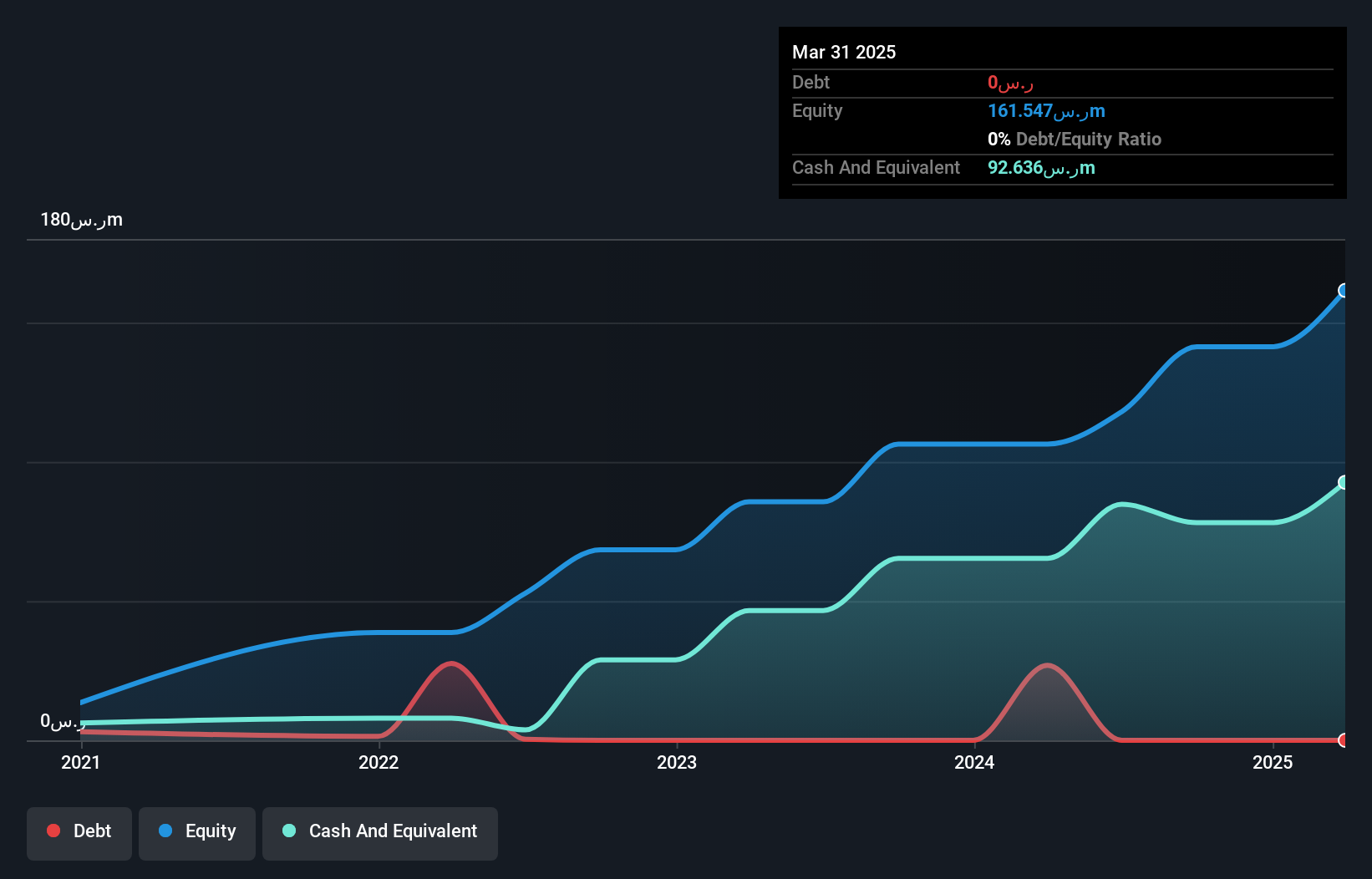

Nofoth Food Products (SASE:9556)

Simply Wall St Value Rating: ★★★★★★

Overview: Nofoth Food Products Company specializes in the production and sale of bakery products in Saudi Arabia, with a market capitalization of SAR940.80 million.

Operations: The company generates revenue through the production and sale of bakery products in Saudi Arabia. With a market capitalization of SAR940.80 million, it focuses on leveraging its position within the local market to drive sales.

Nofoth Food Products, a promising player in the food industry, showcases high-quality earnings with a notable 25% growth over the past year, outpacing its industry peers. This debt-free company trades at an attractive 12.5% below its estimated fair value and has consistently demonstrated positive free cash flow, reaching US$56.35 million by June 2024. With no debt for the last five years, Nofoth's financial health is robust and it recently held a special shareholders meeting in Riyadh on November 3rd to discuss future strategies. These elements underscore its potential as an intriguing investment opportunity within its sector.

- Unlock comprehensive insights into our analysis of Nofoth Food Products stock in this health report.

Understand Nofoth Food Products' track record by examining our Past report.

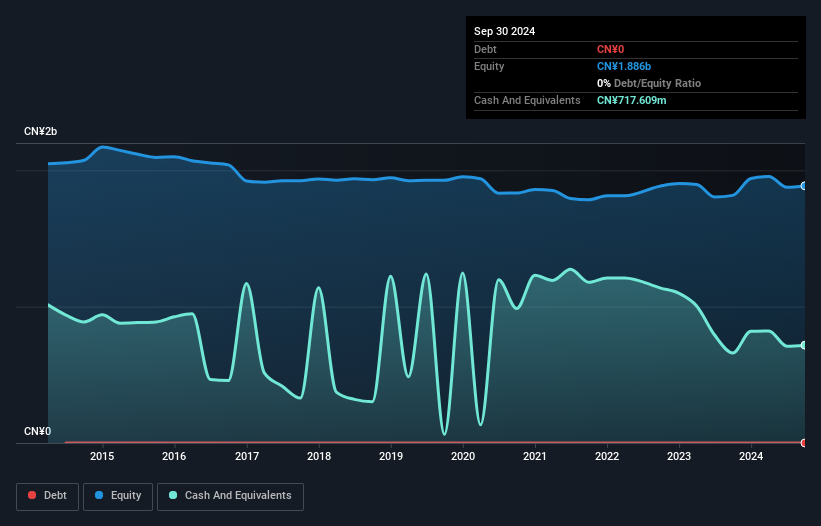

YanTai LongYuan Power Technology (SZSE:300105)

Simply Wall St Value Rating: ★★★★★★

Overview: YanTai LongYuan Power Technology Co., Ltd. is a company with a market cap of CN¥4.06 billion, engaged in the power technology sector.

Operations: YanTai LongYuan Power Technology generates revenue primarily from its power technology operations. The company has a market capitalization of CN¥4.06 billion, reflecting its position in the industry.

YanTai LongYuan Power Technology stands out with its debt-free status, a rarity in the industry. Over the past year, earnings surged by 333%, far outpacing the Electrical industry's modest 1% growth. The company reported net income of CNY 23.32 million for nine months ending September 2024, up from CNY 16.99 million a year earlier, indicating solid performance despite sales dipping to CNY 573.91 million from CNY 614.29 million previously. Trading at nearly half its estimated fair value suggests potential undervaluation in the market, making it an intriguing prospect for those seeking unique investment opportunities in this sector.

Where To Now?

- Gain an insight into the universe of 4502 Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300105

YanTai LongYuan Power Technology

YanTai LongYuan Power Technology Co., Ltd.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives