- South Korea

- /

- Machinery

- /

- KOSE:A100090

3 High Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

In a week marked by tariff uncertainties and mixed economic signals, global markets have shown resilience amid challenges. Despite the volatility, investors are keenly observing companies that not only demonstrate robust growth potential but also boast significant insider ownership, which can be an indicator of confidence in the company's future prospects. In such a climate, stocks with high insider ownership may offer unique insights into potential alignment between management and shareholder interests, providing an intriguing angle for those seeking growth opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.9% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Pharma Mar (BME:PHM) | 11.9% | 44.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 111.4% |

Let's take a closer look at a couple of our picks from the screened companies.

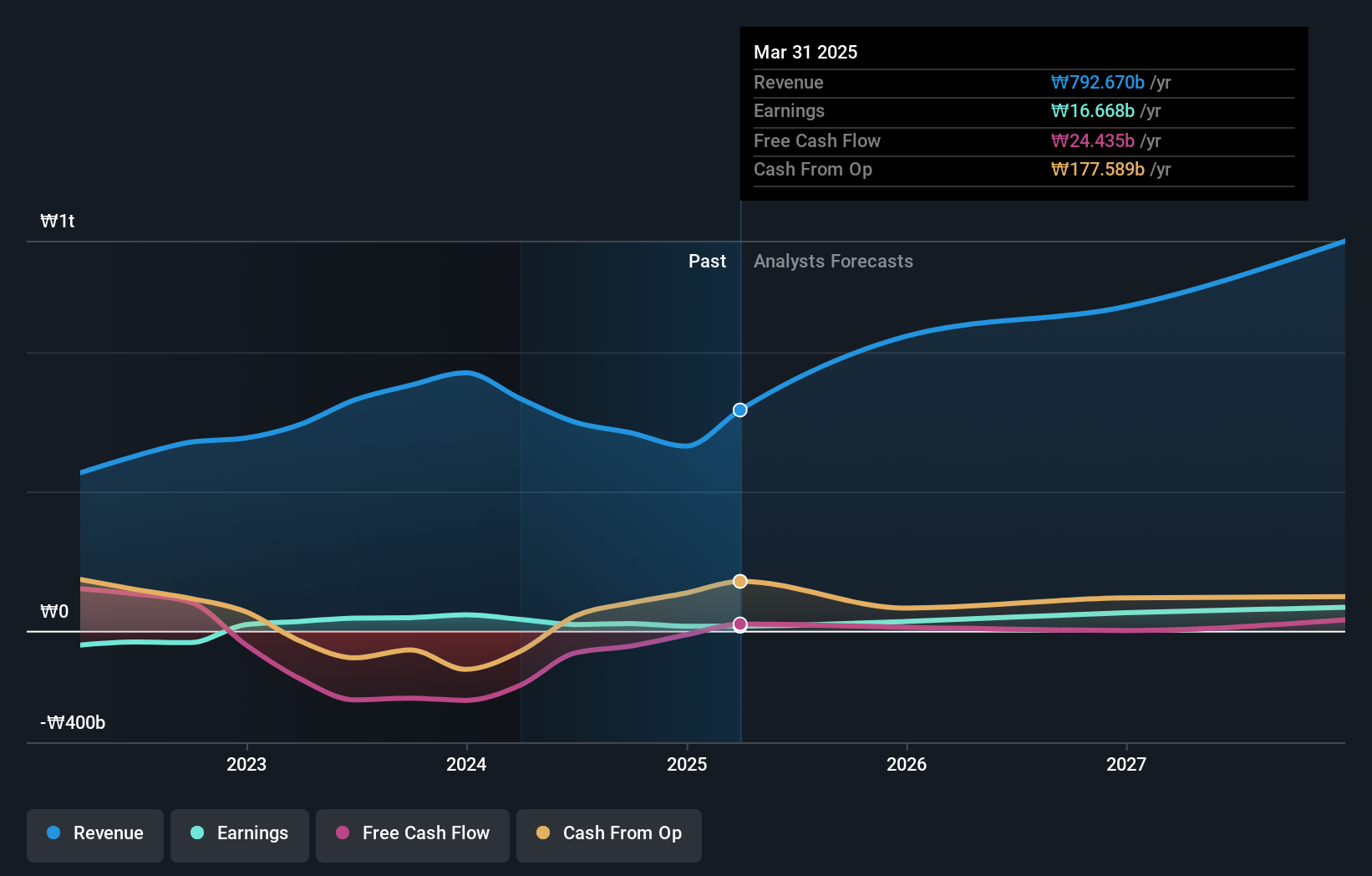

SK oceanplantLtd (KOSE:A100090)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SK oceanplant Co., Ltd. operates in South Korea, focusing on the manufacturing of steel and stainless steel pipes, hull blocks, and shipbuilding equipment, with a market cap of ₩749.42 billion.

Operations: The company generates revenue primarily from its Shipbuilding/Marine segment, amounting to ₩847.12 million, and its Steel Pipe Division, contributing ₩20.86 million.

Insider Ownership: 20.7%

Earnings Growth Forecast: 30.6% p.a.

SK oceanplant Ltd demonstrates strong growth potential with earnings expected to increase significantly at 30.6% annually, outpacing the KR market's average. Despite trading at a substantial discount to its estimated fair value, profit margins have decreased from 5.4% to 3.6%. Revenue growth is projected at 17.7% per year, surpassing the market's rate of 9%. Recent financial performance shows robust sales and net income increases compared to the previous year.

- Dive into the specifics of SK oceanplantLtd here with our thorough growth forecast report.

- Our valuation report unveils the possibility SK oceanplantLtd's shares may be trading at a premium.

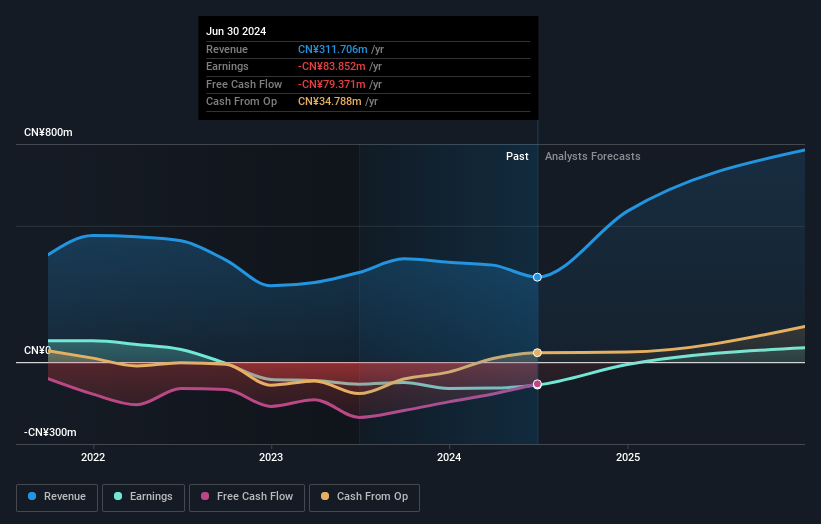

Guangzhou Hexin InstrumentLtd (SHSE:688622)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Hexin Instrument Co., Ltd. focuses on the research and development, production, sale, and technical services of mass spectrometry products in China, with a market capitalization of CN¥5.14 billion.

Operations: The company generates revenue primarily from its Mass Spectrometer Business, which amounts to CN¥266.19 million.

Insider Ownership: 34.4%

Earnings Growth Forecast: 201.5% p.a.

Guangzhou Hexin Instrument Ltd. is poised for substantial growth, with revenue expected to increase by 67% annually, far exceeding the CN market's average of 13.5%. Earnings are projected to grow at a very large rate annually, and the company is anticipated to achieve profitability within three years. However, its share price has been highly volatile recently. There are no recent insider trading activities reported in the past three months.

- Unlock comprehensive insights into our analysis of Guangzhou Hexin InstrumentLtd stock in this growth report.

- Our valuation report here indicates Guangzhou Hexin InstrumentLtd may be overvalued.

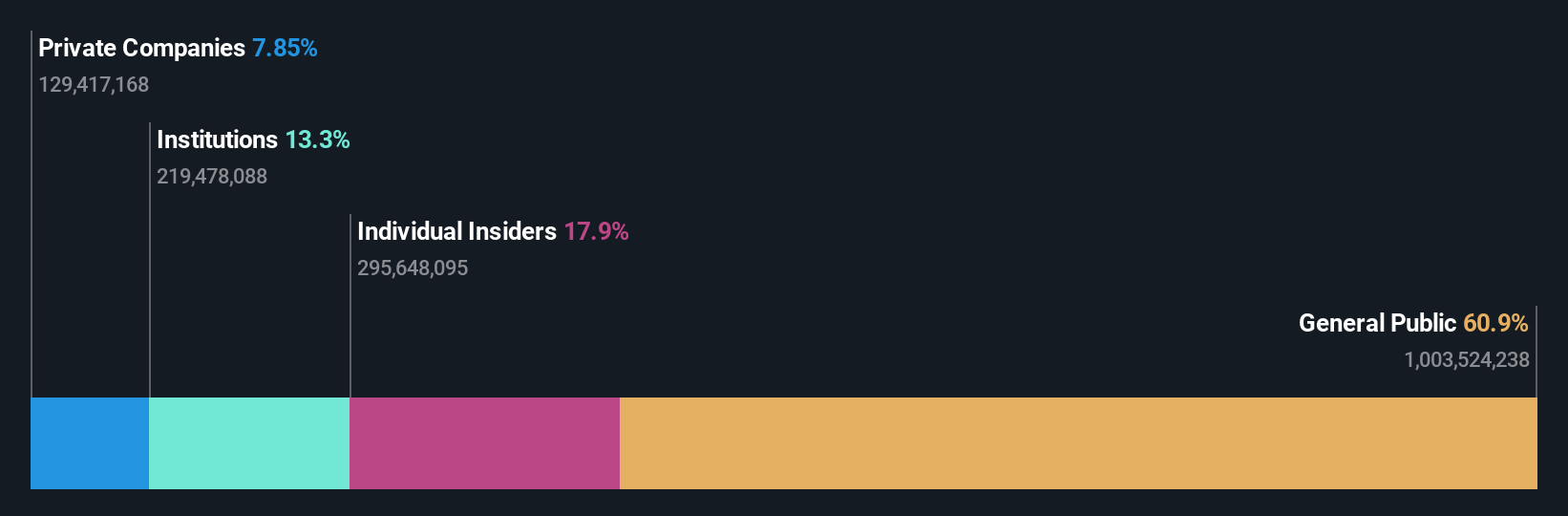

Guangdong Create Century Intelligent Equipment Group (SZSE:300083)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Create Century Intelligent Equipment Group Corporation Limited, along with its subsidiaries, focuses on the research, development, production, and sale of high-end intelligent equipment in China and has a market cap of CN¥11.24 billion.

Operations: Guangdong Create Century Intelligent Equipment Group Corporation Limited specializes in the research, development, production, and sale of advanced intelligent equipment within China.

Insider Ownership: 17.9%

Earnings Growth Forecast: 37% p.a.

Guangdong Create Century Intelligent Equipment Group is positioned for robust growth, with revenue expected to increase by 22% annually, outpacing the CN market's 13.5%. Earnings are forecast to grow significantly at 37% per year. Recent share buybacks amounting to CNY 100.04 million reflect confidence in future prospects. However, Return on Equity is projected to remain low at 11.1% in three years, and there have been no notable insider trading activities recently.

- Click here and access our complete growth analysis report to understand the dynamics of Guangdong Create Century Intelligent Equipment Group.

- Our expertly prepared valuation report Guangdong Create Century Intelligent Equipment Group implies its share price may be too high.

Turning Ideas Into Actions

- Gain an insight into the universe of 1443 Fast Growing Companies With High Insider Ownership by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A100090

SK oceanplantLtd

Engages in manufacturing of steel and stainless steel pipe, hull block, and shipbuilding equipment in South Korea.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives