- China

- /

- Electrical

- /

- SZSE:300068

Further Upside For ZHEJIANG NARADA POWER SOURCE Co. , Ltd. (SZSE:300068) Shares Could Introduce Price Risks After 46% Bounce

ZHEJIANG NARADA POWER SOURCE Co. , Ltd. (SZSE:300068) shareholders would be excited to see that the share price has had a great month, posting a 46% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 85% in the last year.

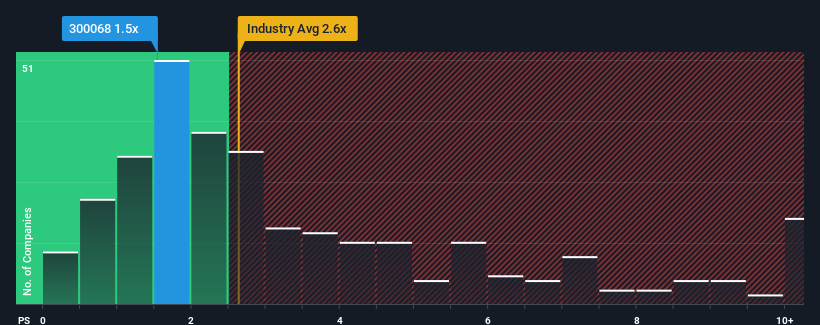

Even after such a large jump in price, ZHEJIANG NARADA POWER SOURCE may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.5x, considering almost half of all companies in the Electrical industry in China have P/S ratios greater than 2.6x and even P/S higher than 5x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for ZHEJIANG NARADA POWER SOURCE

How Has ZHEJIANG NARADA POWER SOURCE Performed Recently?

ZHEJIANG NARADA POWER SOURCE could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think ZHEJIANG NARADA POWER SOURCE's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, ZHEJIANG NARADA POWER SOURCE would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. The last three years don't look nice either as the company has shrunk revenue by 11% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 48% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 25%, which is noticeably less attractive.

With this information, we find it odd that ZHEJIANG NARADA POWER SOURCE is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Despite ZHEJIANG NARADA POWER SOURCE's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To us, it seems ZHEJIANG NARADA POWER SOURCE currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with ZHEJIANG NARADA POWER SOURCE (at least 1 which is potentially serious), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if ZHEJIANG NARADA POWER SOURCE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300068

ZHEJIANG NARADA POWER SOURCE

Engages in the research, development, manufacture, sale, and service of lithium-ion batteries and systems, lead-acid batteries and systems, fuel cells and lithium products, and lead resource regeneration products in China.

High growth potential and good value.

Market Insights

Community Narratives