- China

- /

- Semiconductors

- /

- SHSE:600732

Top Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

In the current global market landscape, investor sentiment is being shaped by tariff uncertainties and mixed economic signals, with U.S. job growth falling short of expectations and manufacturing showing signs of recovery. Amid these fluctuations, stocks with high insider ownership can offer a unique insight into potential growth opportunities, as insiders often have a vested interest in the company's success and may signal confidence in its future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.9% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.1% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 111.4% |

Let's uncover some gems from our specialized screener.

Shanghai Aiko Solar EnergyLtd (SHSE:600732)

Simply Wall St Growth Rating: ★★★★★☆

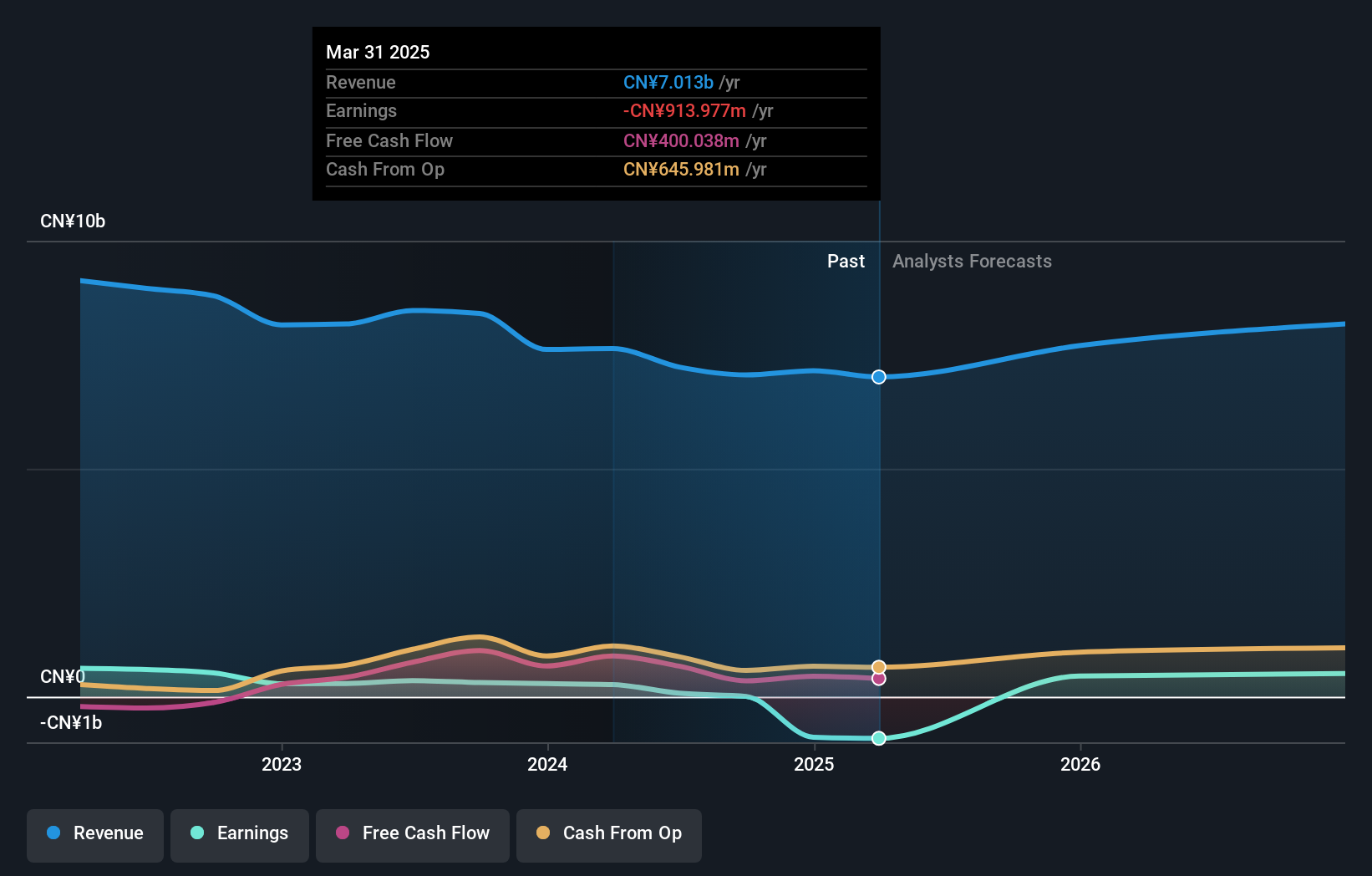

Overview: Shanghai Aiko Solar Energy Co., Ltd. is involved in the research, manufacture, and sale of crystalline silicon solar cells, with a market cap of CN¥21.73 billion.

Operations: Revenue Segments (in millions of CN¥): The company generates its revenue primarily through the research, manufacture, and sale of crystalline silicon solar cells.

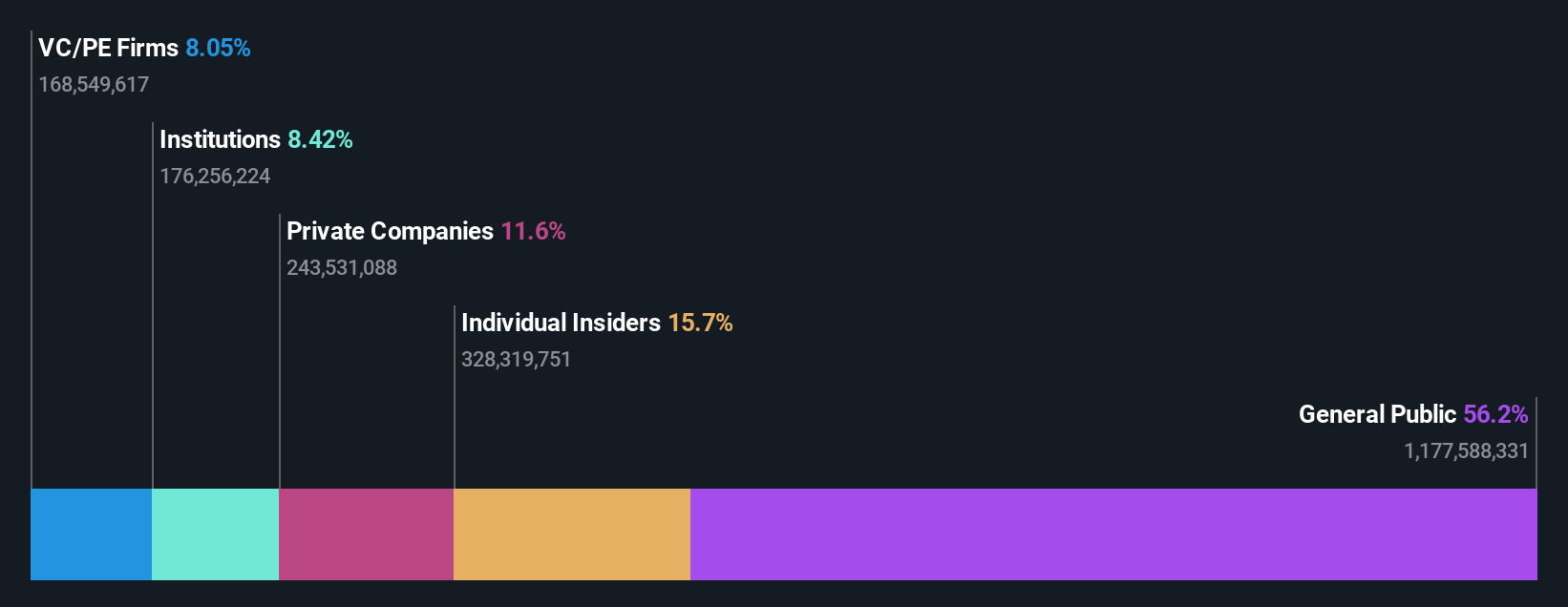

Insider Ownership: 18.2%

Shanghai Aiko Solar Energy Ltd. is trading at a significant discount to its estimated fair value and shows promising growth prospects, with earnings expected to grow over 106% annually and revenue projected to increase by 53.9% per year, outpacing the Chinese market. However, its financial position is challenged by operating cash flow not covering debt well. Recent removal from major indices may impact investor sentiment despite no recent insider trading activity reported.

- Take a closer look at Shanghai Aiko Solar EnergyLtd's potential here in our earnings growth report.

- Our valuation report unveils the possibility Shanghai Aiko Solar EnergyLtd's shares may be trading at a discount.

Hwa Create (SZSE:300045)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hwa Create Corporation focuses on researching, developing, manufacturing, and selling satellite navigation as well as radar and communication products and technologies, with a market cap of CN¥13.92 billion.

Operations: The company's revenue segments include satellite navigation products and technologies, along with radar and communication products.

Insider Ownership: 34.4%

Hwa Create's earnings have grown 3.9% annually over the past five years, and it is forecast to become profitable within three years, with revenue expected to grow at 34.7% per year, significantly outpacing the Chinese market average. Despite no recent insider trading activity reported, its return on equity is projected to remain low at 5.4%, which could be a concern for potential investors seeking robust financial returns.

- Get an in-depth perspective on Hwa Create's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Hwa Create implies its share price may be too high.

Leyard Optoelectronic (SZSE:300296)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Leyard Optoelectronic Co., Ltd. is an audio-visual technology company operating in China and internationally, with a market cap of CN¥19.14 billion.

Operations: Leyard Optoelectronic generates revenue through its operations in the audio-visual technology sector, serving both domestic and international markets.

Insider Ownership: 26.6%

Leyard Optoelectronic is positioned for significant earnings growth, with forecasts indicating a 71% annual increase, surpassing the Chinese market average. However, its volatile share price and low profit margins could pose challenges. Despite trading at good value compared to peers, its dividend yield of 0.71% is not well covered by earnings. Recent buyback activity saw the completion of a small tranche worth CNY 22.4 million but no substantial insider trading was reported in recent months.

- Click to explore a detailed breakdown of our findings in Leyard Optoelectronic's earnings growth report.

- Our valuation report here indicates Leyard Optoelectronic may be undervalued.

Key Takeaways

- Click through to start exploring the rest of the 1439 Fast Growing Companies With High Insider Ownership now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600732

Shanghai Aiko Solar EnergyLtd

Engages in the research, manufacture, and sale of crystalline silicon solar cells.

Undervalued with high growth potential.

Market Insights

Community Narratives