- China

- /

- Electronic Equipment and Components

- /

- SHSE:688002

Asian Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets navigate through a complex landscape marked by geopolitical tensions and economic uncertainties, investors are increasingly turning their attention to Asia, where growth opportunities abound. In this context, stocks with significant insider ownership can be particularly appealing as they often signal confidence from those closest to the company’s operations and strategy.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 59.9% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.9% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 24.3% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 94.4% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

Let's dive into some prime choices out of the screener.

Raytron TechnologyLtd (SHSE:688002)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Raytron Technology Co., Ltd. focuses on the R&D, design, manufacturing, and sales of uncooled infrared imaging and MEMS sensor technology in China, with a market cap of CN¥28.78 billion.

Operations: Raytron Technology Co., Ltd. generates revenue through its involvement in the uncooled infrared imaging and MEMS sensor technology sectors within China.

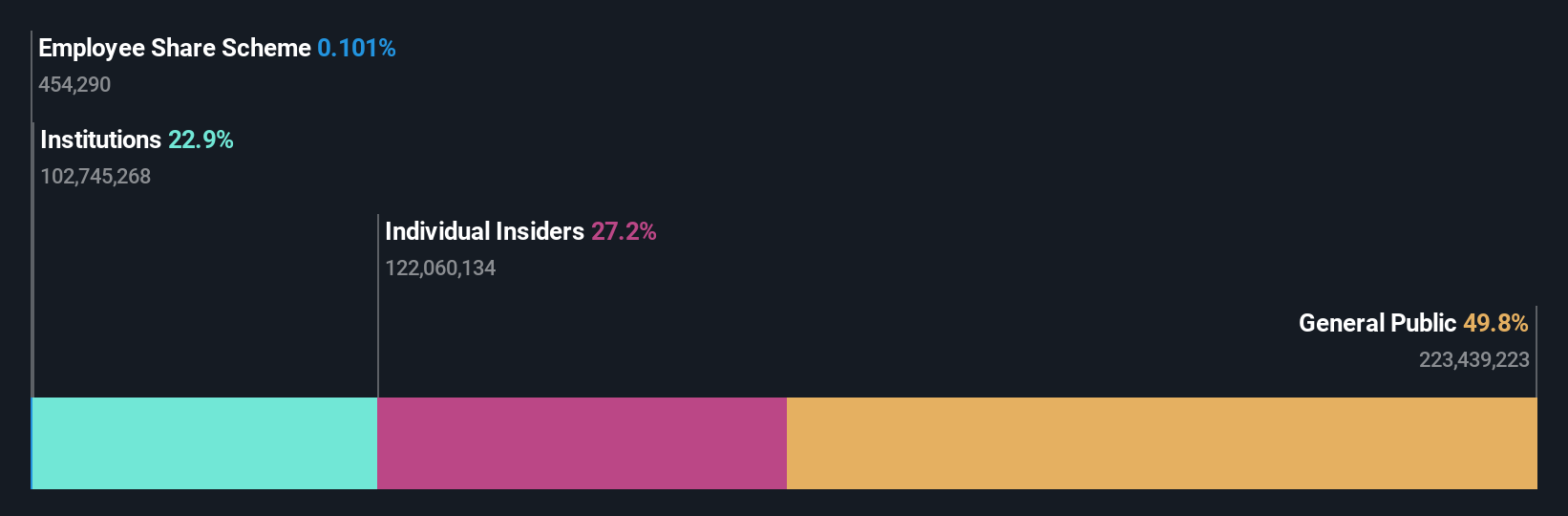

Insider Ownership: 27.2%

Revenue Growth Forecast: 16.7% p.a.

Raytron Technology Ltd. combines robust growth prospects with significant insider ownership, fostering alignment between management and shareholders. The company's revenue is expected to grow at 16.7% annually, outpacing the broader Chinese market's forecasted growth of 12.3%. Recent product innovations, including advanced thermal cameras and AI-driven wildfire prevention systems, highlight Raytron's commitment to technological advancement and market expansion. Despite a low projected return on equity of 14.7%, earnings are anticipated to grow significantly at 27% per year, underscoring its potential as a dynamic player in the tech sector.

- Get an in-depth perspective on Raytron TechnologyLtd's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Raytron TechnologyLtd's shares may be trading at a premium.

Baowu Magnesium Technology (SZSE:002182)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Baowu Magnesium Technology Co., Ltd. is involved in mining and non-ferrous metal smelting and processing both in China and internationally, with a market cap of CN¥12.29 billion.

Operations: The company's revenue primarily comes from its non-ferrous metal smelting and rolling processing segment, which generated CN¥8.96 billion.

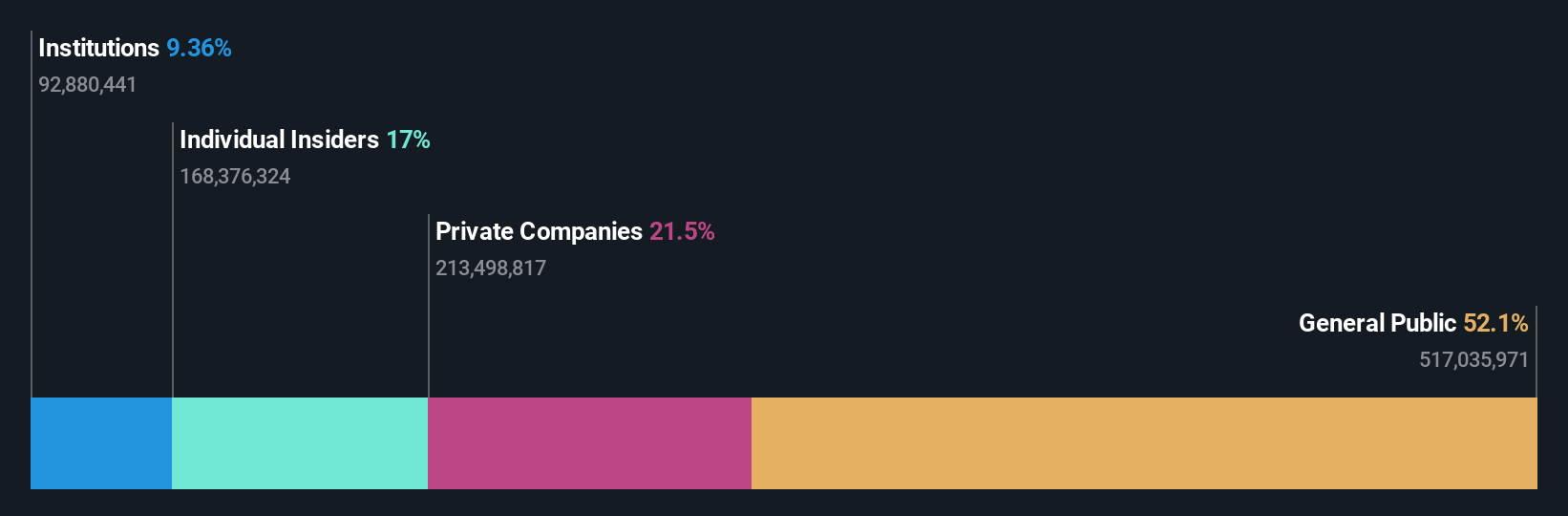

Insider Ownership: 17%

Revenue Growth Forecast: 17.2% p.a.

Baowu Magnesium Technology is poised for significant earnings growth at 55.2% annually, outpacing the Chinese market's 23.2% forecast, despite a modest revenue increase of 17.2%. Insider ownership aligns management interests with shareholders, fostering confidence in strategic decisions. However, recent financials reveal declining profit margins and net income compared to last year. The company has also announced reduced dividends for 2024, reflecting cautious capital allocation amidst evolving market conditions.

- Delve into the full analysis future growth report here for a deeper understanding of Baowu Magnesium Technology.

- The valuation report we've compiled suggests that Baowu Magnesium Technology's current price could be inflated.

Hunan Zhongke Electric (SZSE:300035)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hunan Zhongke Electric Co., Ltd. specializes in the manufacturing of electromagnetic metallurgy products in China, with a market cap of CN¥11.56 billion.

Operations: I can't provide a summary of the company's revenue segments as the necessary information is missing from the provided text.

Insider Ownership: 20.7%

Revenue Growth Forecast: 21.7% p.a.

Hunan Zhongke Electric demonstrates strong growth potential with earnings forecasted to rise by 33.4% annually, surpassing the Chinese market's 23.2% projection, and revenue expected to increase by 21.7%. The company trades at a favorable price-to-earnings ratio of 27.9x compared to the market's 37.9x, indicating good value relative to peers. Recent financials show substantial profit growth; however, dividends remain inadequately covered by free cash flows, suggesting cautious dividend sustainability considerations moving forward.

- Click here and access our complete growth analysis report to understand the dynamics of Hunan Zhongke Electric.

- Our valuation report unveils the possibility Hunan Zhongke Electric's shares may be trading at a discount.

Turning Ideas Into Actions

- Dive into all 587 of the Fast Growing Asian Companies With High Insider Ownership we have identified here.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688002

Raytron TechnologyLtd

Engages in the research and development, design, manufacturing, and sales of uncooled infrared imagining and MEMS sensor technology in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives