Additional Considerations Required While Assessing Hunan Zhongke Electric's (SZSE:300035) Strong Earnings

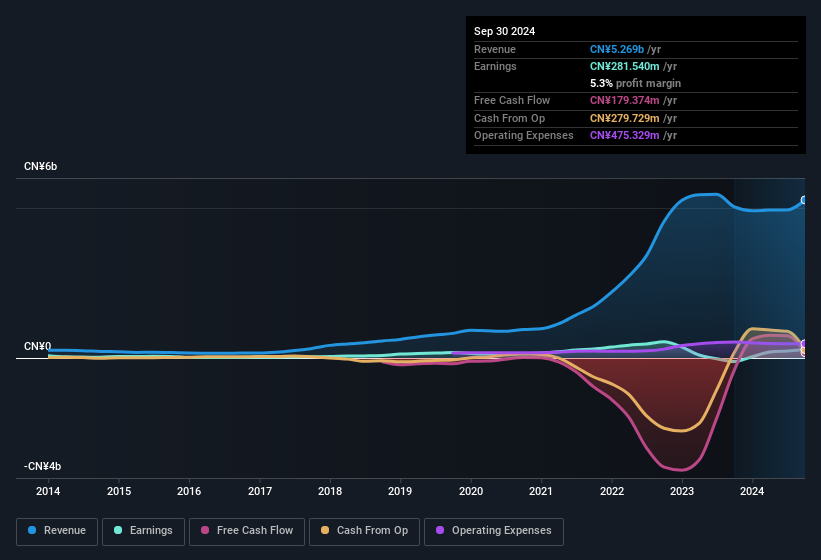

Hunan Zhongke Electric Co., Ltd. (SZSE:300035) announced strong profits, but the stock was stagnant. Our analysis suggests that this might be because shareholders have noticed some concerning underlying factors.

See our latest analysis for Hunan Zhongke Electric

The Impact Of Unusual Items On Profit

For anyone who wants to understand Hunan Zhongke Electric's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from CN¥46m worth of unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Hunan Zhongke Electric's Profit Performance

Arguably, Hunan Zhongke Electric's statutory earnings have been distorted by unusual items boosting profit. Because of this, we think that it may be that Hunan Zhongke Electric's statutory profits are better than its underlying earnings power. On the bright side, the company showed enough improvement to book a profit this year, after losing money last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. For example, we've found that Hunan Zhongke Electric has 3 warning signs (1 is significant!) that deserve your attention before going any further with your analysis.

Today we've zoomed in on a single data point to better understand the nature of Hunan Zhongke Electric's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

If you're looking to trade Hunan Zhongke Electric, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hunan Zhongke Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300035

Hunan Zhongke Electric

Manufactures electromagnetic metallurgy products in China.

High growth potential with solid track record.

Market Insights

Community Narratives