3 Growth Companies With High Insider Ownership Expecting 107% Earnings Growth

Reviewed by Simply Wall St

In a week marked by geopolitical tensions and consumer spending concerns, global markets experienced volatility, with major U.S. indices declining despite early gains. The economic landscape is further complicated by tariff discussions and inflationary pressures, which have contributed to cautious investor sentiment. In such an environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong internal confidence in the company's future prospects and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| On Holding (NYSE:ONON) | 19.1% | 30.2% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

Here we highlight a subset of our preferred stocks from the screener.

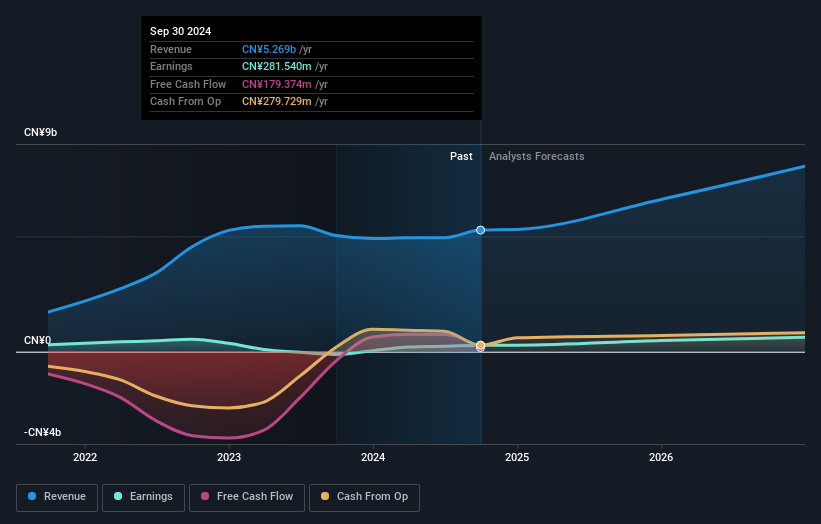

Yuanjie Semiconductor Technology (SHSE:688498)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yuanjie Semiconductor Technology Co., Ltd. (ticker: SHSE:688498) operates in the semiconductor industry with a market cap of approximately CN¥12.41 billion.

Operations: Yuanjie Semiconductor Technology generates its revenue from various segments within the semiconductor industry.

Insider Ownership: 27.8%

Earnings Growth Forecast: 100.1% p.a.

Yuanjie Semiconductor Technology is expected to achieve significant revenue growth of 45.8% annually, outpacing the Chinese market's 13.4% growth rate. Despite high share price volatility recently, the company is projected to become profitable within three years, with earnings growing at 100.1% per year. However, its forecasted Return on Equity remains low at 8.3%. Insider ownership is stable with no substantial buying or selling over the past three months.

- Click here to discover the nuances of Yuanjie Semiconductor Technology with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Yuanjie Semiconductor Technology's share price might be too optimistic.

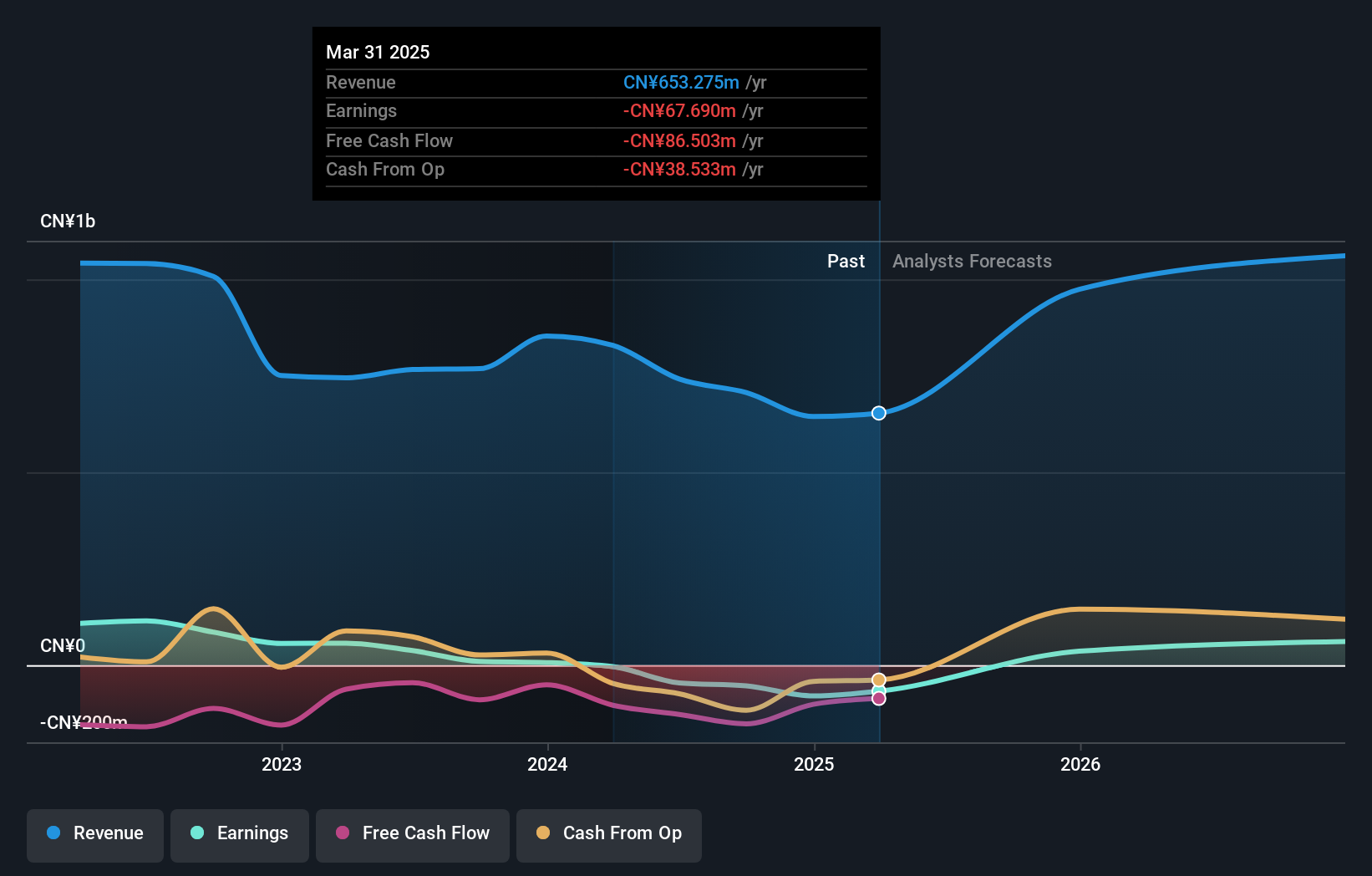

Hunan Zhongke Electric (SZSE:300035)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hunan Zhongke Electric Co., Ltd. is a Chinese company specializing in the manufacture of electromagnetic metallurgy products, with a market cap of CN¥10.47 billion.

Operations: Hunan Zhongke Electric Co., Ltd. generates its revenue primarily from the production and sale of electromagnetic metallurgy products in China.

Insider Ownership: 20.1%

Earnings Growth Forecast: 49.2% p.a.

Hunan Zhongke Electric is poised for robust growth, with revenue expected to rise 23.5% annually, surpassing the Chinese market's 13.4% growth rate. Earnings are forecast to grow significantly at 49.2% per year, although Return on Equity is projected to be modest at 13.1%. Despite a lack of recent insider trading activity and an unstable dividend record, the company's Price-To-Earnings ratio of 37.2x offers relative value compared to the CN market average of 38.1x.

- Navigate through the intricacies of Hunan Zhongke Electric with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Hunan Zhongke Electric is priced higher than what may be justified by its financials.

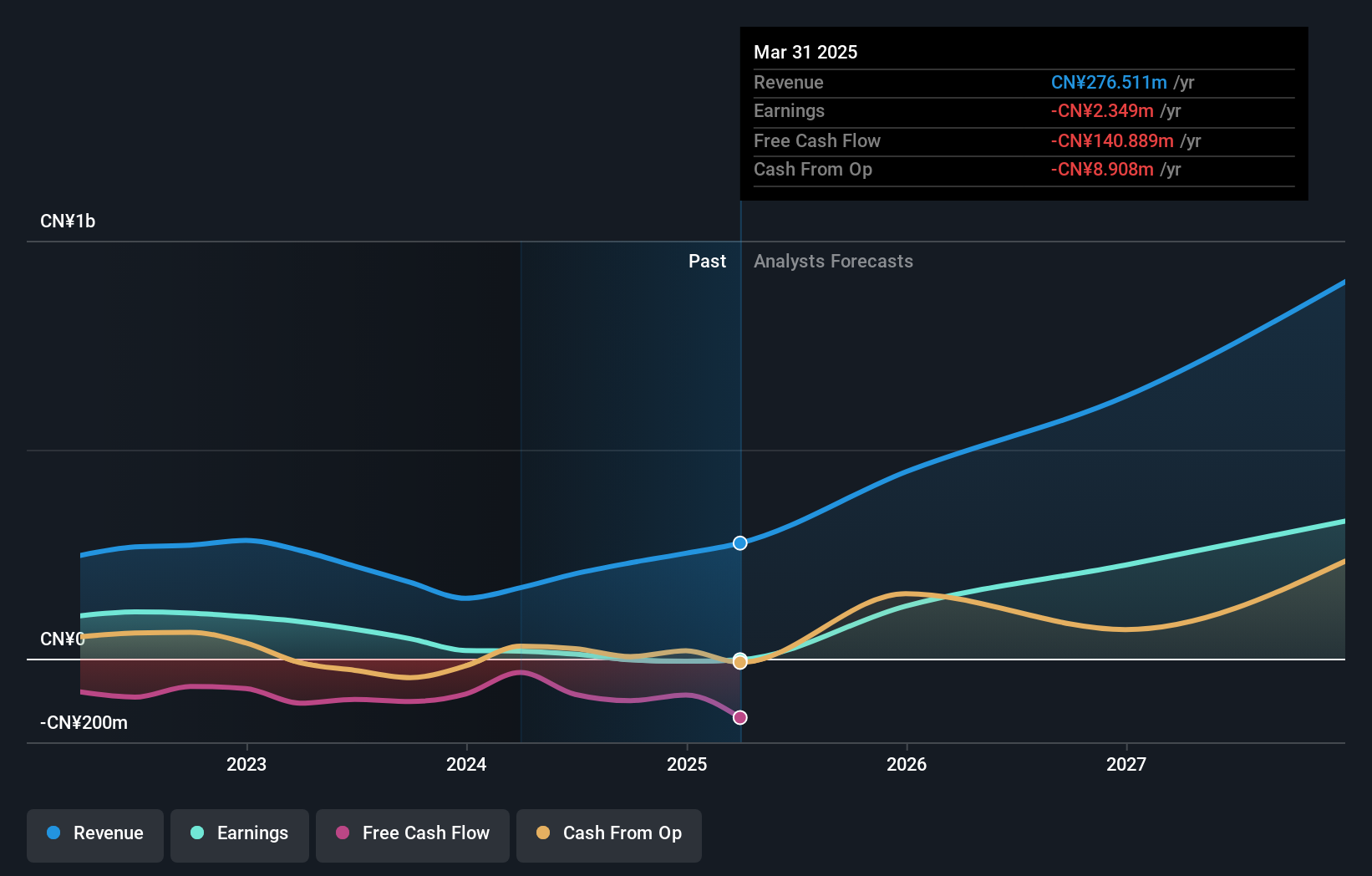

Nexwise Intelligence China (SZSE:301248)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nexwise Intelligence China Limited provides security and intelligent systems globally, with a market capitalization of CN¥3.48 billion.

Operations: The company's revenue is primarily derived from its Appliance & Tool segment, which generated CN¥706.52 million.

Insider Ownership: 36.3%

Earnings Growth Forecast: 107% p.a.

Nexwise Intelligence China is expected to achieve profitability within three years, with earnings projected to grow significantly at 107.02% annually. However, revenue growth of 14.2% per year lags behind the desired threshold of 20%, though it still exceeds the Chinese market average of 13.4%. Recent changes in non-independent directors and amendments to company bylaws may impact governance but have not influenced insider trading activity over the past three months.

- Click to explore a detailed breakdown of our findings in Nexwise Intelligence China's earnings growth report.

- The analysis detailed in our Nexwise Intelligence China valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Embark on your investment journey to our 1454 Fast Growing Companies With High Insider Ownership selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Nexwise Intelligence China might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301248

Nexwise Intelligence China

Engages in the provision of security and intelligent systems worldwide.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives