- China

- /

- Electrical

- /

- SZSE:300032

Jinlong Machinery & Electronic Co.,Ltd's (SZSE:300032) 33% Share Price Surge Not Quite Adding Up

Jinlong Machinery & Electronic Co.,Ltd (SZSE:300032) shares have had a really impressive month, gaining 33% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 35% over that time.

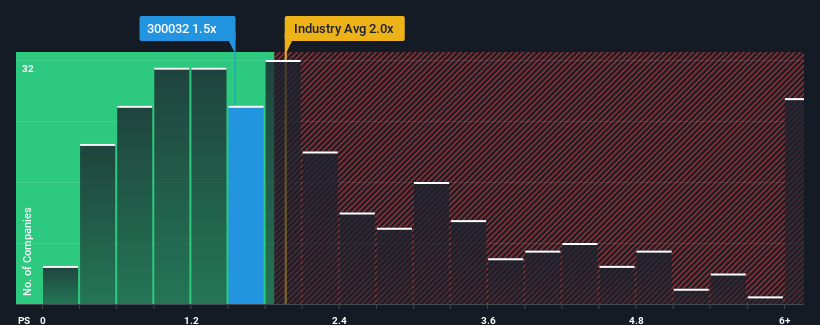

In spite of the firm bounce in price, it's still not a stretch to say that Jinlong Machinery & ElectronicLtd's price-to-sales (or "P/S") ratio of 1.5x right now seems quite "middle-of-the-road" compared to the Electrical industry in China, where the median P/S ratio is around 2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Jinlong Machinery & ElectronicLtd

How Jinlong Machinery & ElectronicLtd Has Been Performing

For example, consider that Jinlong Machinery & ElectronicLtd's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Jinlong Machinery & ElectronicLtd will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Jinlong Machinery & ElectronicLtd's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 50%. Regardless, revenue has managed to lift by a handy 7.9% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 24% shows it's noticeably less attractive.

With this information, we find it interesting that Jinlong Machinery & ElectronicLtd is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Key Takeaway

Its shares have lifted substantially and now Jinlong Machinery & ElectronicLtd's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Jinlong Machinery & ElectronicLtd's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

You should always think about risks. Case in point, we've spotted 2 warning signs for Jinlong Machinery & ElectronicLtd you should be aware of, and 1 of them shouldn't be ignored.

If you're unsure about the strength of Jinlong Machinery & ElectronicLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300032

Jinlong Machinery & ElectronicLtd

Researches, produces, and sells motors in China and internationally.

Excellent balance sheet and overvalued.

Market Insights

Community Narratives