Asian Market Insights: Sihuan Pharmaceutical Holdings Group And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As trade tensions between the U.S. and China show signs of easing, Asian markets are experiencing a cautious optimism, with indices like China's CSI 300 and Japan's Nikkei 225 making gains. In this context, penny stocks—though often seen as relics of past trading days—remain relevant for investors seeking opportunities in smaller or newer companies that may offer surprising value. This article will explore three such penny stocks in Asia, including Sihuan Pharmaceutical Holdings Group, which demonstrate financial strength and potential for long-term growth.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Phol Dhanya (SET:PHOL) | THB2.82 | THB571.05M | ✅ 2 ⚠️ 3 View Analysis > |

| Advice IT Infinite (SET:ADVICE) | THB4.82 | THB2.99B | ✅ 4 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.42 | SGD170.22M | ✅ 4 ⚠️ 3 View Analysis > |

| YKGI (Catalist:YK9) | SGD0.098 | SGD41.65M | ✅ 2 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.19 | SGD37.85M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.23 | SGD8.78B | ✅ 5 ⚠️ 0 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.02 | HK$46.02B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.06 | HK$668.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.11 | HK$1.85B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.90 | HK$1.58B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,158 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Sihuan Pharmaceutical Holdings Group (SEHK:460)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sihuan Pharmaceutical Holdings Group Ltd. is an investment holding company involved in the research, development, manufacture, marketing, and sale of pharmaceutical and medical aesthetic products in China with a market cap of approximately HK$6.62 billion.

Operations: The company's revenue is primarily derived from its Generic Medicine segment at CN¥1.10 billion, followed by Medical Aesthetic Products at CN¥744.22 million, and Innovative Medicine and Other Medicine contributing CN¥109.67 million.

Market Cap: HK$6.62B

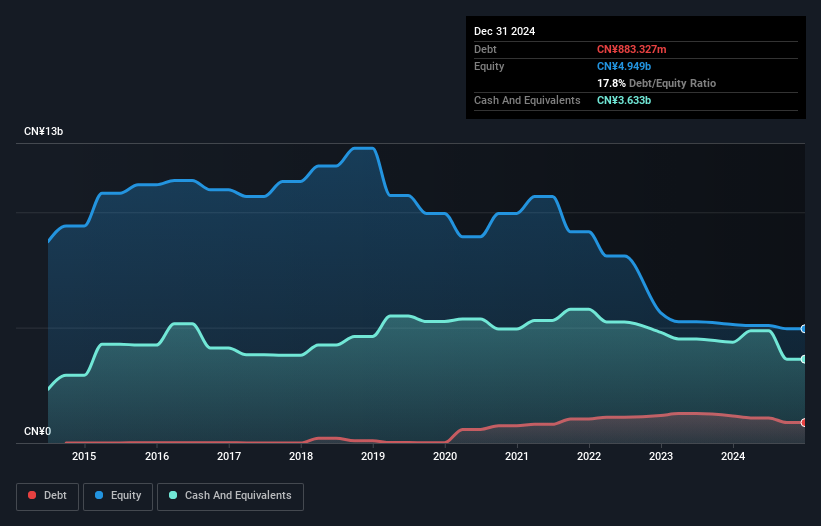

Sihuan Pharmaceutical Holdings Group, with a market cap of approximately HK$6.62 billion, has recently obtained approval for its Dapagliflozin Tablets in China, enhancing its diabetes treatment portfolio. The company reported sales of CN¥1.90 billion for 2024 but faced a net loss of CN¥216.66 million due to challenges such as declining generic drug sales and high R&D expenses for innovative drugs. Despite these hurdles, the medical aesthetics segment shows rapid growth and the firm maintains strong short-term asset coverage over liabilities (CN¥5.7B vs CN¥3.3B). Its board and management are experienced, supporting strategic stability amidst financial volatility.

- Dive into the specifics of Sihuan Pharmaceutical Holdings Group here with our thorough balance sheet health report.

- Evaluate Sihuan Pharmaceutical Holdings Group's historical performance by accessing our past performance report.

Hainan RuiZe New Building MaterialLtd (SZSE:002596)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hainan RuiZe New Building Material Co., Ltd is a Chinese company that produces and sells commercial concrete and cement, with a market cap of CN¥4.10 billion.

Operations: The company's revenue is primarily derived from the Concrete Slab segment, which generated CN¥1.02 billion, and the Municipal Sanitation Sector, contributing CN¥336.87 million.

Market Cap: CN¥4.1B

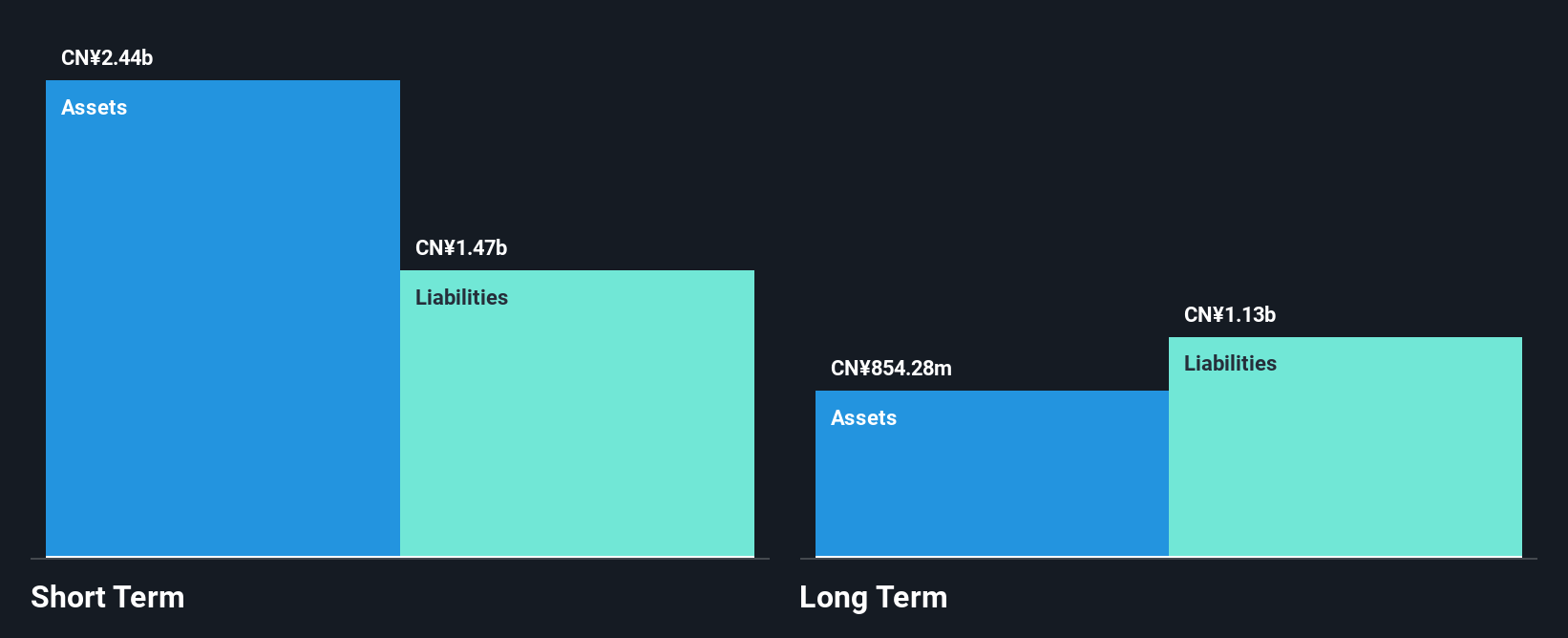

Hainan RuiZe New Building Material Co., Ltd, with a market cap of CN¥4.10 billion, reported sales of CN¥1.30 billion for 2024 but remains unprofitable with a net loss of CN¥241.53 million, though this is an improvement from the previous year's loss. The company benefits from seasoned management and board members with average tenures exceeding industry norms, providing strategic stability. Its short-term assets (CN¥2.60 billion) effectively cover both short and long-term liabilities, yet its high net debt to equity ratio (167%) poses financial risk despite having a sufficient cash runway due to positive free cash flow growth.

- Click to explore a detailed breakdown of our findings in Hainan RuiZe New Building MaterialLtd's financial health report.

- Gain insights into Hainan RuiZe New Building MaterialLtd's historical outcomes by reviewing our past performance report.

Jinlong Machinery & ElectronicLtd (SZSE:300032)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jinlong Machinery & Electronic Co., Ltd researches, produces, and sells motors both in China and internationally with a market cap of CN¥3.46 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥3.46B

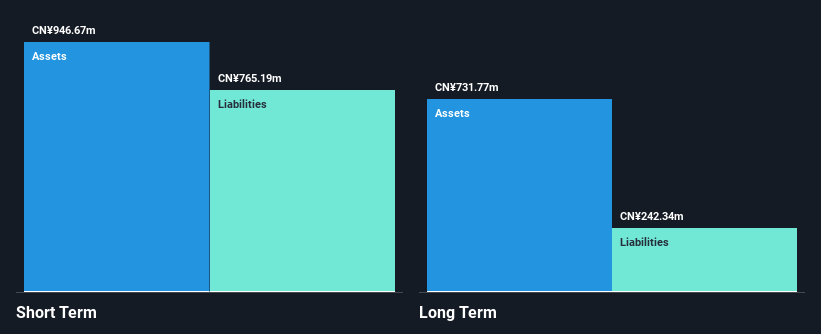

Jinlong Machinery & Electronic Co., Ltd, with a market cap of CN¥3.46 billion, reported 2024 sales of CN¥1.49 billion but remains unprofitable, though its net loss decreased significantly from the previous year. The company has more cash than total debt and a reduced debt to equity ratio over five years, suggesting improved financial health. Short-term assets exceed both short and long-term liabilities, providing some stability despite declining earnings over the past five years. The management team is relatively new with an average tenure of 1.4 years, potentially impacting strategic direction amidst ongoing financial challenges.

- Click here to discover the nuances of Jinlong Machinery & ElectronicLtd with our detailed analytical financial health report.

- Learn about Jinlong Machinery & ElectronicLtd's historical performance here.

Turning Ideas Into Actions

- Access the full spectrum of 1,158 Asian Penny Stocks by clicking on this link.

- Looking For Alternative Opportunities? The latest GPUs need a type of rare earth metal called Terbium and there are only 23 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:460

Sihuan Pharmaceutical Holdings Group

An investment holding company, engages in the research and development, manufacture, marketing, and sale of pharmaceutical and medical aesthetic products in the People’s Republic of China.

Adequate balance sheet with weak fundamentals.

Market Insights

Community Narratives