- China

- /

- Electrical

- /

- SZSE:003021

Revenues Not Telling The Story For Shenzhen Zhaowei Machinery & Electronics Co., Ltd. (SZSE:003021) After Shares Rise 26%

Shenzhen Zhaowei Machinery & Electronics Co., Ltd. (SZSE:003021) shares have continued their recent momentum with a 26% gain in the last month alone. The annual gain comes to 149% following the latest surge, making investors sit up and take notice.

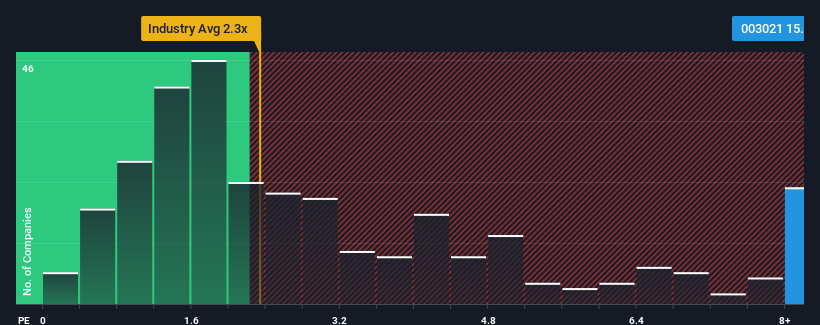

After such a large jump in price, when almost half of the companies in China's Electrical industry have price-to-sales ratios (or "P/S") below 2.3x, you may consider Shenzhen Zhaowei Machinery & Electronics as a stock not worth researching with its 15.4x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Shenzhen Zhaowei Machinery & Electronics

What Does Shenzhen Zhaowei Machinery & Electronics' Recent Performance Look Like?

Recent times have been advantageous for Shenzhen Zhaowei Machinery & Electronics as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Shenzhen Zhaowei Machinery & Electronics' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Shenzhen Zhaowei Machinery & Electronics' is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. The latest three year period has also seen a 24% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 20% over the next year. That's shaping up to be materially lower than the 24% growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Shenzhen Zhaowei Machinery & Electronics' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Shenzhen Zhaowei Machinery & Electronics' P/S

Shares in Shenzhen Zhaowei Machinery & Electronics have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that Shenzhen Zhaowei Machinery & Electronics currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Shenzhen Zhaowei Machinery & Electronics that you should be aware of.

If you're unsure about the strength of Shenzhen Zhaowei Machinery & Electronics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:003021

Shenzhen Zhaowei Machinery & Electronics

Shenzhen Zhaowei Machinery & Electronics Co., Ltd.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion