- South Korea

- /

- Retail Distributors

- /

- KOSDAQ:A257720

3 Asian Stocks Estimated To Be Up To 49.4% Below Intrinsic Value

Reviewed by Simply Wall St

As Asian markets navigate a landscape marked by political shifts and economic fluctuations, investors are increasingly focused on identifying opportunities that may be undervalued. In this environment, a good stock is often characterized by its potential to offer value relative to its intrinsic worth, making it an attractive option for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Taiyo Yuden (TSE:6976) | ¥3146.00 | ¥6249.22 | 49.7% |

| Suzhou Alton Electrical & Mechanical Industry (SZSE:301187) | CN¥29.68 | CN¥58.37 | 49.2% |

| SRE Holdings (TSE:2980) | ¥3275.00 | ¥6450.05 | 49.2% |

| Kolmar Korea (KOSE:A161890) | ₩78900.00 | ₩155031.26 | 49.1% |

| Jiangxi Rimag Group (SEHK:2522) | HK$17.25 | HK$34.45 | 49.9% |

| Inspur Digital Enterprise Technology (SEHK:596) | HK$9.69 | HK$19.31 | 49.8% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥39.97 | CN¥77.63 | 48.5% |

| Food Empire Holdings (SGX:F03) | SGD2.59 | SGD5.13 | 49.5% |

| CGN Mining (SEHK:1164) | HK$2.95 | HK$5.83 | 49.4% |

| Anhui Ronds Science & Technology (SHSE:688768) | CN¥49.92 | CN¥97.20 | 48.6% |

Let's uncover some gems from our specialized screener.

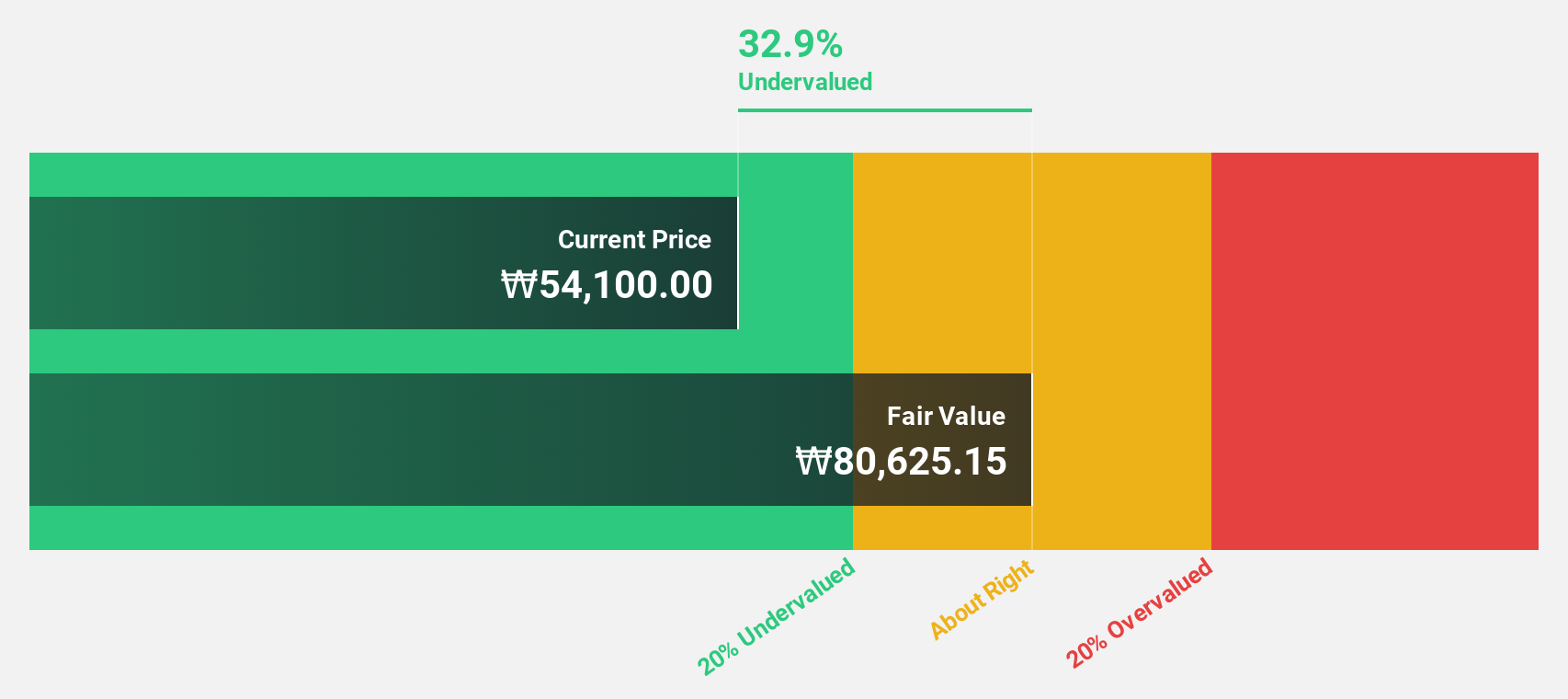

SILICON2 (KOSDAQ:A257720)

Overview: SILICON2 Co., Ltd. is involved in the global distribution of cosmetics products and has a market cap of approximately ₩2.70 trillion.

Operations: The company generates revenue primarily through its wholesale miscellaneous segment, which amounts to approximately ₩871.20 million.

Estimated Discount To Fair Value: 46.2%

SILICON2 is trading at ₩44,200, significantly below its estimated fair value of ₩82,153.75, suggesting it may be undervalued based on cash flows. Analysts expect revenue to grow 27% annually—outpacing the Korean market—and earnings to increase by 28.7% per year over the next three years. Despite recent share price volatility and high non-cash earnings levels, SILICON2's robust growth prospects and favorable valuation metrics highlight its potential as an undervalued investment opportunity in Asia.

- Upon reviewing our latest growth report, SILICON2's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of SILICON2 stock in this financial health report.

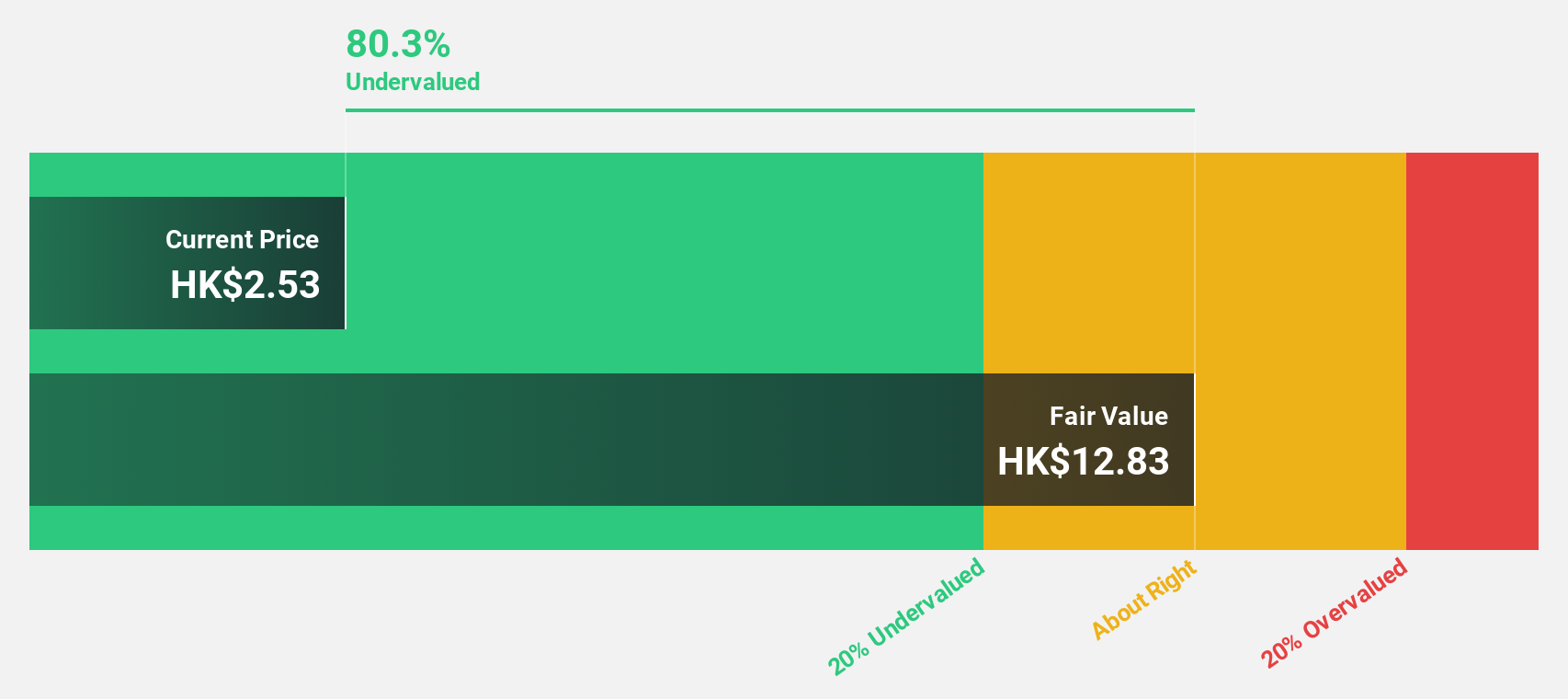

CGN Mining (SEHK:1164)

Overview: CGN Mining Company Limited focuses on the development and trading of natural uranium resources for nuclear power plants, with a market cap of HK$22.42 billion.

Operations: The company's revenue is primarily derived from natural uranium trading, amounting to HK$6.26 billion.

Estimated Discount To Fair Value: 49.4%

CGN Mining is trading at HK$2.95, well below its estimated fair value of HK$5.83, highlighting potential undervaluation based on cash flows. Despite a recent net loss of HK$67.57 million for the first half of 2025 and no interim dividend, analysts forecast revenue growth at 21.2% annually and earnings to rise significantly by 43.54% per year over three years—outpacing the Hong Kong market's growth rates—underscoring its attractive valuation metrics amidst current financial challenges.

- Our expertly prepared growth report on CGN Mining implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of CGN Mining here with our thorough financial health report.

Rayhoo Motor DiesLtd (SZSE:002997)

Overview: Rayhoo Motor Dies Co., Ltd. designs, develops, manufactures, and sells stamping dies and auto welding lines both in China and internationally, with a market cap of CN¥8.66 billion.

Operations: The company's revenue is primarily derived from the Special Equipment Manufacturing Industry, which accounts for CN¥1.97 billion, followed by the Auto Parts and Accessories Manufacturing Industry at CN¥909.83 million.

Estimated Discount To Fair Value: 31.1%

Rayhoo Motor Dies Ltd. is trading at CN¥41.35, significantly below its estimated fair value of CN¥60, indicating potential undervaluation based on cash flows. The company reported strong earnings growth for the first half of 2025, with net income rising to CN¥226.96 million from CN¥161.74 million a year ago and revenue increasing to CN¥1.66 billion from CN¥1.12 billion previously, despite earnings forecasted to grow slower than the market average in coming years.

- Our earnings growth report unveils the potential for significant increases in Rayhoo Motor DiesLtd's future results.

- Get an in-depth perspective on Rayhoo Motor DiesLtd's balance sheet by reading our health report here.

Where To Now?

- Dive into all 281 of the Undervalued Asian Stocks Based On Cash Flows we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A257720

Very undervalued with exceptional growth potential.

Market Insights

Community Narratives