- Taiwan

- /

- Communications

- /

- TWSE:2345

3 Asian Stocks Estimated To Be Trading At Up To 41% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a landscape of easing trade tensions and mixed economic signals, investors are increasingly turning their attention to Asia, where opportunities may arise amidst the shifting dynamics. In this context, identifying undervalued stocks becomes crucial as investors seek to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alexander Marine (TWSE:8478) | NT$149.00 | NT$291.69 | 48.9% |

| Lingbao Gold Group (SEHK:3330) | HK$9.11 | HK$18.16 | 49.8% |

| Renesas Electronics (TSE:6723) | ¥1712.50 | ¥3410.94 | 49.8% |

| Hyosung Heavy Industries (KOSE:A298040) | ₩537000.00 | ₩1072806.39 | 49.9% |

| Shenzhen Yinghe Technology (SZSE:300457) | CN¥17.47 | CN¥34.66 | 49.6% |

| Globe-ing (TSE:277A) | ¥1700.00 | ¥3367.42 | 49.5% |

| Seegene (KOSDAQ:A096530) | ₩26500.00 | ₩52791.90 | 49.8% |

| Bloks Group (SEHK:325) | HK$127.80 | HK$255.58 | 50% |

| Yuhan (KOSE:A000100) | ₩109800.00 | ₩219128.89 | 49.9% |

| MicroPort CardioFlow Medtech (SEHK:2160) | HK$0.87 | HK$1.73 | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

Nongfu Spring (SEHK:9633)

Overview: Nongfu Spring Co., Ltd. is engaged in the research, development, production, and marketing of packaged drinking water and beverage products primarily in Mainland China, with a market cap of HK$430.74 billion.

Operations: The company's revenue segments consist of CN¥15.95 billion from water products, CN¥4.08 billion from juice beverages, CN¥4.93 billion from functional drinks, and CN¥16.74 billion from ready-to-drink tea products.

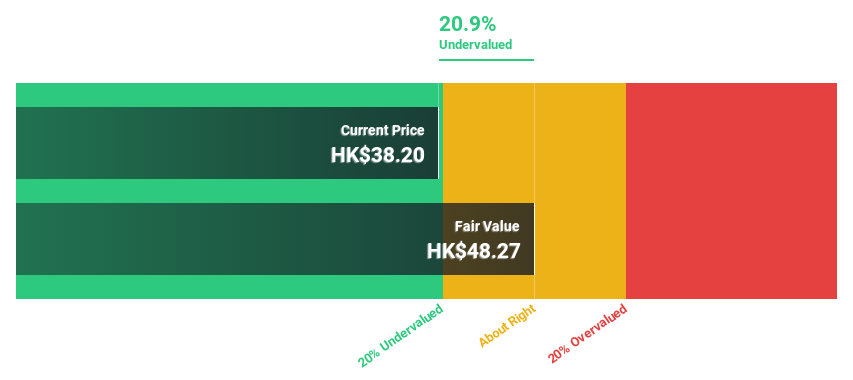

Estimated Discount To Fair Value: 20.6%

Nongfu Spring is trading at HK$38.3, significantly below its estimated fair value of HK$48.25, indicating potential undervaluation based on cash flows. Revenue is forecast to grow 10.8% annually, outpacing the Hong Kong market's growth rate of 8.5%. Recent earnings show modest growth with net income reaching CNY 12.12 billion for 2024, while a proposed dividend increase to RMB 0.76 per share reflects ongoing shareholder returns amidst board and supervisory changes.

- Our growth report here indicates Nongfu Spring may be poised for an improving outlook.

- Dive into the specifics of Nongfu Spring here with our thorough financial health report.

Rayhoo Motor DiesLtd (SZSE:002997)

Overview: Rayhoo Motor Dies Co., Ltd. designs, develops, manufactures, and sells stamping dies and auto welding lines both in China and internationally, with a market cap of CN¥8.92 billion.

Operations: Rayhoo Motor Dies Co., Ltd. generates revenue through the design, development, manufacturing, and sale of stamping dies and auto welding lines for both domestic and international markets.

Estimated Discount To Fair Value: 25.3%

Rayhoo Motor Dies Ltd. trades at CNY 42.62, over 25% below its estimated fair value of CNY 57.08, suggesting it may be undervalued based on cash flows. The company reported strong Q1 results with net income rising to CNY 97.44 million from CNY 75.83 million a year ago, though its dividend yield of 0.7% is not well covered by free cash flows. Revenue is expected to grow significantly faster than the market at an annual rate of 25.8%.

- Upon reviewing our latest growth report, Rayhoo Motor DiesLtd's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Rayhoo Motor DiesLtd stock in this financial health report.

Accton Technology (TWSE:2345)

Overview: Accton Technology Corporation is engaged in the research, development, manufacturing, and sale of network communication equipment across Taiwan, America, Asia, Europe, and internationally with a market capitalization of NT$362.17 billion.

Operations: The company's revenue primarily comes from its Computer Networks segment, which generated NT$110.42 billion.

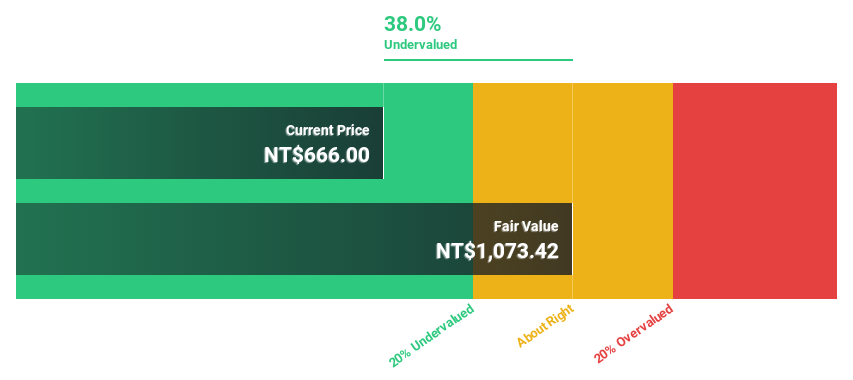

Estimated Discount To Fair Value: 41%

Accton Technology trades at NT$648, 41% below its estimated fair value of NT$1,097.54, highlighting potential undervaluation based on cash flows. Recent earnings show robust growth with net income rising to TWD 11.99 billion from TWD 8.92 billion last year. The company's revenue and profit are projected to grow significantly faster than the market at annual rates of 21.5% and 20.3%, respectively, though share price volatility remains a concern.

- Our earnings growth report unveils the potential for significant increases in Accton Technology's future results.

- Click to explore a detailed breakdown of our findings in Accton Technology's balance sheet health report.

Taking Advantage

- Dive into all 262 of the Undervalued Asian Stocks Based On Cash Flows we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2345

Accton Technology

Researches and develops, manufactures, and sells network communication equipment in Taiwan, America, rest of Asia, Europe, and internationally.

Exceptional growth potential with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives