As global markets navigate a period of mixed performances, with the Nasdaq Composite reaching new heights while other indices face declines, investors are keenly observing the Federal Reserve's anticipated rate cut. In this environment, growth stocks with substantial insider ownership can be particularly appealing as they often signal confidence from those closest to the company's operations and potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's explore several standout options from the results in the screener.

BioArctic (OM:BIOA B)

Simply Wall St Growth Rating: ★★★★★★

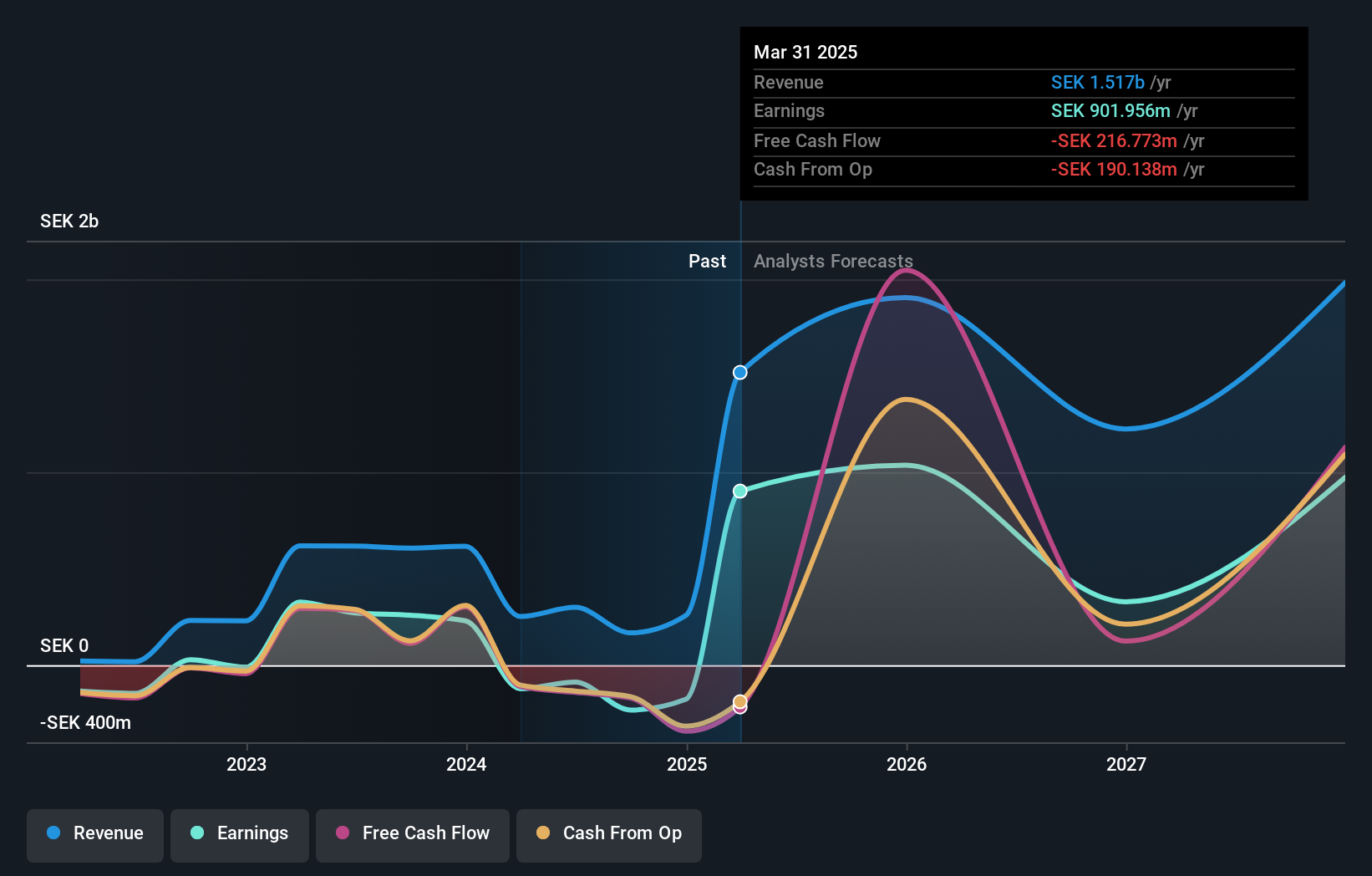

Overview: BioArctic AB (publ) is a Swedish company focused on developing biological drugs for central nervous system disorders, with a market cap of SEK19.46 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to SEK167.14 million.

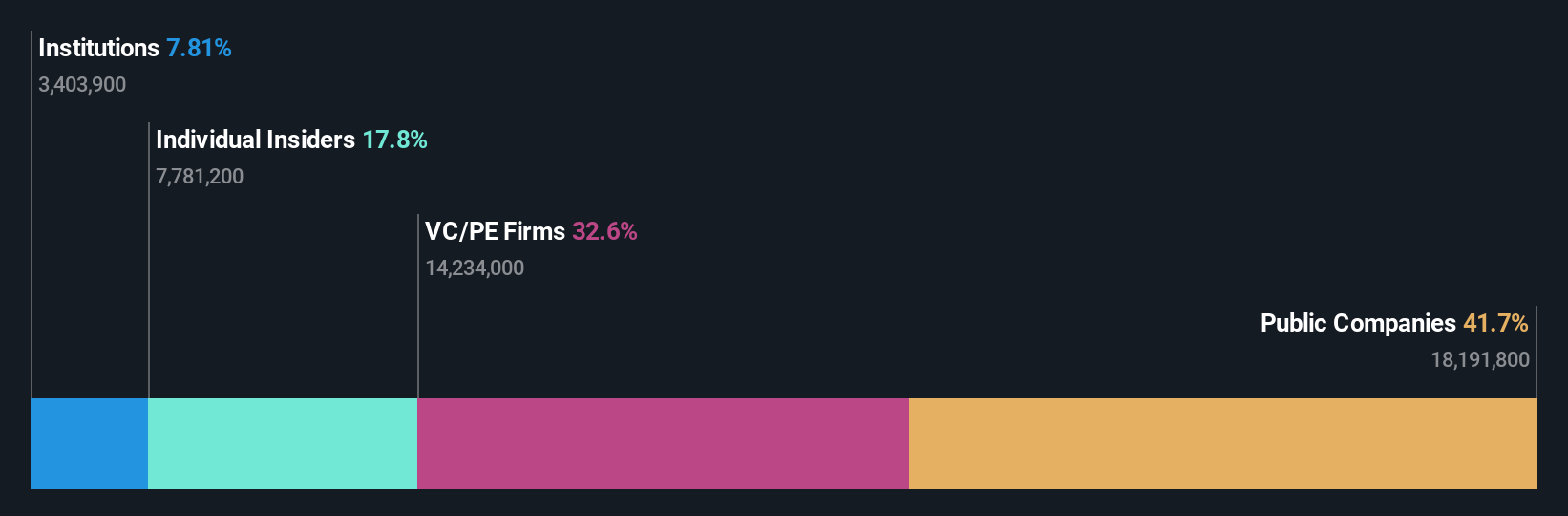

Insider Ownership: 34%

Earnings Growth Forecast: 62.5% p.a.

BioArctic's insider ownership reflects strong internal confidence, with recent developments highlighting its growth potential. The company entered a lucrative agreement with Bristol Myers Squibb for its PyroGlu-Ab antibody program, securing a US$100 million upfront and up to US$1.25 billion in milestone payments, plus royalties. Despite recent financial losses, BioArctic's revenue is forecasted to grow significantly faster than the Swedish market at 49.2% annually, supported by promising advancements in Alzheimer's and Parkinson's treatments.

- Unlock comprehensive insights into our analysis of BioArctic stock in this growth report.

- According our valuation report, there's an indication that BioArctic's share price might be on the cheaper side.

Lucky Harvest (SZSE:002965)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lucky Harvest Co., Ltd. operates in China, focusing on the research, development, production, and sale of precision stamping dies and structural metal parts, with a market cap of CN¥6.73 billion.

Operations: The company's revenue segments include precision stamping dies and structural metal parts.

Insider Ownership: 33.1%

Earnings Growth Forecast: 27% p.a.

Lucky Harvest demonstrates strong growth potential with expected annual earnings growth of 27%, outpacing the Chinese market. Despite a recent decline in net income, the company reported increased sales of CNY 4.88 billion for the first nine months of 2024. Trading at a favorable price-to-earnings ratio compared to peers, Lucky Harvest's insider ownership suggests confidence in its strategic direction, including plans discussed at a recent shareholders meeting to optimize capital and project management.

- Navigate through the intricacies of Lucky Harvest with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Lucky Harvest shares in the market.

dely (TSE:299A)

Simply Wall St Growth Rating: ★★★★★☆

Overview: dely inc. is involved in planning, developing, managing, and operating various smartphone apps and web media with a market cap of ¥42.64 billion.

Operations: Revenue Segments (in millions of ¥):

Insider Ownership: 25%

Earnings Growth Forecast: 25.5% p.a.

Dely Inc. recently completed a ¥15.15 billion IPO, positioning itself for substantial growth with forecasted revenue expansion of 26.7% annually, outpacing the JP market's 4.2%. Despite high illiquidity and limited financial data, its earnings are projected to grow significantly at 25.5% per year over the next three years, surpassing market expectations. The absence of recent insider trading activity suggests stability in executive confidence post-IPO amidst strategic developments discussed in recent board meetings.

- Click here to discover the nuances of dely with our detailed analytical future growth report.

- The valuation report we've compiled suggests that dely's current price could be inflated.

Seize The Opportunity

- Reveal the 1567 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002965

Lucky Harvest

Engages in the research, development, production, and sale of precision stamping dies and structural metal parts in China.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives