- China

- /

- Electronic Equipment and Components

- /

- SZSE:002546

Yeebo (International Holdings) And 2 Other Undiscovered Gems in Asia

Reviewed by Simply Wall St

As Asian markets continue to demonstrate resilience amidst global economic fluctuations, small-cap stocks have garnered attention for their potential to outperform in dynamic environments. In this context, identifying promising companies like Yeebo (International Holdings) and other undiscovered gems can provide unique opportunities for investors seeking growth in a region marked by both challenges and emerging prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Top Union Electronics | 2.13% | 8.82% | 18.65% | ★★★★★★ |

| ASIX Electronics | NA | -2.46% | -3.16% | ★★★★★★ |

| Advanced International Multitech | 30.42% | 1.80% | -3.87% | ★★★★★★ |

| TCM Biotech International | 2.84% | 2.11% | 5.25% | ★★★★★★ |

| Machvision | NA | -8.57% | -12.44% | ★★★★★★ |

| Green World Fintech Service | 5.27% | 9.27% | 14.30% | ★★★★★★ |

| Taisun Enterprise | 0.03% | 5.34% | 7.18% | ★★★★★★ |

| Tait Marketing & Distribution | 0.69% | 8.02% | 10.61% | ★★★★★☆ |

| Huang Hsiang Construction | 252.86% | 13.06% | 7.67% | ★★★★☆☆ |

| Li Ming Development Construction | 170.96% | 14.13% | 22.83% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Yeebo (International Holdings) (SEHK:259)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Yeebo (International Holdings) Limited, along with its subsidiaries, is engaged in the manufacturing and sale of liquid crystal displays and modules, with a market capitalization of approximately HK$5.42 billion.

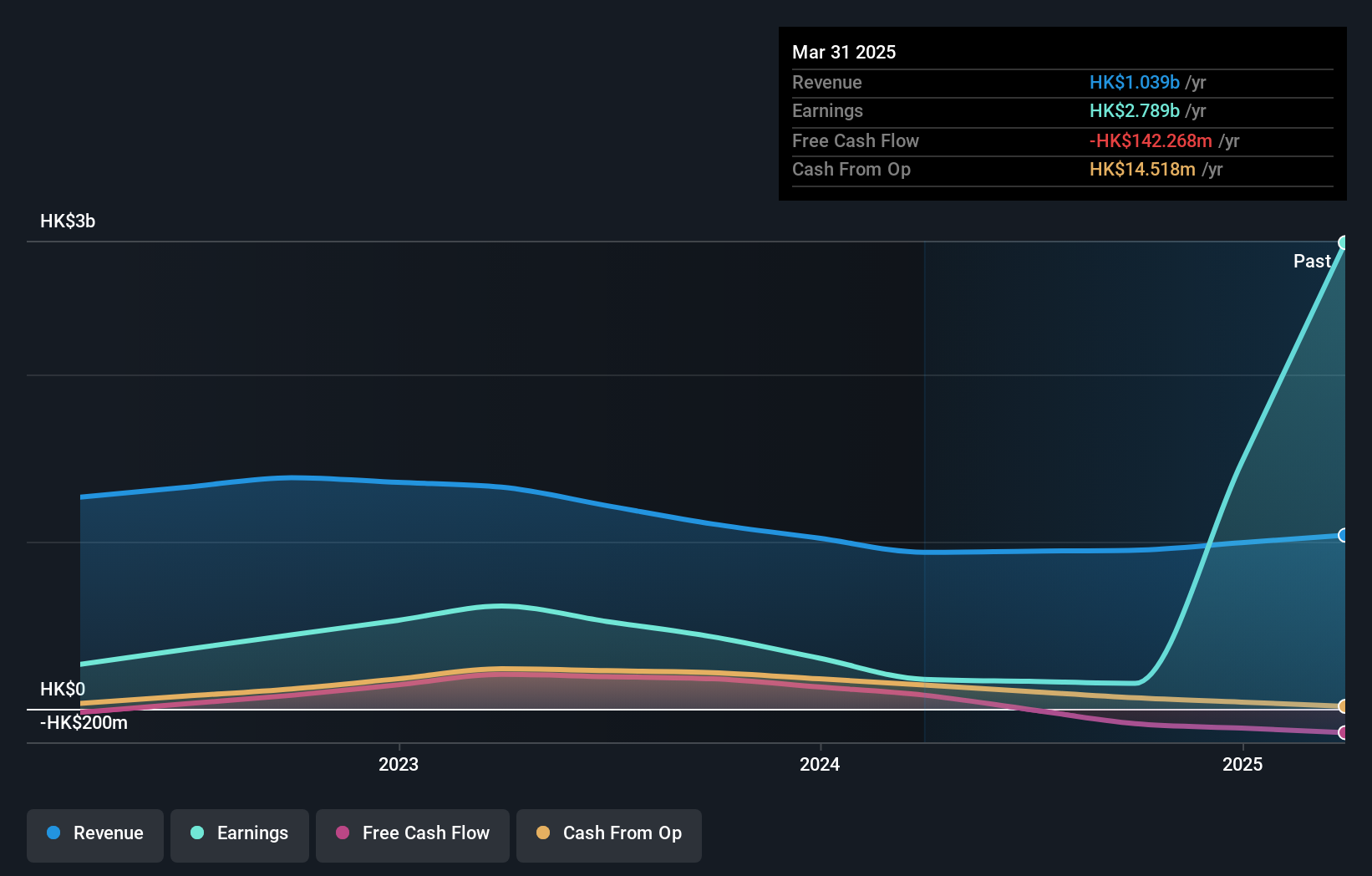

Operations: Yeebo generates revenue primarily from the sale of liquid crystal displays and modules, amounting to HK$1.04 billion. The company's net profit margin is a key indicator of its financial performance.

Yeebo's recent performance paints a compelling picture, with earnings skyrocketing by 1478% over the past year, outpacing the electronic industry's growth of 9%. The company boasts a low price-to-earnings ratio of 1.9x compared to Hong Kong's market average of 12.7x, suggesting potential undervaluation. However, its debt-to-equity ratio has risen from 0.2 to 0.4 over five years, indicating increased leverage. Despite this, Yeebo remains profitable and recently declared a final dividend of HK$0.05 per share for the fiscal year ending March 2025, reflecting confidence in its financial health amidst high non-cash earnings levels and volatile share prices.

Nanjing Xinlian Electronics (SZSE:002546)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nanjing Xinlian Electronics Co., Ltd specializes in manufacturing power consumption information collection systems for power grid enterprises and enterprise users in China, with a market capitalization of CN¥6.14 billion.

Operations: The company generates revenue primarily through the sale of power consumption information collection systems to power grid enterprises and enterprise users in China. It has a market capitalization of CN¥6.14 billion.

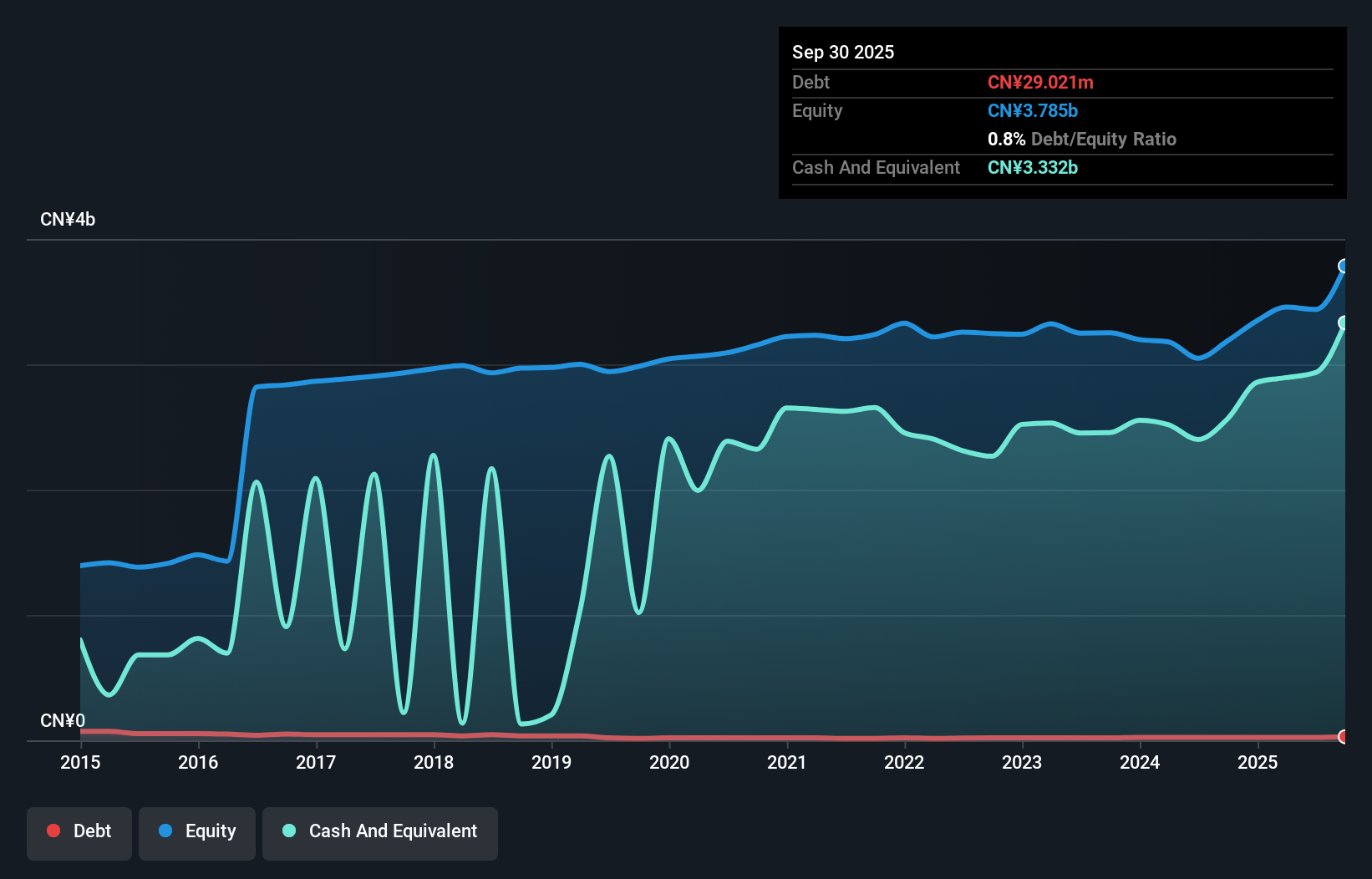

Nanjing Xinlian Electronics, a smaller player in the electronics sector, has shown remarkable earnings growth of 1246% over the past year, far outpacing the industry average of 5.7%. The company's net income for the nine months ended September 2025 reached CNY 534.95 million, a substantial rise from CNY 102.59 million last year. With a price-to-earnings ratio at an attractive 8.8x compared to the broader CN market's 44.9x, it seems undervalued relative to peers. Despite its debt-to-equity ratio increasing slightly to 0.8% over five years, Nanjing Xinlian holds more cash than total debt and remains profitable with positive free cash flow trends noted recently at CNY 280 million as of September 2024.

- Dive into the specifics of Nanjing Xinlian Electronics here with our thorough health report.

Gain insights into Nanjing Xinlian Electronics' past trends and performance with our Past report.

Shenzhen Colibri Technologies (SZSE:002957)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Colibri Technologies Co., Ltd. specializes in the R&D, design, production, sale, and technical service of industrial automation equipment and precision parts in China with a market cap of CN¥9.32 billion.

Operations: Colibri generates revenue primarily from automatic equipment, contributing CN¥1.85 billion, followed by precision parts at CN¥301.42 million and automation equipment accessories at CN¥258.62 million. Technical services add another CN¥88.33 million to the revenue stream.

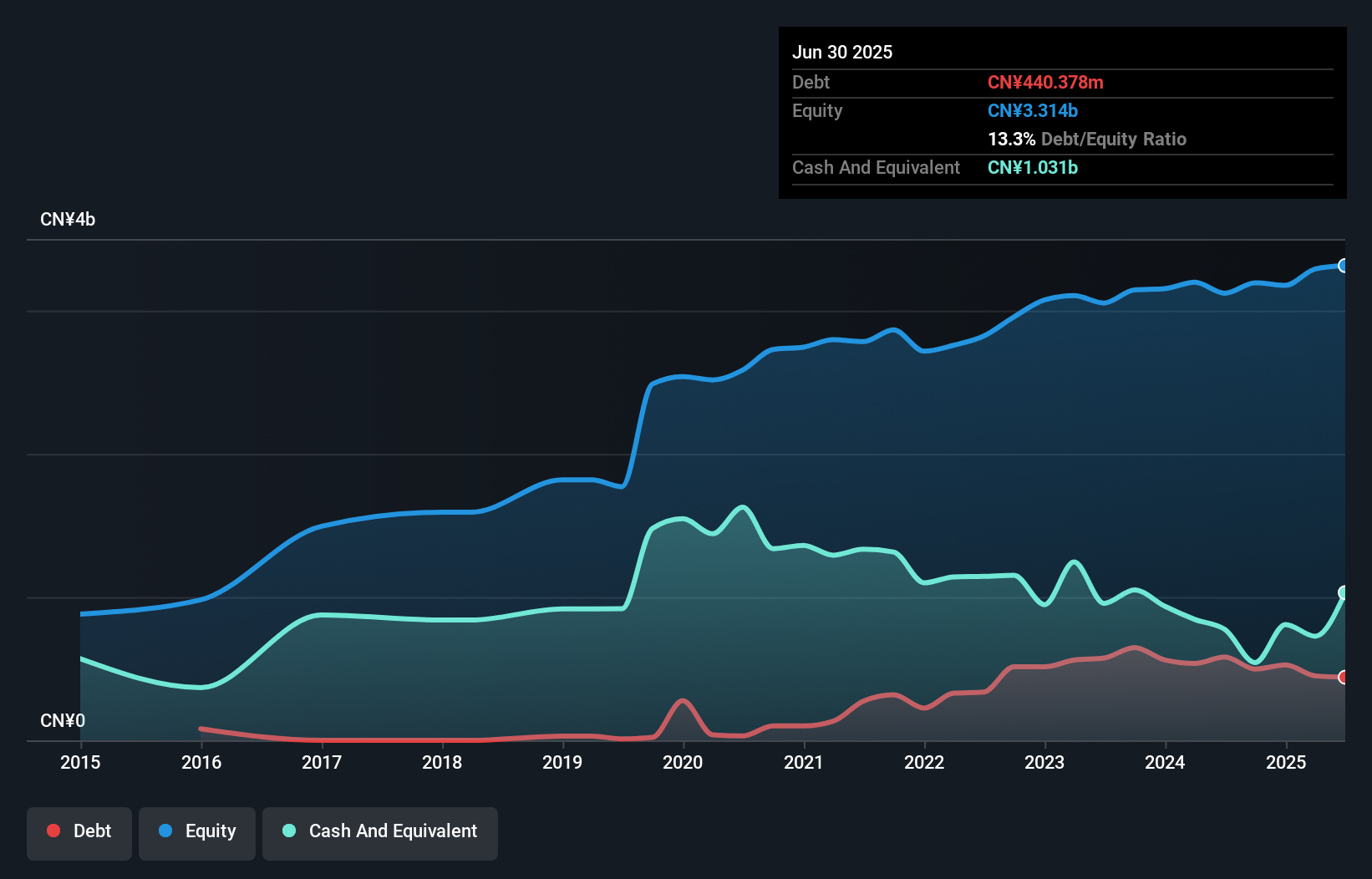

Shenzhen Colibri Technologies, a nimble player in the machinery sector, has shown resilience despite a challenging landscape. The company reported CNY 1.1 billion in revenue for the first half of 2025, up from CNY 1.04 billion last year, while net income rose to CNY 122.94 million from CNY 89.56 million. Trading at nearly 79% below its estimated fair value indicates potential upside for investors seeking undervalued opportunities. However, earnings have shrunk by an average of 9% annually over five years and its debt-to-equity ratio has climbed from 1.2 to 13 over the same period, suggesting some financial strain amidst growth efforts.

Where To Now?

- Click here to access our complete index of 2388 Asian Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Xinlian Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002546

Nanjing Xinlian Electronics

Manufactures power consumption information collection systems for power grid enterprises and enterprise users in China.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives