Undiscovered Gems Featuring Suzhou Shihua New Material Technology And 2 Other Promising Small Caps

Reviewed by Simply Wall St

As global markets experience a rebound, with major U.S. indices climbing higher amid easing inflation and strong bank earnings, small-cap stocks are drawing renewed attention from investors seeking growth opportunities. The S&P MidCap 400 and Russell 2000 indices both posted significant gains, highlighting the potential for smaller companies to thrive in the current economic climate. In this environment, identifying promising small-cap stocks involves looking for companies with robust fundamentals that can capitalize on market trends and economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Xiangtan Electrochemical ScientificLtd | 44.62% | 13.70% | 36.55% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tureks Turizm Tasimacilik Anonim Sirketi | 4.71% | 50.82% | 59.08% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Suzhou Shihua New Material Technology (SHSE:688093)

Simply Wall St Value Rating: ★★★★★★

Overview: Suzhou Shihua New Material Technology Co., Ltd. is a company focused on the development and production of advanced materials, with a market cap of CN¥5.06 billion.

Operations: Suzhou Shihua New Material Technology generates revenue primarily from its advanced materials segment. The company's net profit margin has shown variability, reflecting changes in operational efficiency and cost management.

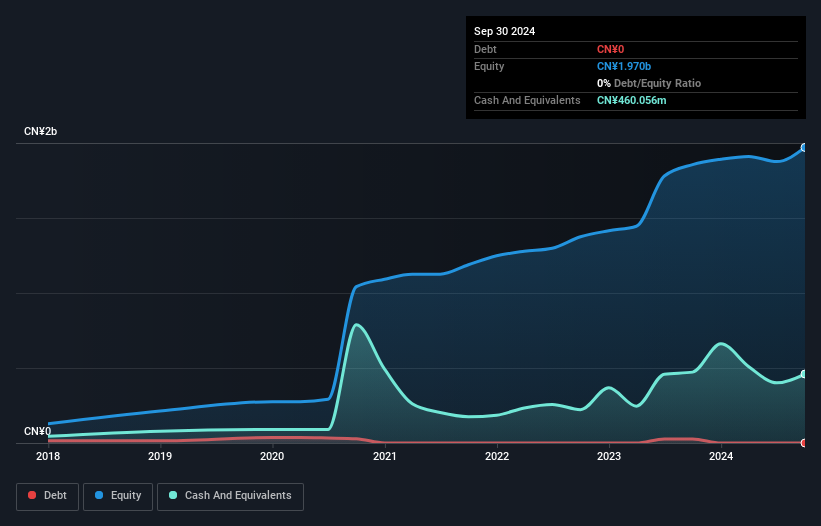

Suzhou Shihua New Material Technology, a nimble player in the chemicals sector, has shown robust growth with earnings up 18.4% over the past year, outpacing the industry average of -5%. The company boasts a debt-free status compared to five years ago when its debt-to-equity ratio was 11.9%, highlighting prudent financial management. Trading at 35.8% below estimated fair value suggests potential undervaluation in the market. Recent developments include plans for a private placement aimed at raising CNY 600 million, which could further bolster its strategic initiatives and enhance shareholder value once fully approved and executed.

Guangdong Rifeng Electric Cable (SZSE:002953)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangdong Rifeng Electric Cable Co., Ltd. (SZSE:002953) is a company engaged in the manufacturing and distribution of electric cables, with a market capitalization of approximately CN¥4.87 billion.

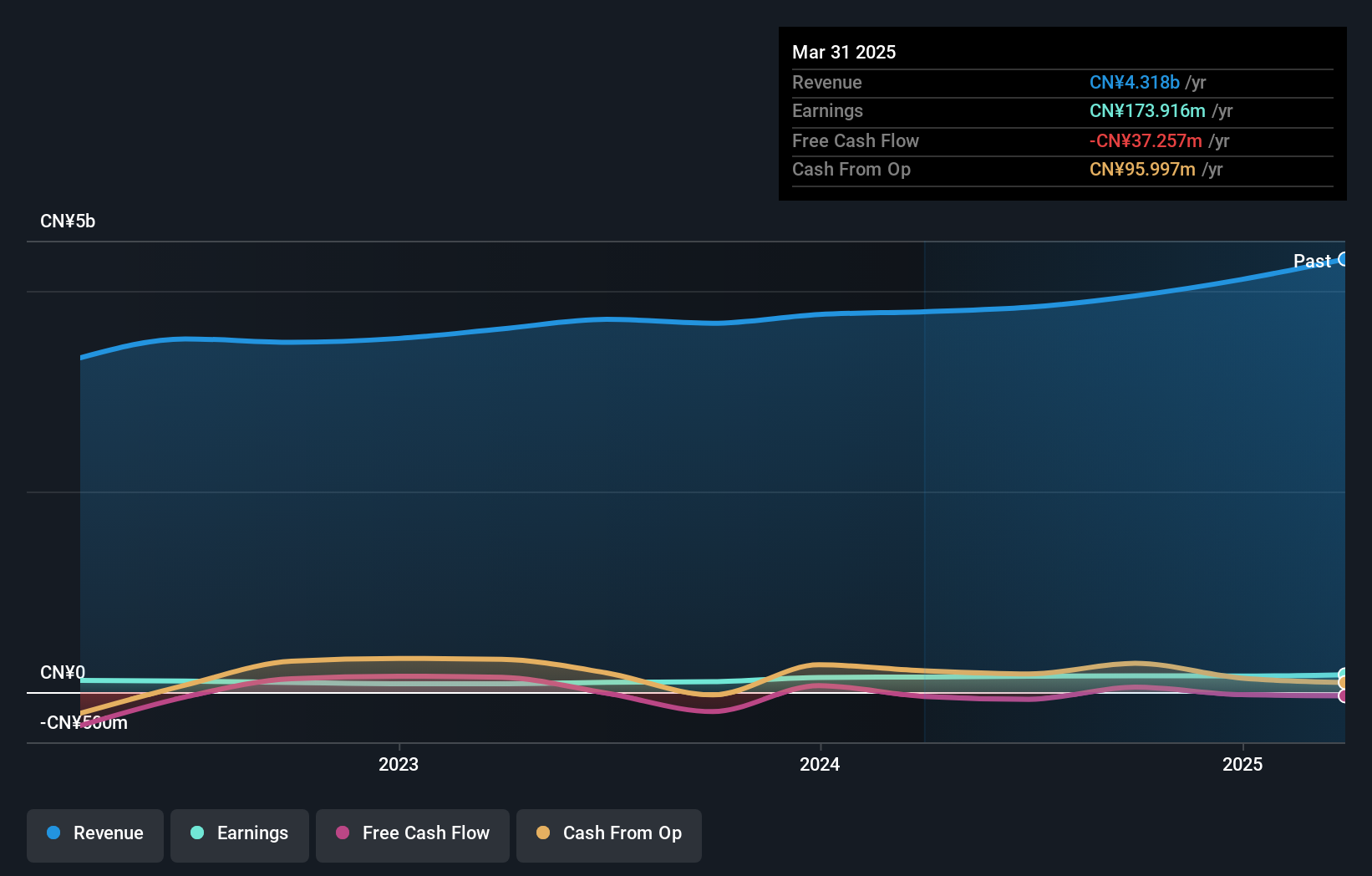

Operations: Rifeng Electric Cable generates revenue primarily from its Wire & Cable Products segment, amounting to CN¥3.95 billion.

Rifeng Electric Cable, a smaller player in the electrical industry, has shown impressive growth with earnings surging by 57% over the past year, outpacing the industry's 1.1%. The company's interest payments are comfortably covered by EBIT at 11.7 times, indicating solid financial health. Despite its volatile share price recently, Rifeng's net debt to equity ratio stands at a satisfactory 16.6%, reflecting prudent management of leverage. Recent activities include a private placement raising CNY 230 million and completing a share buyback of approximately CNY 32 million for nearly 0.78% of shares outstanding, showcasing active capital management strategies.

Techshine ElectronicsLtd (SZSE:301379)

Simply Wall St Value Rating: ★★★★★★

Overview: Techshine Electronics Co., Ltd. focuses on the R&D, design, production, and sale of LCD displays and modules in China with a market cap of CN¥3.12 billion.

Operations: Techshine Electronics generates revenue primarily from electronic components and parts, amounting to CN¥1.37 billion. The company's financial performance is influenced by its cost structure and market dynamics within the LCD display sector in China.

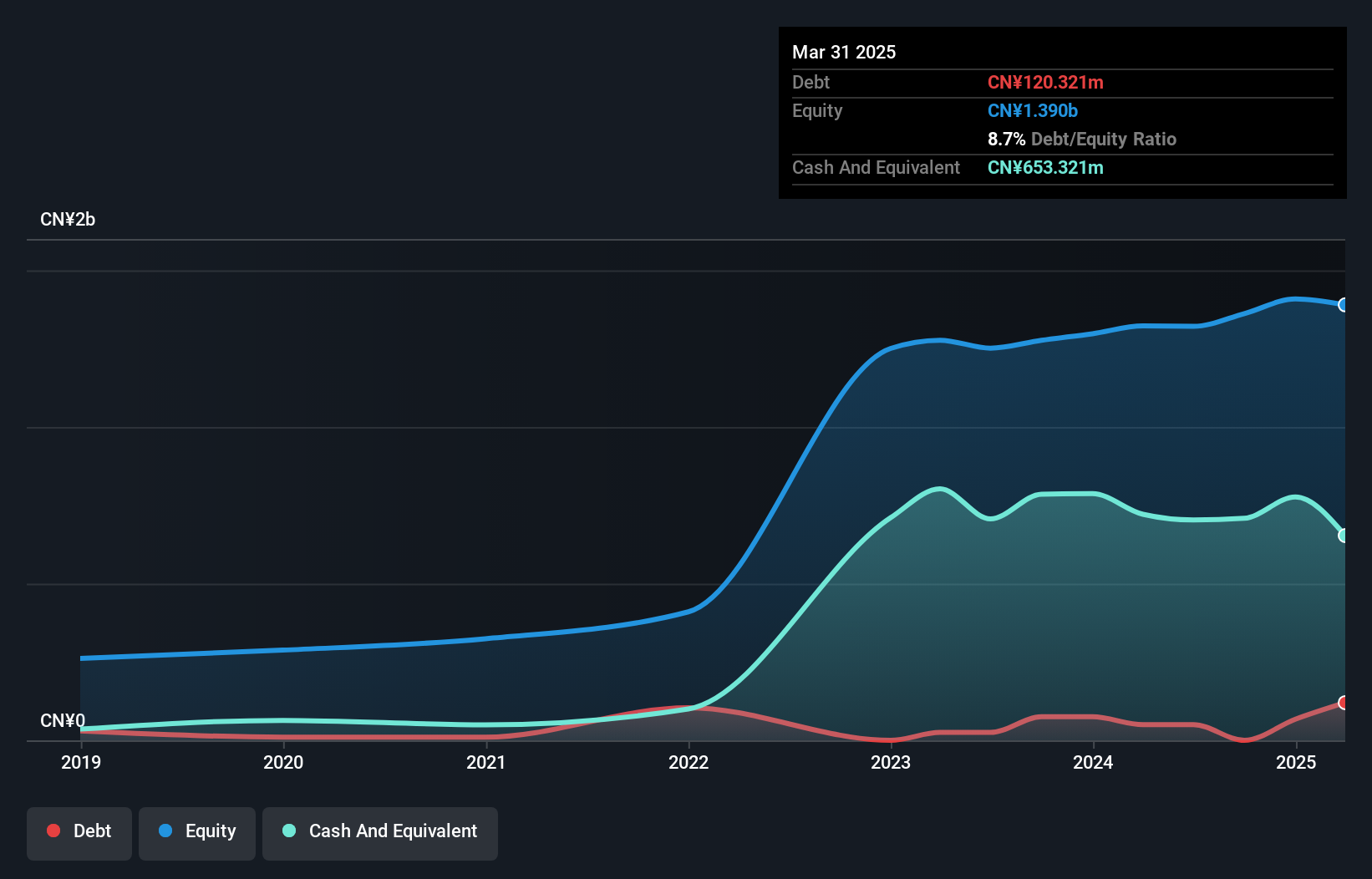

Techshine Electronics, a nimble player in the electronics sector, has seen its earnings grow by 12% over the past year, outpacing the industry's 2% rise. The company boasts a debt-free balance sheet, having reduced its debt from a 5.4% debt-to-equity ratio five years ago to zero today. A notable CN¥27 million one-off gain impacted recent financials, yet Techshine remains profitable with strong cash flow positivity. Its price-to-earnings ratio of 24.9x is attractive compared to the broader market's 34.3x. Recent announcements include plans for an up to CN¥80 million share repurchase program aimed at equity incentives and ESOPs.

Key Takeaways

- Embark on your investment journey to our 4642 Undiscovered Gems With Strong Fundamentals selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Suzhou Shihua New Material Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688093

Suzhou Shihua New Material Technology

Suzhou Shihua New Material Technology Co., Ltd.

Flawless balance sheet and good value.

Market Insights

Community Narratives