As global markets navigate the evolving landscape shaped by the incoming Trump administration, investors have seen fluctuations in key indices like the S&P 500 and Russell 2000, driven by uncertainty around policy impacts on sectors such as financials and healthcare. Amidst this backdrop of shifting economic indicators and market sentiment, identifying promising small-cap stocks requires a keen eye for companies with robust fundamentals that can thrive despite broader volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Brillian Network & Automation Integrated System | 8.39% | 20.15% | 19.93% | ★★★★★★ |

| Gallant Precision Machining | 29.51% | -2.07% | 4.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

China Master Logistics (SHSE:603967)

Simply Wall St Value Rating: ★★★★★☆

Overview: China Master Logistics Co., Ltd. is an integrated logistics company in China with a market cap of CN¥3.56 billion.

Operations: The company's primary revenue streams include transportation services and warehousing, with transportation services contributing significantly more to the overall revenue. The cost structure is heavily influenced by operational expenses related to these core activities. Gross profit margin has shown variability, reflecting changes in operational efficiency and market conditions.

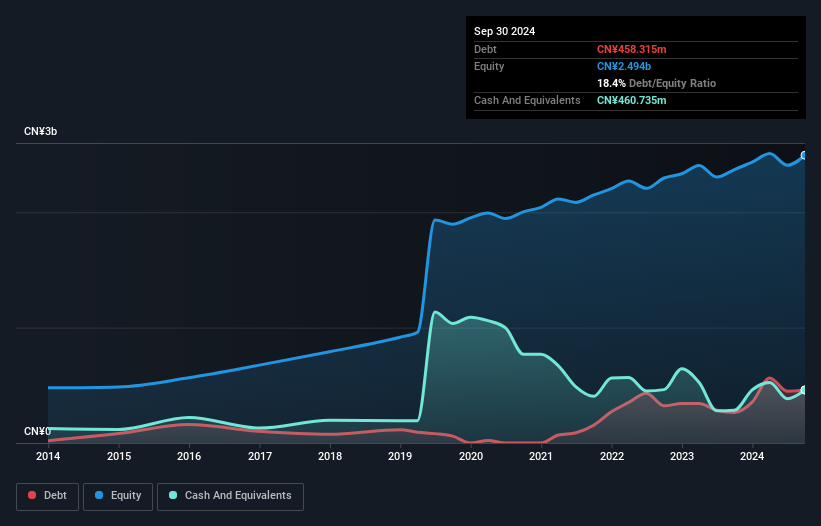

China Master Logistics, a noteworthy player in the logistics sector, has demonstrated promising growth with earnings increasing by 8.2% over the past year, surpassing the industry average of 4.9%. The company is trading at a significant discount of 55.5% below its estimated fair value, suggesting potential for value appreciation. Recent financial results show substantial revenue growth from CNY 5,388 million to CNY 9,152 million over nine months in 2024, alongside an increase in net income to CNY 200 million from CNY 186 million last year. Despite rising debt levels from a debt-to-equity ratio of 3.2% to 18.4%, it maintains more cash than total debt and generates positive free cash flow.

Guangdong Rifeng Electric Cable (SZSE:002953)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangdong Rifeng Electric Cable Co., Ltd. is a company that specializes in the production and distribution of electric cables, with a market cap of CN¥4.05 billion.

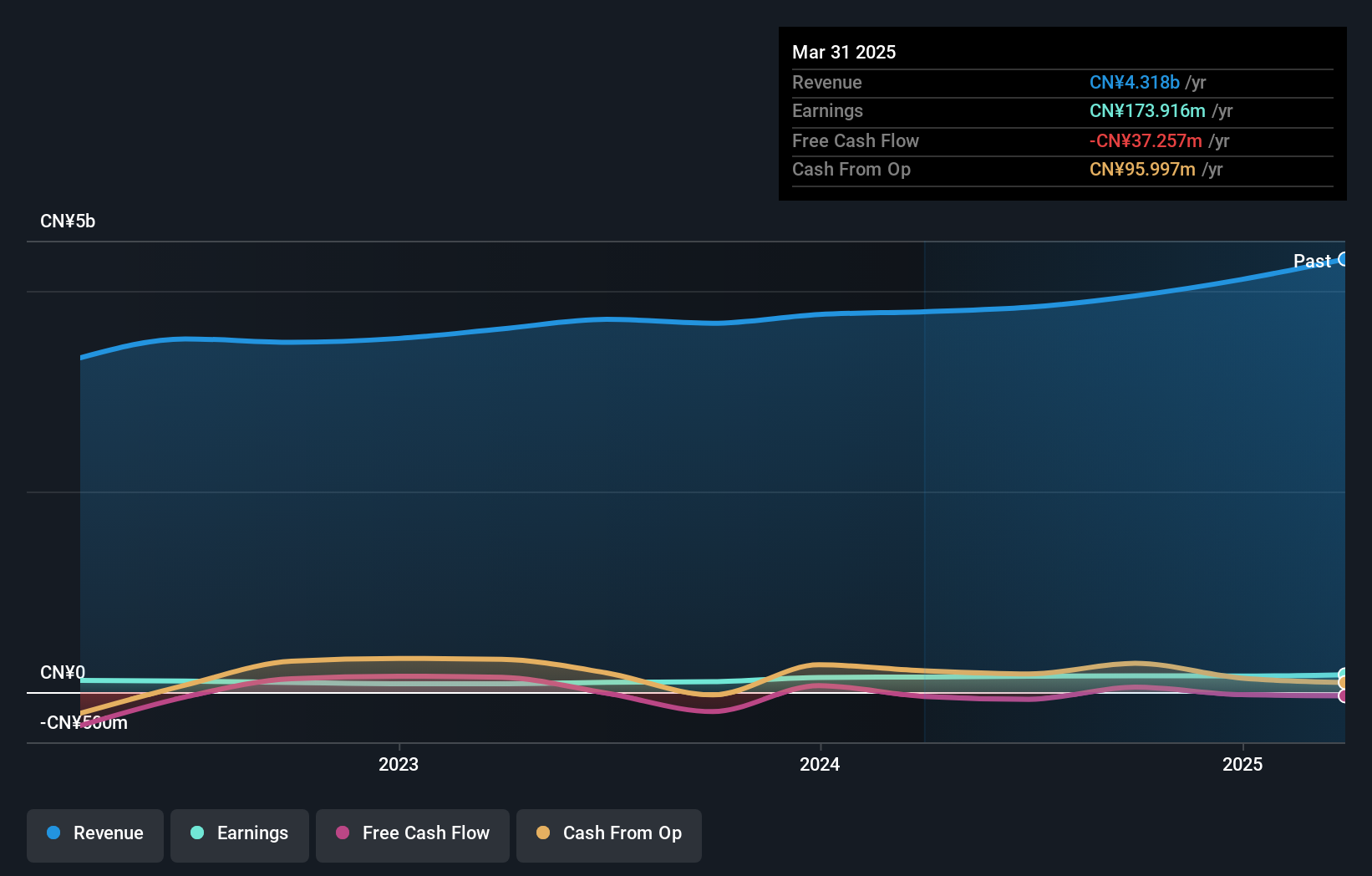

Operations: Rifeng Electric Cable generates revenue primarily from its Wire & Cable Products segment, amounting to CN¥3.95 billion.

Guangdong Rifeng Electric Cable has been on a roll, with earnings growth of 57% over the past year, outpacing the electrical industry's modest 0.8%. The company’s debt to equity ratio has increased from 6.5% to 31.7% over five years, yet its net debt to equity remains satisfactory at 16.6%. It recently completed a share buyback program worth CNY 32 million, repurchasing about 0.78% of its shares. With sales climbing to CNY 3 billion and net income rising to CNY 126 million for the first nine months of this year, it seems poised for continued momentum in its market space.

Kagome (TSE:2811)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kagome Co., Ltd. is engaged in the manufacturing, purchasing, and selling of food products both in Japan and internationally, with a market cap of ¥282.49 billion.

Operations: Kagome generates revenue primarily from its food product sales in Japan and international markets. The company's financial performance is influenced by its cost structure, which includes manufacturing and purchasing expenses.

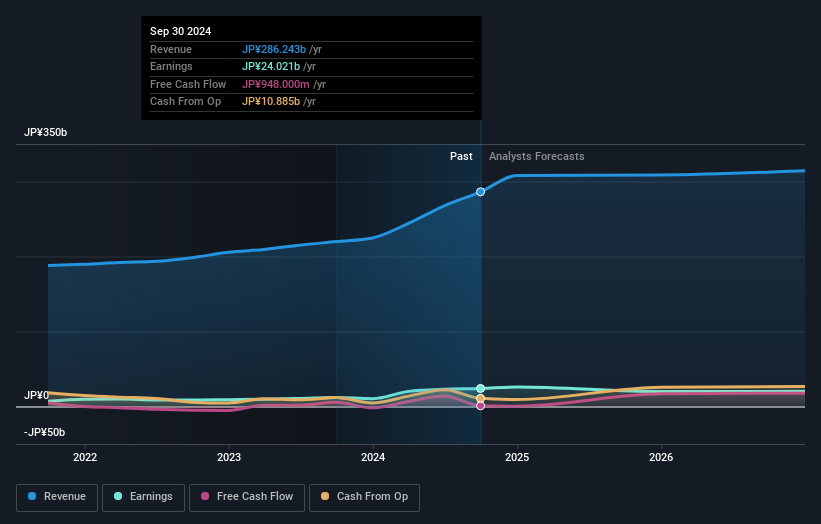

Kagome, a notable player in the food industry, has demonstrated impressive earnings growth of 99.7% over the past year, significantly outpacing the industry's 20.1%. Trading at 47.2% below its estimated fair value suggests potential undervaluation. The company's debt to equity ratio has risen from 28.5% to 54.8% over five years, though its net debt to equity remains satisfactory at 30.2%. Recent guidance forecasts revenue of ¥300 billion and net income of ¥24 billion for fiscal year-end December 2024, alongside a special dividend announcement of ¥10 per share and an increased regular dividend to ¥42 per share.

- Click to explore a detailed breakdown of our findings in Kagome's health report.

Evaluate Kagome's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Access the full spectrum of 4629 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kagome might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2811

Kagome

Manufactures, purchases, and sells food products in Japan and internationally.

Undervalued with solid track record.