- China

- /

- Electrical

- /

- SZSE:002892

Discover 3 Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

Amidst recent global market fluctuations, with U.S. stocks ending the week lower due to tariff uncertainties and a cooling labor market, investors are increasingly seeking opportunities in small-cap companies that may offer resilience and growth potential. In this environment, identifying promising stocks involves looking for those with strong fundamentals and the ability to navigate economic challenges effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Akmerkez Gayrimenkul Yatirim Ortakligi | NA | 43.32% | 27.57% | ★★★★★★ |

| African Rainbow Capital Investments | NA | 37.52% | 38.29% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| OHB | 57.88% | 1.74% | 24.66% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

GUILIN FUDALtd (SHSE:603166)

Simply Wall St Value Rating: ★★★★★☆

Overview: GUILIN FUDA Co., Ltd. is engaged in the research, development, production, and sale of auto parts and components in China with a market capitalization of CN¥6.96 billion.

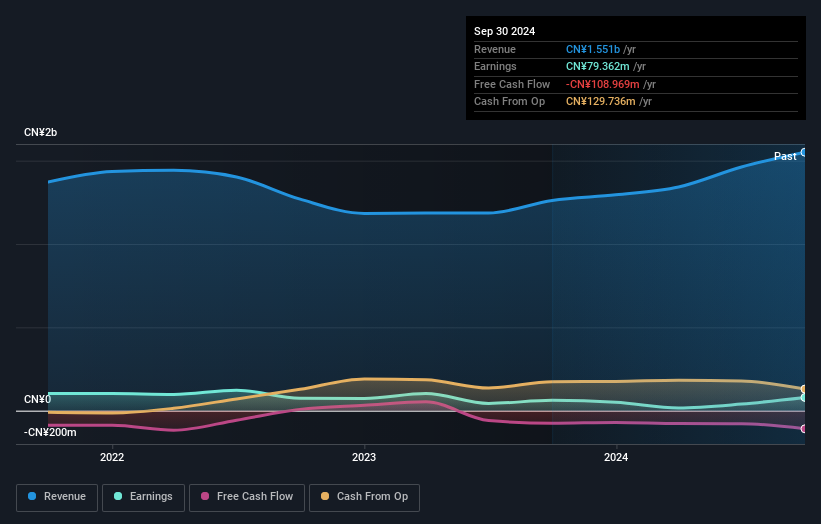

Operations: GUILIN FUDA generates revenue primarily from the sale of automobile and internal combustion engine parts, amounting to CN¥1.51 billion.

GUILIN FUDA, a small player in the auto components industry, has shown impressive earnings growth of 97.9% over the past year, outpacing the industry's 10.5%. The company boasts a satisfactory net debt to equity ratio of 18.2%, suggesting sound financial health despite an increase from 22.5% to 26.8% over five years. While it is not free cash flow positive currently, its interest payments are well covered by EBIT at a multiple of 13.3x, indicating strong operational performance. With earnings forecasted to grow by 35.57% annually, GUILIN FUDA appears poised for future expansion amidst market volatility.

- Click here and access our complete health analysis report to understand the dynamics of GUILIN FUDALtd.

Examine GUILIN FUDALtd's past performance report to understand how it has performed in the past.

Keli Motor Group (SZSE:002892)

Simply Wall St Value Rating: ★★★★★☆

Overview: Keli Motor Group Co., Ltd. focuses on the research, development, manufacture, and sale of micro motors in China with a market cap of CN¥11.28 billion.

Operations: Keli generates revenue primarily from the sale of micro motors. The company reported a net profit margin of 12.5% in the latest financial period, reflecting its efficiency in converting sales into actual profit.

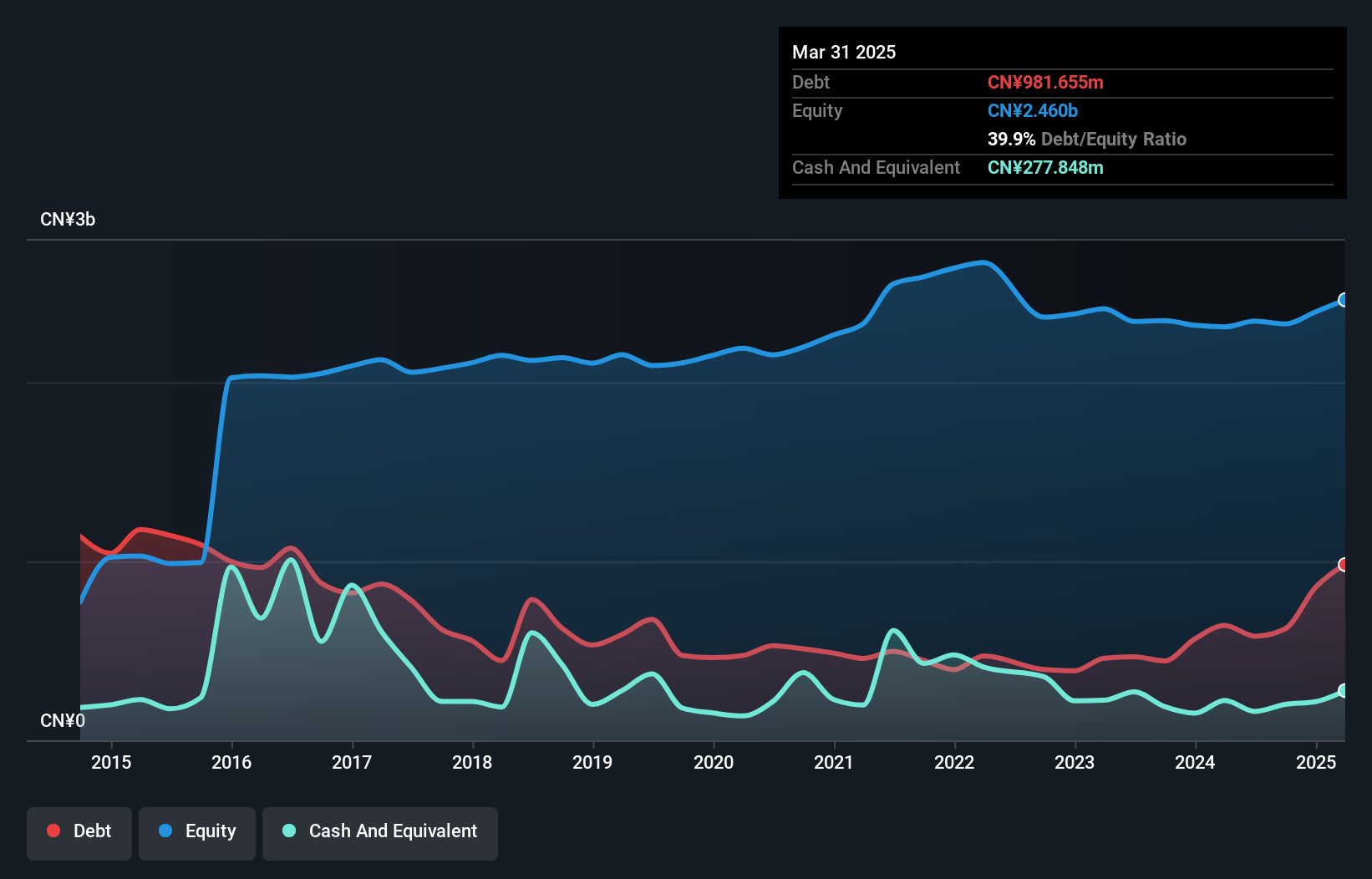

Keli Motor Group, a nimble player in the industry, has shown impressive earnings growth of 28.5% over the past year, outpacing the electrical sector's modest 1.1%. Despite this surge, its debt-to-equity ratio has moved up to 21.7% from zero over five years, though it holds more cash than total debt, which is reassuring for investors. Interest payments are comfortably covered by EBIT at a rate of 4.4 times. However, recent financial results were skewed by a one-off gain of CN¥18.9M, and its share price has been quite volatile lately—factors worth considering when evaluating future potential.

- Click here to discover the nuances of Keli Motor Group with our detailed analytical health report.

Gain insights into Keli Motor Group's past trends and performance with our Past report.

Reach Machinery (SZSE:301596)

Simply Wall St Value Rating: ★★★★★☆

Overview: Reach Machinery Co., Ltd. focuses on the research, development, production, and sale of components for automation equipment, power transmission, and braking systems globally with a market capitalization of CN¥7.67 billion.

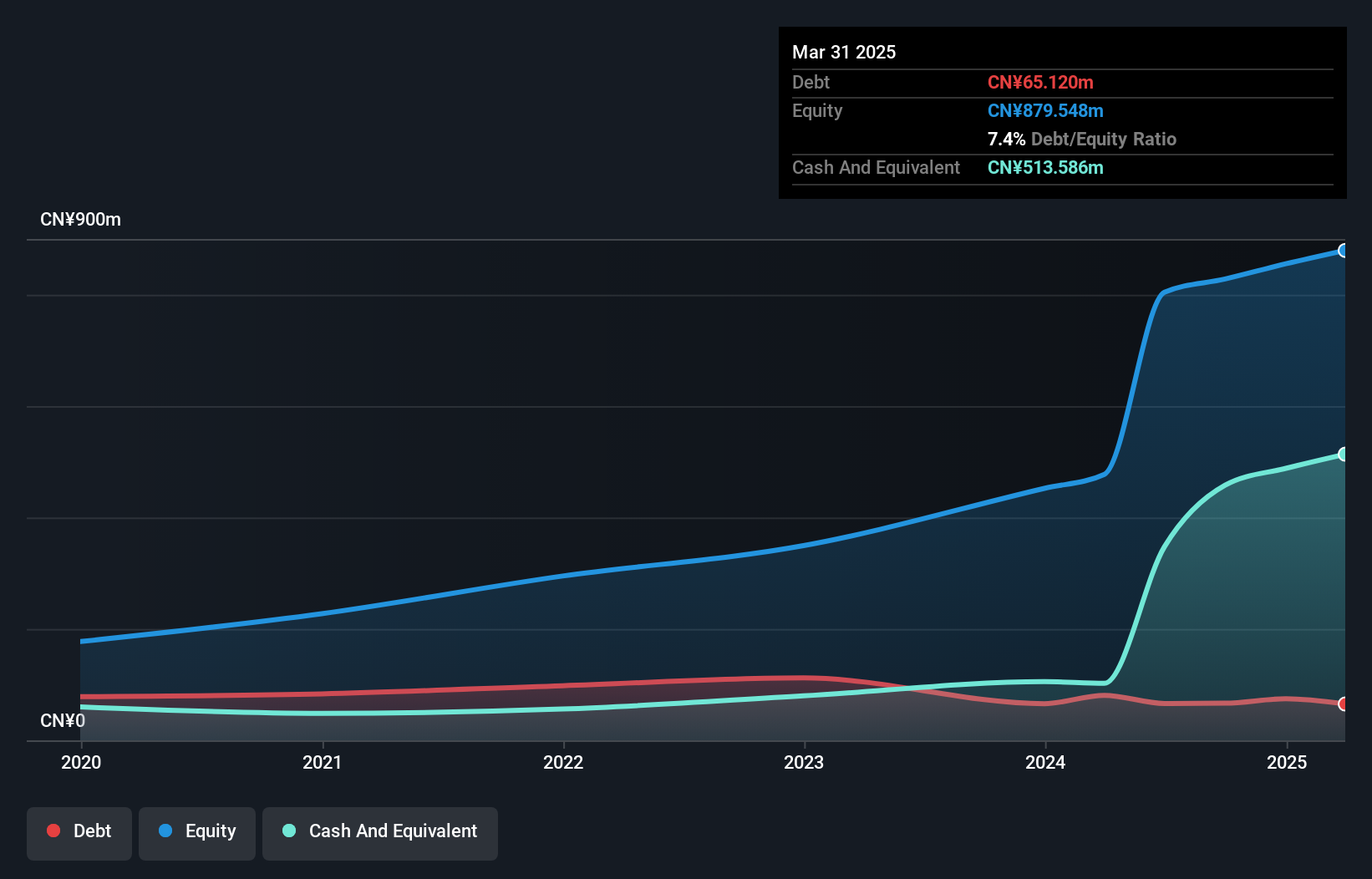

Operations: Reach Machinery generates revenue primarily from its Machinery & Industrial Equipment segment, which contributes CN¥599.22 million. The company's financial strategy is reflected in its cost management and pricing structure, impacting profitability metrics such as the net profit margin.

Reach Machinery, a smaller player in the machinery sector, is showing promising signs with its high-quality earnings and positive free cash flow. Over the past year, it has outpaced industry growth at 9.3%, while its interest payments are comfortably covered by EBIT at 533 times. Despite recent share price volatility, Reach's financial standing appears robust with more cash than total debt. Capital expenditure seems to have been significant recently, possibly impacting performance positively by enhancing operational capacity or efficiency. Looking ahead, these factors may position Reach as a compelling prospect for those seeking potential growth opportunities in this space.

- Click to explore a detailed breakdown of our findings in Reach Machinery's health report.

Explore historical data to track Reach Machinery's performance over time in our Past section.

Next Steps

- Discover the full array of 4721 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keli Motor Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002892

Keli Motor Group

Engages in the research and development, manufacture, and sale of micro motors in China.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives