- China

- /

- Commercial Services

- /

- SHSE:688101

Identifying Undiscovered Gems In December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by record highs in major indexes and mixed performances across sectors, the spotlight turns to small-cap stocks, with the Russell 2000 Index showing signs of volatility after recent outperformance. In this environment, identifying undiscovered gems requires a keen understanding of market dynamics and economic indicators that impact smaller companies.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| African Rainbow Capital Investments | NA | 37.52% | 38.29% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Transcorp Power | 46.33% | 114.79% | 152.92% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Fujian Highton Development (SHSE:603162)

Simply Wall St Value Rating: ★★★★★★

Overview: Fujian Highton Development Co., Ltd. operates in the coastal and international ocean dry bulk transportation industry, with a market cap of CN¥8.94 billion.

Operations: The company generates revenue primarily from its coastal and international ocean dry bulk transportation services. It has a market capitalization of CN¥8.94 billion, indicating its scale within the industry.

Fujian Highton Development has shown impressive growth, with earnings rising by 43.2% over the past year, outpacing the Shipping industry's 6.1%. The company reported sales of CNY 2.59 billion for the nine months ending September 2024, up from CNY 1.14 billion a year earlier, and net income increased to CNY 410.49 million from CNY 151.41 million in the same period last year. A price-to-earnings ratio of 20.1x suggests it may be undervalued compared to the broader CN market at 37.6x, indicating potential value for investors seeking opportunities in smaller-cap stocks within this sector.

- Click to explore a detailed breakdown of our findings in Fujian Highton Development's health report.

Suntar Environmental Technology (SHSE:688101)

Simply Wall St Value Rating: ★★★★★★

Overview: Suntar Environmental Technology Co., Ltd. operates in the environmental technology sector, focusing on providing solutions for water treatment and pollution control, with a market cap of CN¥4.90 billion.

Operations: Suntar Environmental Technology generates revenue through its environmental technology solutions, particularly in water treatment and pollution control. The company's financial performance is highlighted by a market capitalization of CN¥4.90 billion.

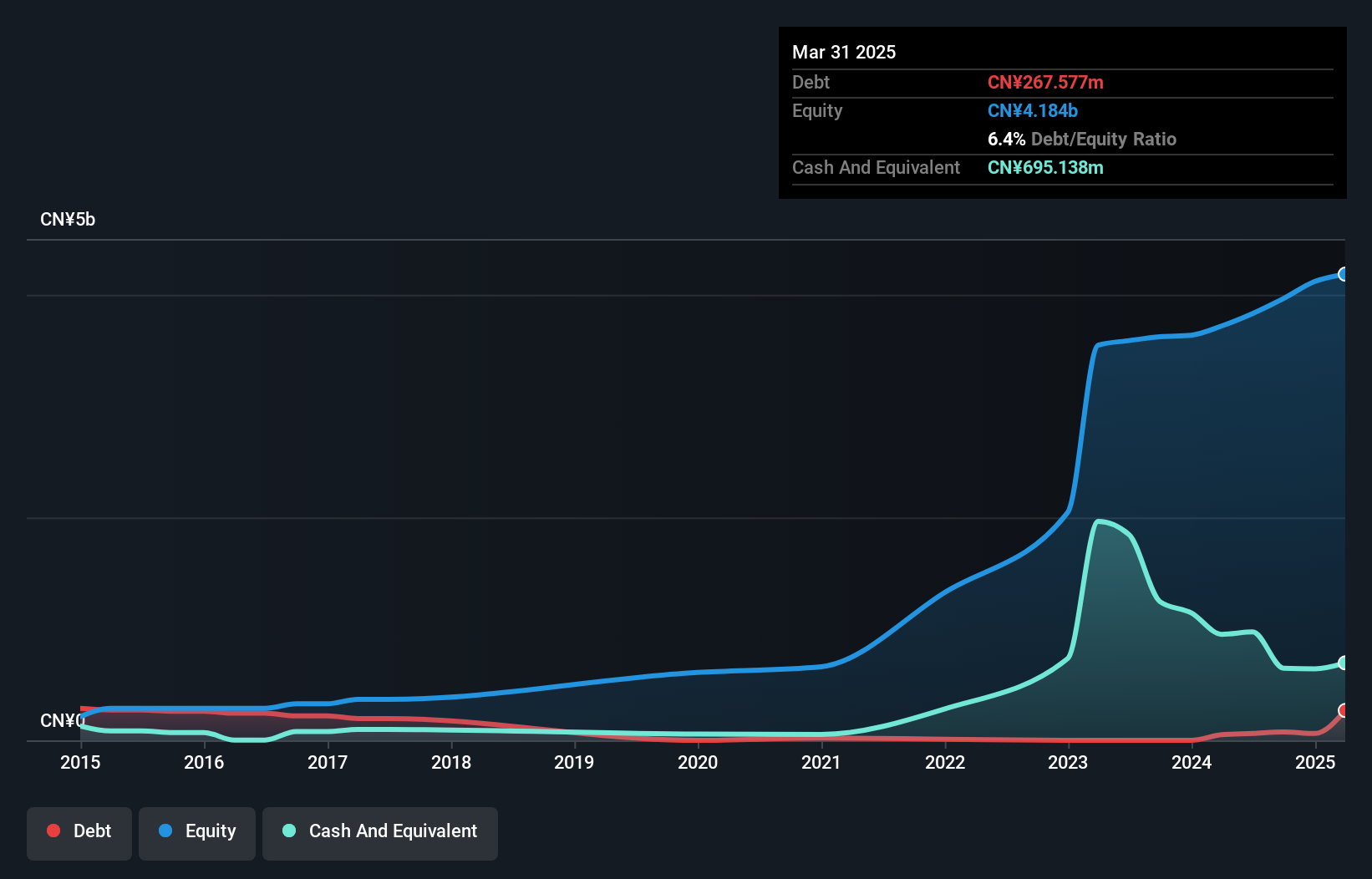

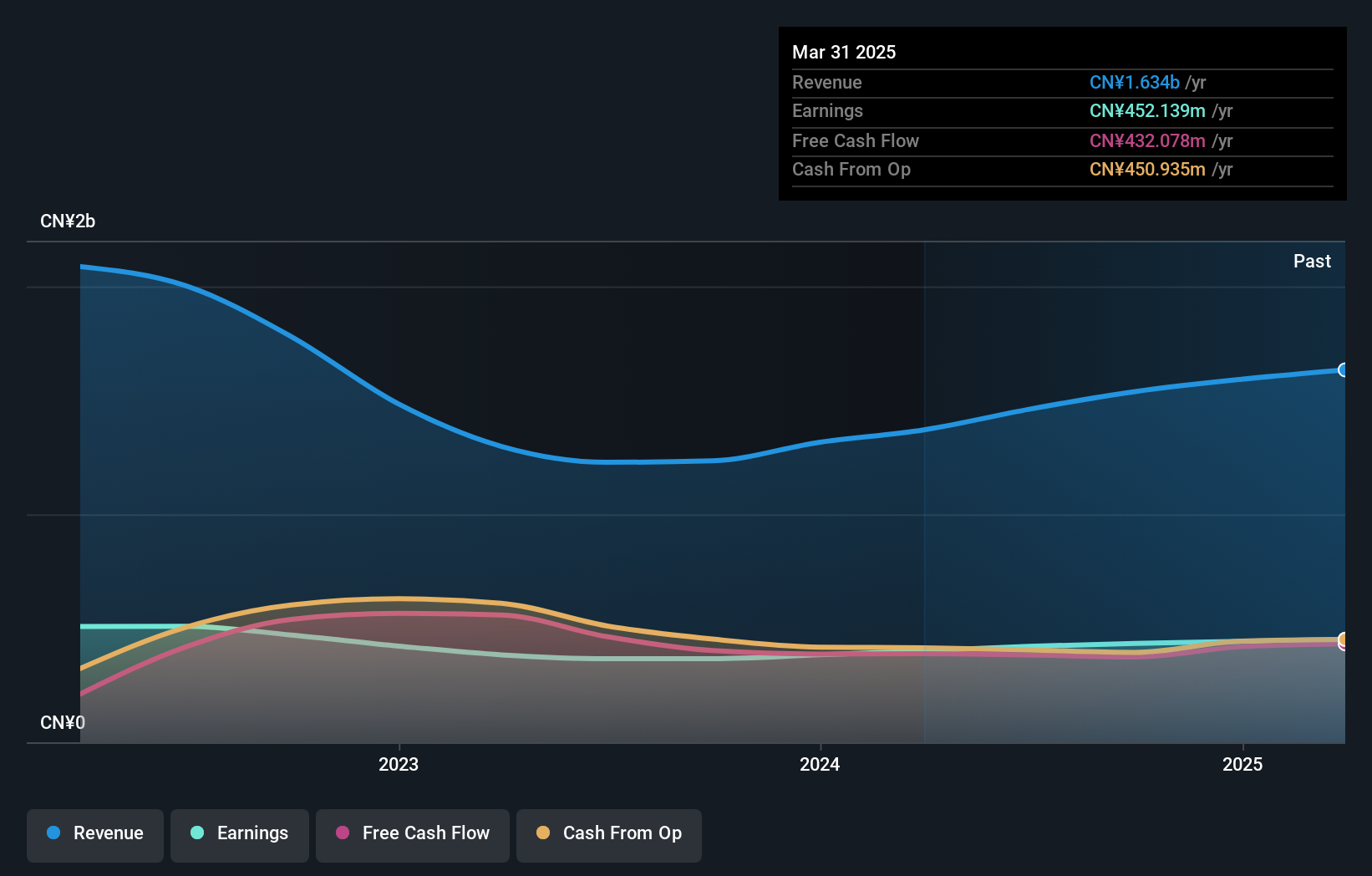

Suntar Environmental Technology, with its nimble market position, has shown robust financial health. Over the past year, earnings grew by 37%, outpacing the industry average of 0.9%. The debt-to-equity ratio stands at a commendable 2.1%, down from 4.9% five years ago, indicating prudent financial management. Despite not being free cash flow positive recently, Suntar's profitability ensures that cash runway is not an immediate concern. Recent earnings reveal a revenue increase to CNY 1,041 million and net income rising to CNY 212 million for nine months ending September 2024. The upcoming shareholders meeting on Nov 27 could provide further strategic insights.

Guangdong Lingxiao Pump IndustryLtd (SZSE:002884)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong Lingxiao Pump Industry Co., Ltd. is engaged in the manufacturing and sale of pumps with a market capitalization of CN¥6.59 billion.

Operations: Lingxiao Pump's revenue is derived primarily from the manufacturing and sale of pumps. The company has a market capitalization of CN¥6.59 billion.

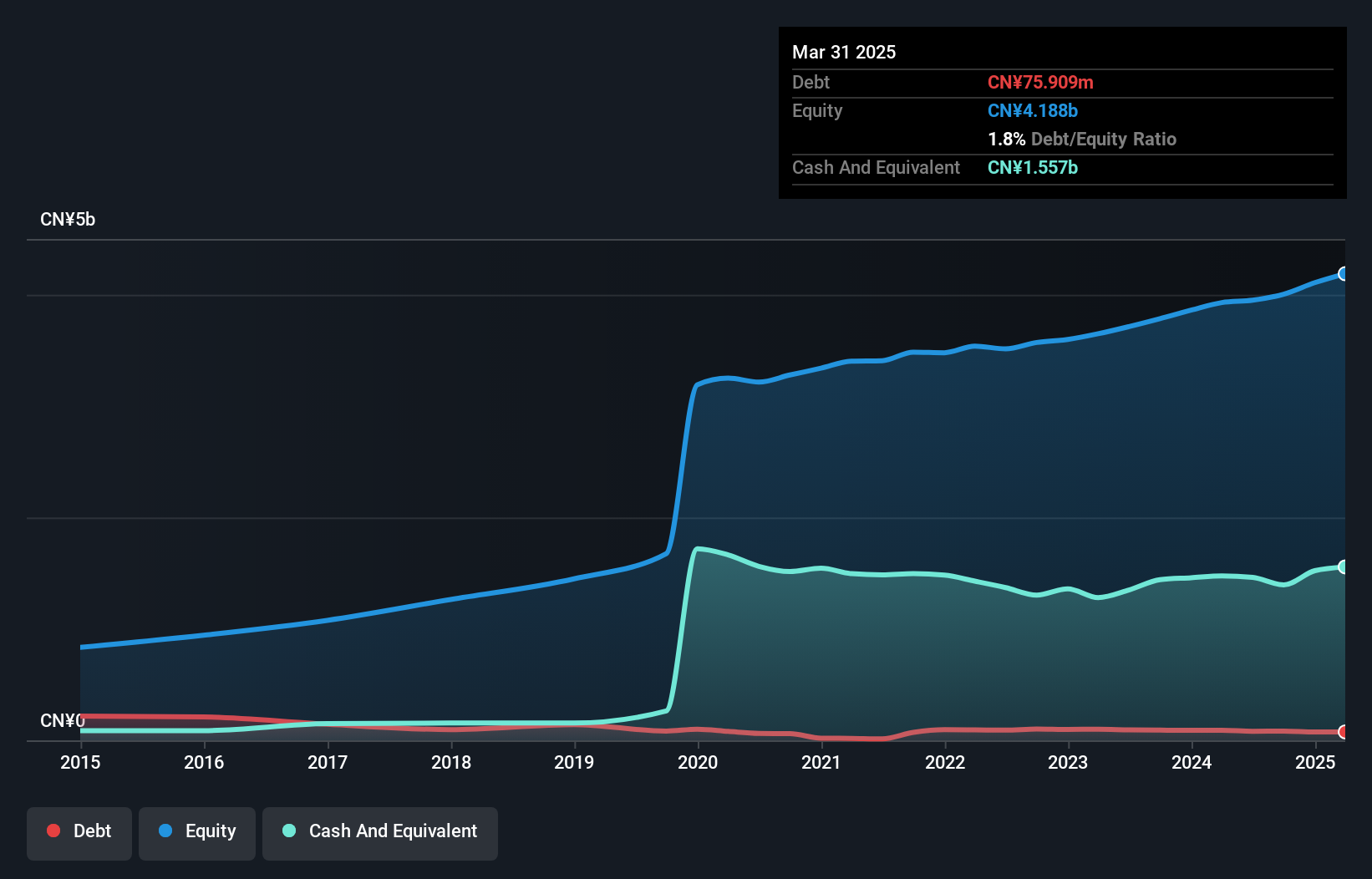

Guangdong Lingxiao Pump Industry has shown impressive growth, with earnings increasing by 18% over the past year, outpacing the Machinery industry's -0.4%. The company is debt-free and boasts a price-to-earnings ratio of 15x, significantly lower than the CN market's 38x. Recent earnings for nine months ending September 2024 reported sales at CNY 1.17 billion and net income at CNY 330 million, up from CNY 945 million and CNY 280 million respectively a year ago. High-quality earnings and inclusion in the S&P Global BMI Index highlight its solid position in the market landscape.

- Dive into the specifics of Guangdong Lingxiao Pump IndustryLtd here with our thorough health report.

Where To Now?

- Investigate our full lineup of 4628 Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688101

Suntar Environmental Technology

Suntar Environmental Technology Co., Ltd.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives