- China

- /

- Electrical

- /

- SZSE:300907

Undiscovered Gems With Promising Potential In November 2024

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes approaching record highs and small-cap stocks outperforming their larger counterparts, investors are keenly watching the Federal Reserve's upcoming decisions on interest rates amidst a strong labor market and encouraging home sales reports. In this dynamic environment, identifying stocks with solid fundamentals and growth potential becomes crucial for those looking to capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| All E Technologies | NA | 34.23% | 31.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| PBA Holdings Bhd | 1.86% | 7.41% | 40.17% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Clas Ohlson (OM:CLAS B)

Simply Wall St Value Rating: ★★★★★★

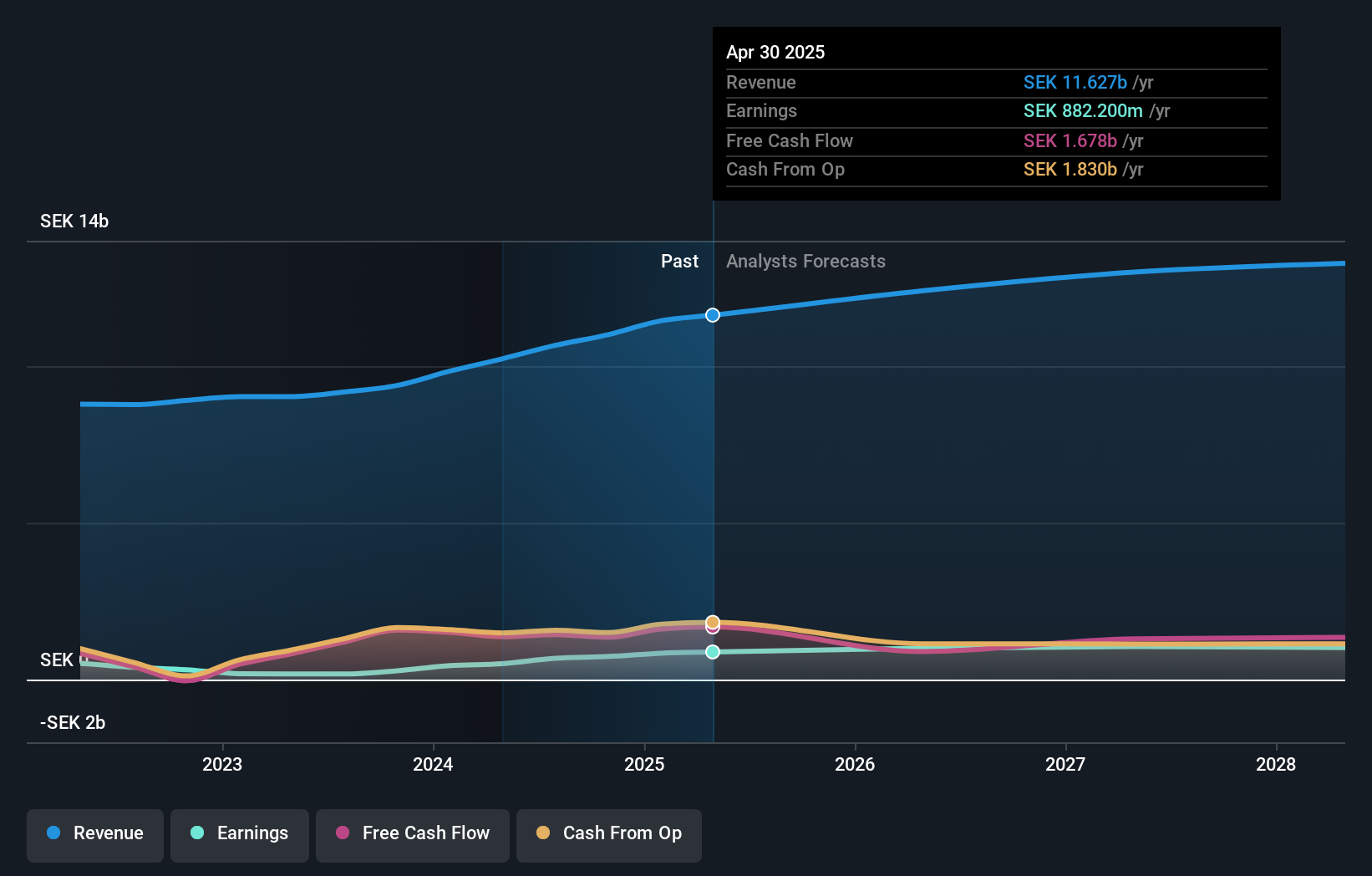

Overview: Clas Ohlson AB (publ) is a retail company that offers hardware, electrical, multimedia, home, and leisure products across Sweden, Norway, Finland, and internationally with a market cap of approximately SEK12.24 billion.

Operations: Clas Ohlson generates revenue primarily from its retail specialty segment, amounting to SEK10.66 billion. The company's financial performance is influenced by its net profit margin, which reflects the efficiency in converting revenue into profit.

Clas Ohlson, a notable player in the specialty retail sector, showcases impressive financial health with no debt and a substantial earnings growth of 281.8% over the past year. This growth significantly outpaces the industry average of 1.4%. Trading at 62.6% below its estimated fair value, it appears undervalued to some analysts. Recent sales figures indicate robust performance with total sales reaching SEK 5.42 billion for the year to date, marking a 17% increase from last year, driven by organic growth and contributions from Spares Group sales despite minor currency effects adjustments.

- Dive into the specifics of Clas Ohlson here with our thorough health report.

Assess Clas Ohlson's past performance with our detailed historical performance reports.

Qingdao Weflo Valve (SZSE:002871)

Simply Wall St Value Rating: ★★★★★☆

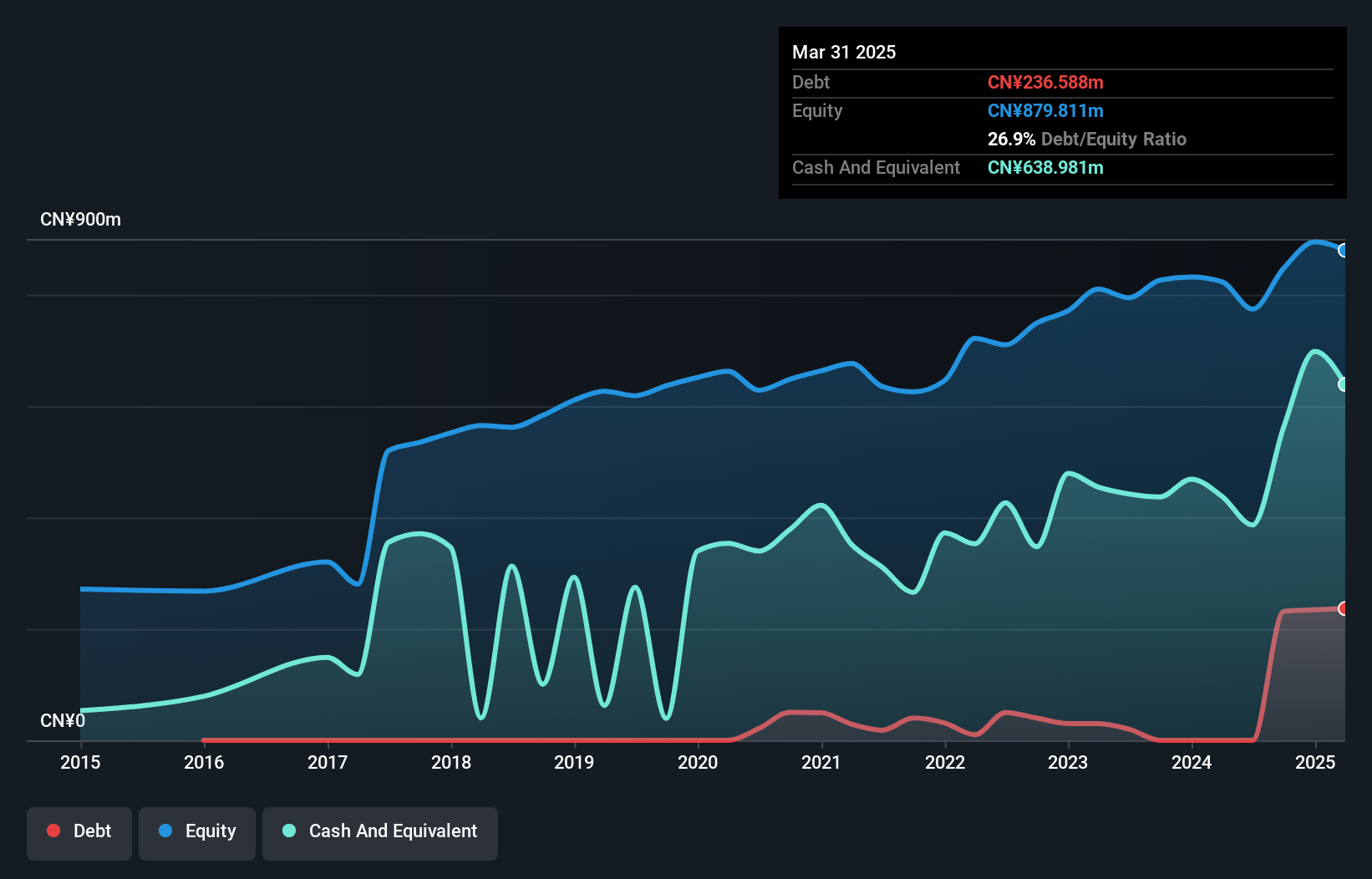

Overview: Qingdao Weflo Valve Co., Ltd. specializes in the design and manufacture of valve and fire hydrant products globally, with a market cap of CN¥2.10 billion.

Operations: Qingdao Weflo Valve generates revenue primarily from its valve and fire hydrant products. The company's financial performance reflects a focus on cost efficiency, with a notable gross profit margin trend.

Qingdao Weflo Valve, a notable contender in the machinery sector, has shown resilience despite challenges. Over the past five years, its debt to equity ratio climbed from 0% to 27.3%, yet it maintains more cash than total debt, indicating prudent financial management. The company’s earnings growth of 0.9% outpaced the industry’s -0.4%, showcasing competitive strength. With a price-to-earnings ratio of 19.6x below the CN market's average of 35.2x, it appears undervalued by market standards. Recent earnings reveal net income at CNY 89 million for nine months ending September 2024, slightly down from CNY 95 million last year, reflecting ongoing stability amidst evolving business strategies and shareholder meetings focused on strategic adjustments and capital expansion plans.

Kangping Technology (Suzhou) (SZSE:300907)

Simply Wall St Value Rating: ★★★★★☆

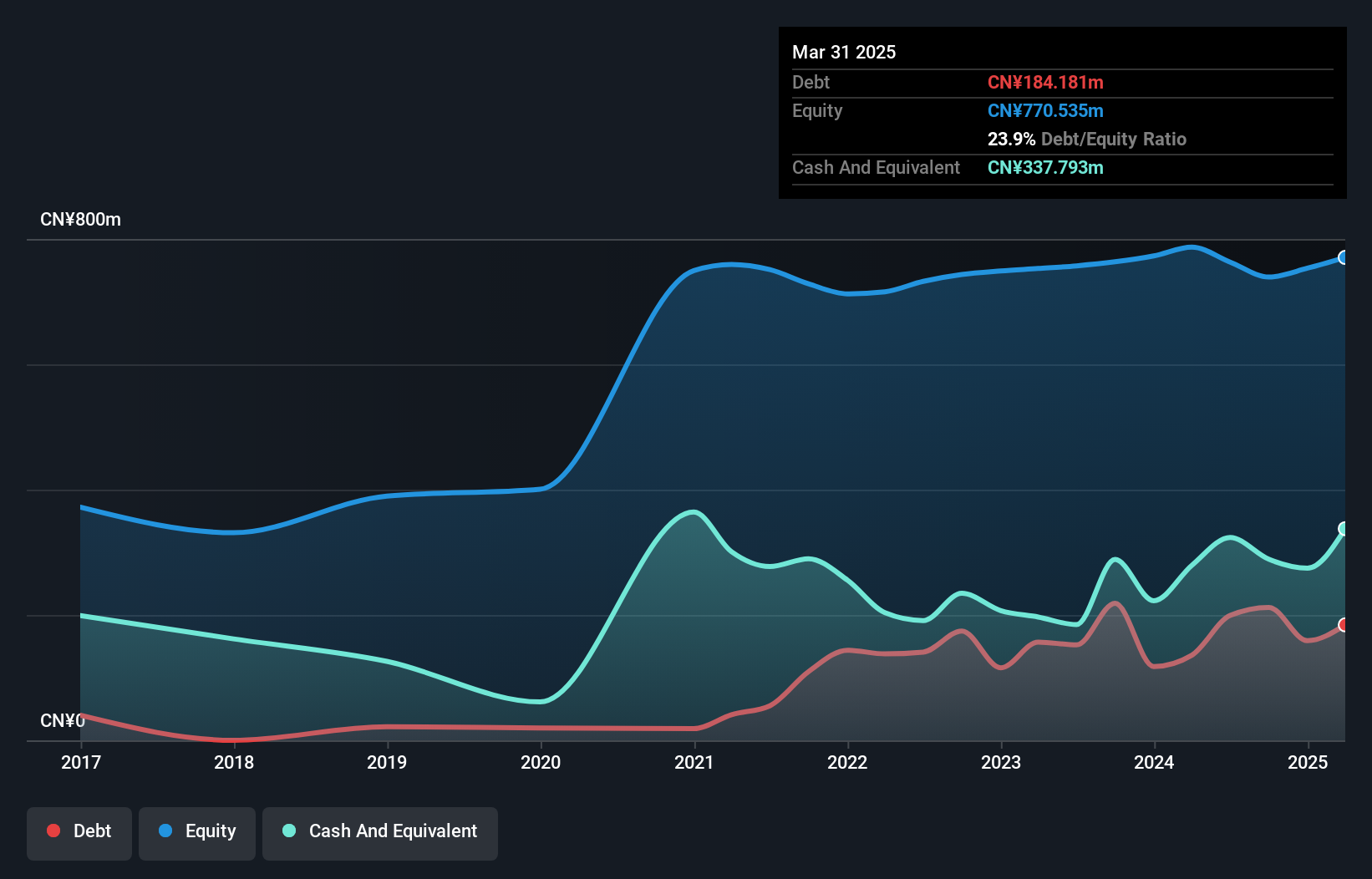

Overview: Kangping Technology (Suzhou) Co., Ltd. focuses on the research and development, design, production, and sale of motors and related products with a market capitalization of CN¥2.18 billion.

Operations: Kangping Technology generates revenue primarily from the sale of motors and related products. The company's net profit margin has shown variability, reflecting changes in operational efficiency and cost management over time.

Kangping Technology, a nimble player in its field, showcases robust financial health with earnings growing by 85% over the past year, outpacing the Electrical industry’s modest 1.1% rise. Its price-to-earnings ratio of 29.3x offers a competitive edge against the CN market average of 35.2x, hinting at good value potential. The company has more cash than total debt and generates positive free cash flow, currently at CNY 87.87 million as of September 2024. Recent earnings reports reveal sales rose to CNY 869 million from CNY 721 million last year, while net income climbed to CNY 67.86 million from CNY 40.62 million previously, reflecting solid operational performance and growth momentum in its niche market segment.

- Delve into the full analysis health report here for a deeper understanding of Kangping Technology (Suzhou).

Gain insights into Kangping Technology (Suzhou)'s past trends and performance with our Past report.

Key Takeaways

- Access the full spectrum of 4639 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kangping Technology (Suzhou) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300907

Kangping Technology (Suzhou)

Engages in the research and development, design, production, and sale of motors and related products.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives