- Malaysia

- /

- Energy Services

- /

- KLSE:PENERGY

Petra Energy Berhad And Two More Top Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate through a mix of economic signals, with some indices reaching record highs amid varying inflation cues and interest rate adjustments, investors continue to seek stable returns in this complex environment. In this context, dividend stocks like Petra Energy Berhad offer potential for steady income, aligning well with the needs of those looking for more predictable financial outcomes amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.31% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.89% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 7.80% | ★★★★★★ |

| Sonae SGPS (ENXTLS:SON) | 6.16% | ★★★★★★ |

| Huntington Bancshares (NasdaqGS:HBAN) | 4.98% | ★★★★★★ |

| Globeride (TSE:7990) | 3.68% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.58% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.78% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.48% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.20% | ★★★★★★ |

Click here to see the full list of 1974 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Petra Energy Berhad (KLSE:PENERGY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Petra Energy Berhad is an investment holding company that offers integrated brownfield services for the upstream oil and gas sector in Malaysia, with a market capitalization of approximately MYR 478.20 million.

Operations: Petra Energy Berhad generates revenue primarily through its Services and Marine Assets segments, totaling approximately MYR 388.01 million and MYR 378.39 million respectively.

Dividend Yield: 4.8%

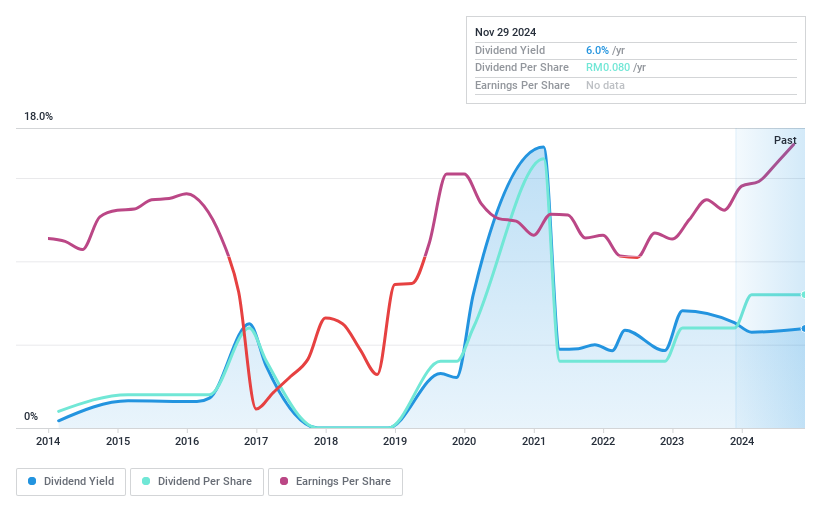

Petra Energy Berhad's recent financial performance shows a notable improvement with sales rising to MYR 118.82 million from MYR 81.5 million year-over-year, and a reduced net loss of MYR 2.36 million compared to last year's MYR 5.89 million. Despite this progress, the company's dividend history is marked by instability and unreliability over the past decade, with fluctuations exceeding 20% annually at times. However, its dividends are well-supported by both earnings and cash flows, evidenced by low payout ratios of 39.9% and cash payout ratio of 20.8%, respectively. The stock offers a competitive dividend yield at 4.85%, placing it in the top quartile within the Malaysian market context where average yields are around 4.5%.

- Take a closer look at Petra Energy Berhad's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Petra Energy Berhad is trading beyond its estimated value.

Qingdao Weflo Valve (SZSE:002871)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Qingdao Weflo Valve Co., Ltd. specializes in designing and manufacturing valve and fire hydrant products globally, with a market capitalization of approximately CN¥1.73 billion.

Operations: Qingdao Weflo Valve Co., Ltd. primarily generates its revenue from the design and production of valves and fire hydrants, serving customers around the world.

Dividend Yield: 3.6%

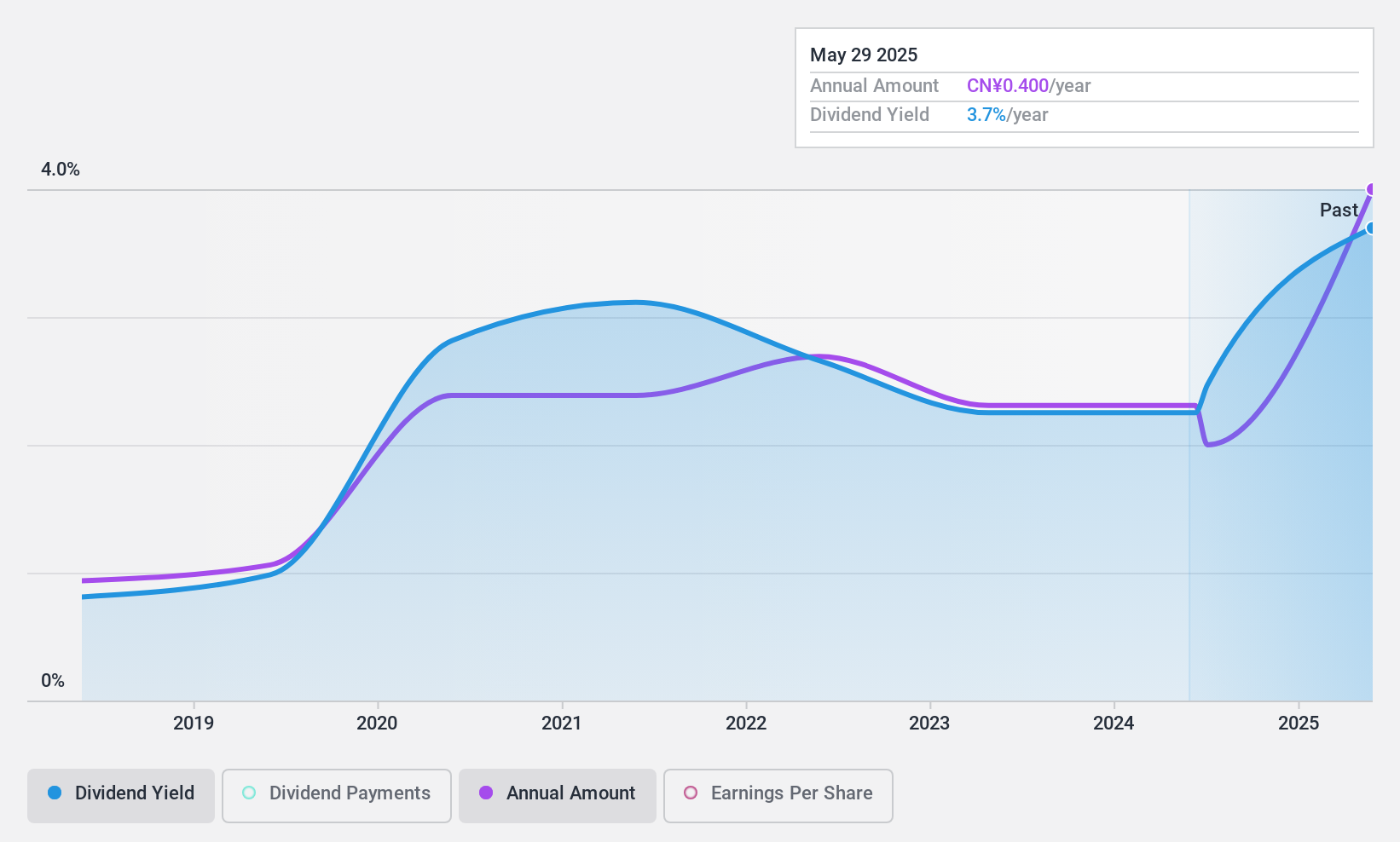

Qingdao Weflo Valve Co., Ltd. has maintained a stable dividend yield of 3.59%, ranking in the top 25% within the Chinese market, supported by a reasonable cash payout ratio of 60.6%. Despite its relatively short dividend history of six years, recent affirmations and increases in dividends demonstrate commitment to shareholder returns. However, volatility in share price and declining profit margins from 28% to 19.6% year-over-year suggest potential concerns for sustainability and growth stability moving forward.

- Dive into the specifics of Qingdao Weflo Valve here with our thorough dividend report.

- Our valuation report unveils the possibility Qingdao Weflo Valve's shares may be trading at a discount.

Itoki (TSE:7972)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Itoki Corporation operates in the manufacturing and sales of office furniture and related products and services, both domestically in Japan and internationally, with a market capitalization of approximately ¥80.67 billion.

Operations: Itoki Corporation generates its revenue through the production and sales of office furniture and related products, serving markets both in Japan and globally.

Dividend Yield: 3.1%

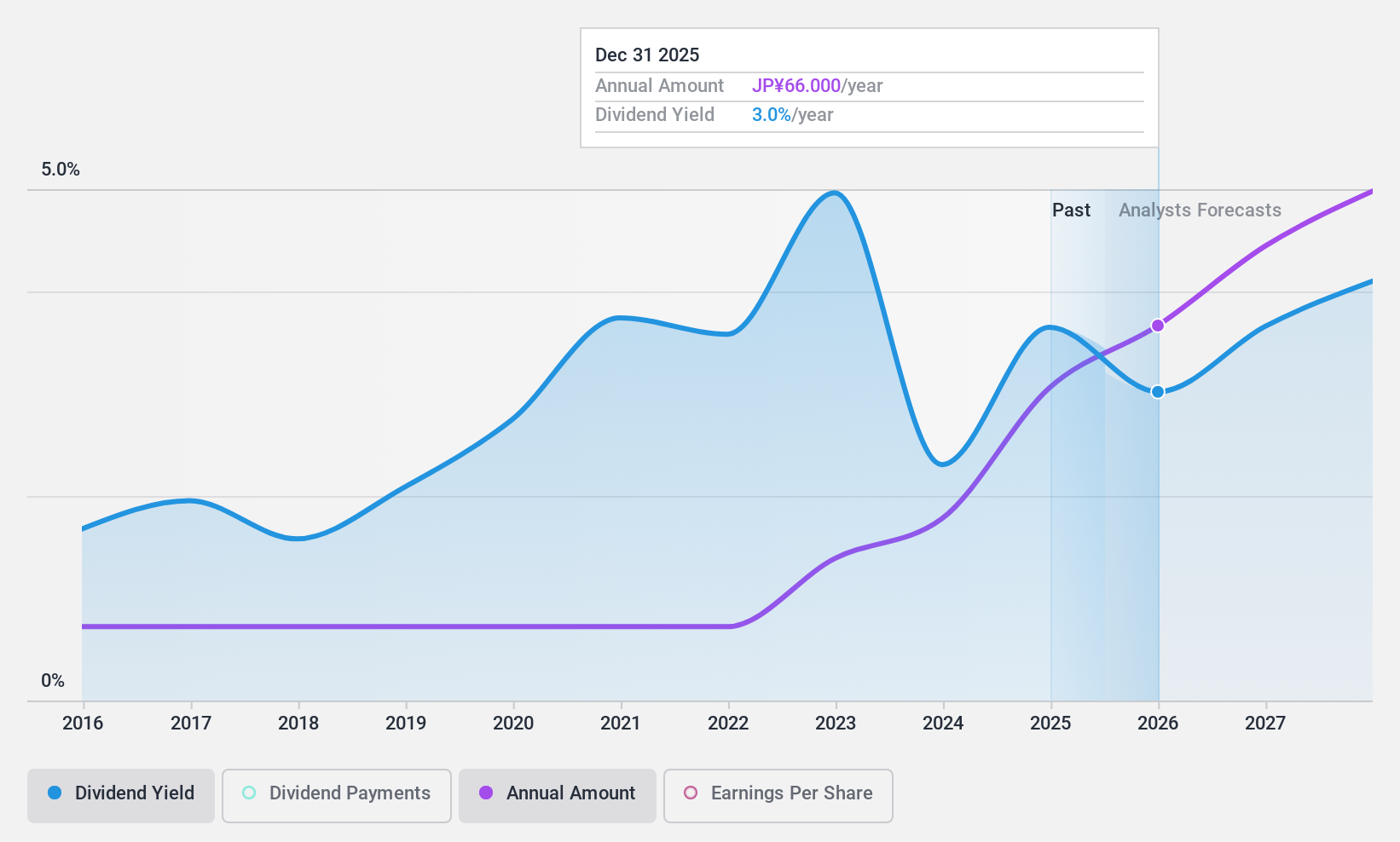

Itoki has demonstrated a consistent dividend growth over the past decade, with a current yield of 3.11%, slightly below the top quartile in Japan's market at 3.45%. Its dividends are well-supported by earnings and cash flows, with a payout ratio of 28.8% and a cash payout ratio of 85%, respectively. Despite this reliability, Itoki's share price has shown high volatility recently. Additionally, while its P/E ratio is favorable at 12.2x compared to the JP market average of 14.2x, shareholder dilution within the last year raises some concerns about future value retention.

- Navigate through the intricacies of Itoki with our comprehensive dividend report here.

- Our valuation report here indicates Itoki may be undervalued.

Turning Ideas Into Actions

- Reveal the 1974 hidden gems among our Top Dividend Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:PENERGY

Petra Energy Berhad

An investment holding company, engages in the provision of a range of integrated brownfield services and products for the upstream oil and gas industry in Malaysia.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives