- China

- /

- Electrical

- /

- SZSE:002861

YingTong Telecommunication Co.,Ltd.'s (SZSE:002861) 31% Share Price Surge Not Quite Adding Up

YingTong Telecommunication Co.,Ltd. (SZSE:002861) shares have had a really impressive month, gaining 31% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 2.8% isn't as impressive.

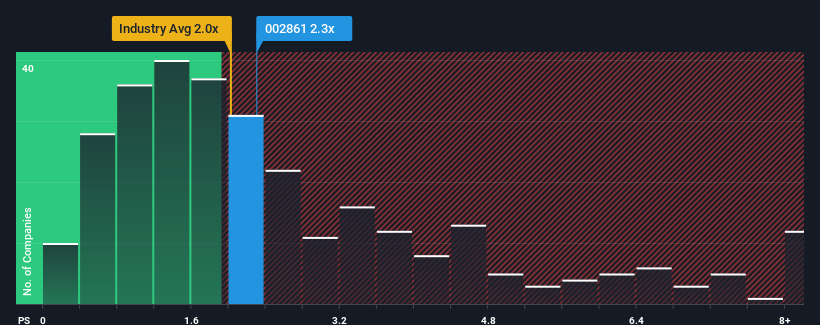

In spite of the firm bounce in price, it's still not a stretch to say that YingTong TelecommunicationLtd's price-to-sales (or "P/S") ratio of 2.3x right now seems quite "middle-of-the-road" compared to the Electrical industry in China, where the median P/S ratio is around 2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for YingTong TelecommunicationLtd

How YingTong TelecommunicationLtd Has Been Performing

Revenue has risen firmly for YingTong TelecommunicationLtd recently, which is pleasing to see. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on YingTong TelecommunicationLtd will help you shine a light on its historical performance.How Is YingTong TelecommunicationLtd's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like YingTong TelecommunicationLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 20%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 34% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 23% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that YingTong TelecommunicationLtd is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Final Word

Its shares have lifted substantially and now YingTong TelecommunicationLtd's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that YingTong TelecommunicationLtd currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Before you settle on your opinion, we've discovered 3 warning signs for YingTong TelecommunicationLtd that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002861

YingTong TelecommunicationLtd

Engages in the research, development, production, marketing, and sale of telecommunication cables.

Slight with mediocre balance sheet.

Market Insights

Community Narratives